In the projected Q3/2025 business results for the electricity sector, MB Securities (MBS) reports improved nationwide electricity consumption, with most power sources showing better mobilization rates.

Specifically, hydropower mobilization increased by approximately 3% compared to the same period in Q3/2024 (as of September 20), a modest growth due to strong mobilization in the previous year.

Coal-fired power mobilization rose slightly by 6% year-on-year, aligning with overall system demand growth. MBS notes that imported coal prices have dropped by ~25% since the beginning of the year, leading to a ~15% reduction in blended coal prices for power plants (GENCO3), thereby lowering coal-fired electricity prices.

Gas-fired power mobilization increased by 12%, primarