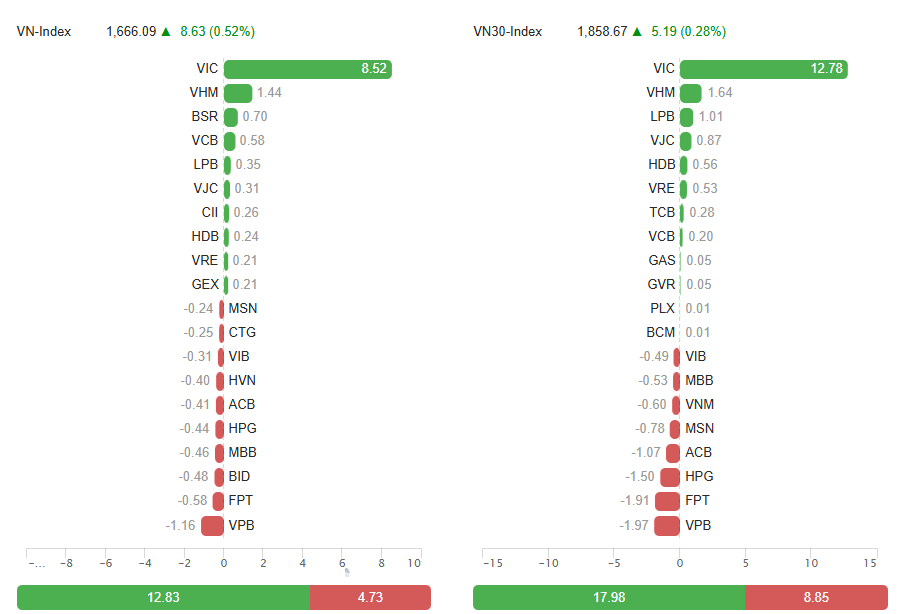

Closing the session on September 25th, green returned to Vietnam’s stock market, with the VN-Index rising 8.63 points to 1,666.09, the HNX-Index gaining 0.37 points to 277.65, and the UPCoM-Index climbing 0.84 points to 110.49.

Despite the indices performing well in the afternoon session, liquidity didn’t show many notable highlights. By the close, the market recorded over 1.12 billion shares traded, corresponding to a transaction value of more than 30.3 trillion VND. On the HOSE, the value reached over 27.3 trillion VND, approximately the average of the last five sessions.

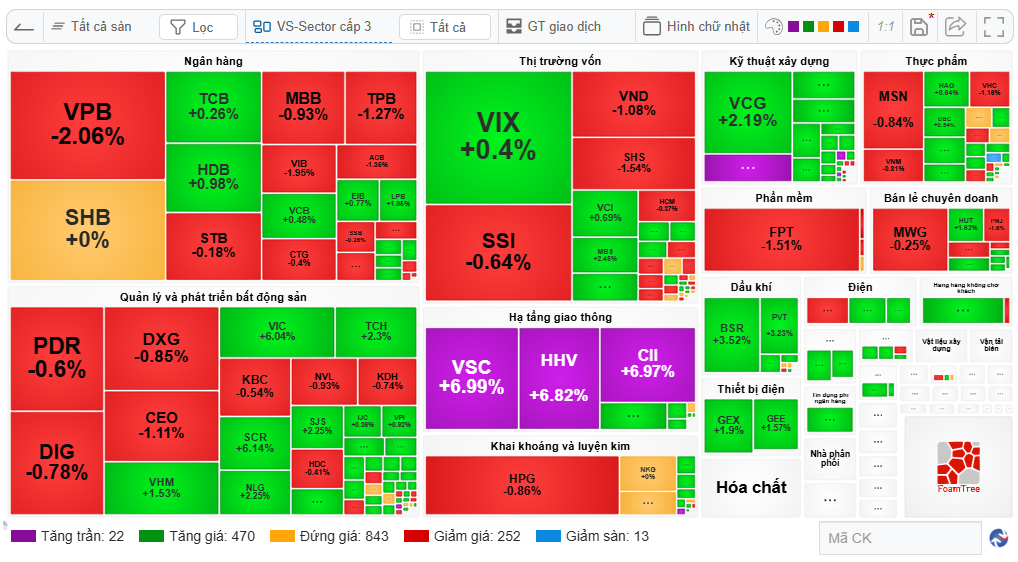

Looking at the market map, besides 843 stocks closing at the reference price, the market recorded up to 492 gainers, including 22 ceiling stocks, overwhelmingly outpacing 265 decliners, which included 13 floor stocks.

In reality, the majority of stocks rising occurred in the morning session, but the “pillar” group didn’t support. This was rectified in the afternoon session, specifically by VIC.

Accordingly, while the real estate group still showed significant divergence, VIC closing up 6.04% directly contributed 8.52 points to the VN-Index. Additionally, VHM rising 1.53% and adding 1.44 points was also a notable highlight.

|

VIC contributed significantly to the VN-Index

Source: VietstockFinance

|

Otherwise, the market picture didn’t change much from the morning session. The bright spots continued to include transportation infrastructure (VSC, HHV, CII hitting the ceiling, followed by a series of well-performing stocks), construction engineering (LCG, LIG at the ceiling, VCG up 2.19%…), oil and gas (BSR up 3.52%, PVI up 3.23%…), electrical equipment (GEX up 1.9%, GEE up 1.67%…).

Less positive, many bank stocks closed lower. Some notable decliners included VPB down 2.06%, TPB down 1.27%, VIB down 1.95%, CTG down 0.4%, ACB down 1.35%…

In the securities group, VIX stood out in trading value but closed only slightly up 0.4%. Other “leading” stocks like SSI, HCM, VND all dipped slightly.

In the market, pressure from many pillar stocks continued from the morning session, notably HPG, FPT, MWG, MSN, and VNM.

|

Market map at the close of September 25th

Source: VietstockFinance

|

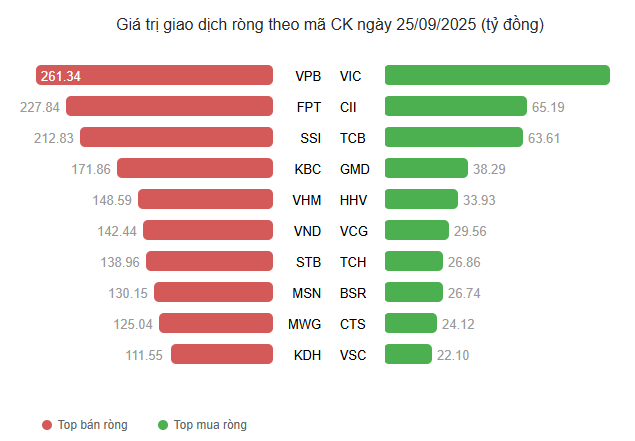

Regarding foreign trading, the net selling status continued, with today’s scale nearing 2.3 trillion VND—a not insignificant amount.

The market recorded three stocks heavily sold: VPB over 261 billion VND, FPT nearly 228 billion VND, and SSI nearly 213 billion VND—all stocks that declined today. Following were a series of stocks net sold by hundreds of billions of VND.

On the flip side, VIC was the only stock net bought by hundreds of billions, with a scale slightly over 103 billion VND. Thus, the buying side continued to lag behind the selling side in another session.

Source: VietstockFinance

|

Morning Session: Pressure from Pillar Stocks

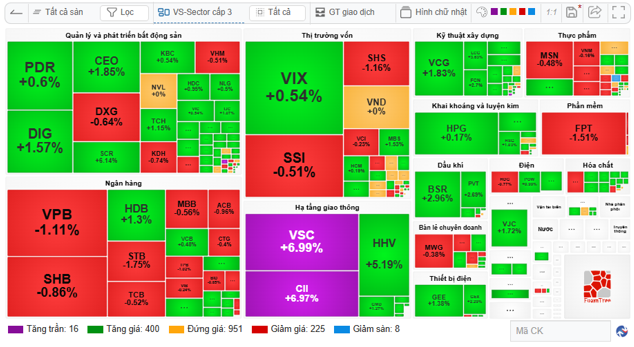

Closing the morning session, the VN-Index rose slightly by 0.44 points to 1,657.9, the HNX-Index gained 2.07 points to 279.35, and the UPCoM-Index increased by 0.95 points to 110.5. Although all indices rose and most stocks gained, many pillar stocks exerted significant pressure, preventing the market from surging.

|

The market couldn’t surge due to pressure from pillar stocks

Source: VietstockFinance

|

By market capitalization, all segments showed positivity, with Large Cap up 0.05%, Mid Cap up 0.5%, Small Cap up 0.34%, and Micro Cap up 0.53%. Across the market, 416 gainers (including 16 ceiling stocks) dominated 233 decliners (8 floor stocks). Meanwhile, 951 stocks remained unchanged.

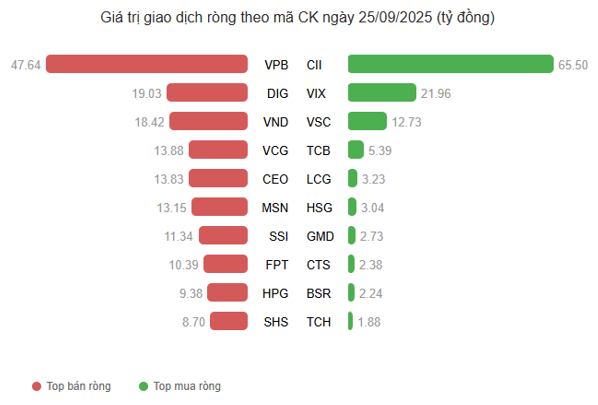

Despite the overwhelming number of gainers, the market didn’t rise strongly in the morning session due to significant pressure from banking, securities, food, software, and retail sectors.

In banking, notable decliners included VPB down 1.11%, STB down 1.75%, TPB down 1.02%, along with other red stocks like SHB, TCB, MBB, ACB, CTG…

In securities, “giant” SSI fell 0.51%, SHS dropped 1.16%, VCI slipped 0.23%, significantly impacting overall performance. Some bright spots included VIX up 0.54%, MBS up 1.53%, HCM up 0.19%, but these weren’t enough to balance the scale.

The food sector saw MSN down 0.48%, VNM down 0.16%, VHC down 0.99%, KDC down 0.39%; software with FPT down 1.51%; retail with MWG down 0.38%, PNJ down 1.26%, FRT down 1.97%; and real estate “giant” VHM down 0.51%… also contributed to market pressure.

On the flip side, efforts in most real estate, construction engineering, mining and metallurgy, oil and gas, electrical equipment, and especially transportation infrastructure stocks were “saving” many points for the market.

|

Market map at the close of the morning session on September 25th

Source: VietstockFinance

|

Liquidity continued to improve compared to recent sessions, with today’s scale temporarily reaching over 16 trillion VND.

10:40 AM: Green and Red Battle for Points, Industrial Stocks Surge

The market continuously battled for points, with divergence evident on the map. Notably, industrial sector stocks surged, becoming a positive highlight.

Specifically, the transportation infrastructure sector was truly booming, with a series of stocks recording strong gains, notably CII hitting the ceiling, VSC repeatedly touching the ceiling, followed by HHV up 5.19%… In construction engineering, CDC quickly hit the ceiling, followed by VCG up 1.65%, LCG up 2.82%, FCN up 2.43%…

On the market map, green was also widespread across many other sectors, including real estate and oil and gas…

On the flip side, the banking sector exerted considerable pressure on the market. Red appeared quite prominently and occupied large areas on the sector map by trading value. Specifically, VPB fell 0.79%, SHB dropped 1.44%, STB declined 1.4%, CTG slipped 0.4%…

Additionally, many large-cap stocks also significantly impacted the overall index, such as SSI, VND, SHS, VCI in securities; VHM in real estate; alongside FPT, MWG, MSN, HPG, VNM, all declining.

Liquidity was trending upward faster. On the VN-Index, trading value reached 10.7 trillion VND, a strong increase compared to the average of the last five sessions.

Opening: Early Session Volatility

After closing the ATO with a 2.24-point gain, the VN-Index continuously fluctuated and was highly unpredictable afterward.

As of 9:30 AM, the VN-Index rose slightly by 1.09 points to 1,658.55, while the HNX-Index and UPCoM-Index were also slightly green. Liquidity wasn’t outstanding yet, with over 134 million shares traded, corresponding to a transaction value of nearly 3.6 trillion VND.

On the market map, green had greater spread with 308 gainers, alongside 13 ceiling stocks. Conversely, 124 stocks were in the red, with 7 floor stocks. In sectors attracting much attention like finance, real estate, or industry, green had high coverage and occupied large areas.

Among the few early ceiling stocks, CII stood out, heading toward its second consecutive ceiling session. In the market, CII was priced at 26,100 VND/share, with nearly 19.2 million shares matched and over 7.2 million shares in buy surplus.

Additionally, this stock was also the most net bought by foreign investors in the market at that time, recording a scale of nearly 66 billion VND, far surpassing other stocks. Overall foreign trading as of 9:30 AM continued to show net selling, with a temporary scale of nearly 168 billion VND.

Source: VietstockFinance

|

Source: VietstockFinance

|

Globally, Asian markets opened quite mixed, with Nikkei 225 up 0.23% and All Ordinaries up 0.12%, while Hang Seng fell 0.05%, Shanghai Composite dropped 0.02%, and Singapore Straits Times declined 0.18%.

Wall Street last night marked its second consecutive declining session, with the S&P 500 down 0.28% to 6,637.97, as major AI stocks like Nvidia and Oracle faced pressure for the second straight session. Meanwhile, the Nasdaq Composite lost 0.34% to 22,497.86, and the Dow Jones fell 0.37% to 46,121.28.

– 15:55 25/09/2025

SSI Chairman: Market Upgrade is No Miracle

The question of whether the market will be upgraded has become a focal point at SSI Securities’ extraordinary shareholders’ meeting held on the afternoon of September 25, 2025, in Ho Chi Minh City. SSI Chairman Nguyen Duy Hung shared his insights on the matter, emphasizing that an impending market upgrade is not a magical solution.

Vietstock Daily 26/09/2025: Clear Market Polarization?

The VN-Index rallied after a volatile session, breaking above the Bollinger Bands’ Middle line. Sustaining this level with trading volume surpassing the 20-day average would strengthen the near-term outlook. Additionally, the Stochastic Oscillator is poised to potentially generate a buy signal.

Technical Analysis for the Afternoon Session of September 25: Holding Strong Above Key Support Levels

The VN-Index is currently fluctuating as it retests the middle band of the Bollinger Bands. However, the index has found stability after successfully testing the previous August 2025 low (around the 1,600-1,630 point range). Meanwhile, the HNX-Index shows even stronger momentum, with the Stochastic Oscillator generating a clear buy signal.

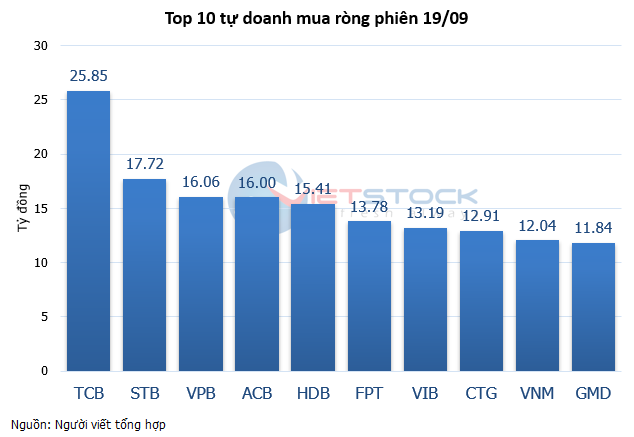

Surge in Brokerage Firm’s Proprietary Trading: One Stock Witnessed Unexpected Net Buying Spike on September 23rd

Proprietary trading firms recorded a net purchase of VND 61 billion on the Ho Chi Minh City Stock Exchange (HOSE), signaling a significant shift in market dynamics. This substantial investment underscores growing confidence in the bourse’s potential, as traders capitalize on emerging opportunities within Vietnam’s vibrant financial landscape.

When Will the Stock Market’s “Sawing Off the Table Legs” End?

The “lullaby of the sawing table leg” phenomenon is how many investors are describing the current state of the VN-Index. While the decline in the index isn’t substantial, the impact on investors’ portfolios is significant.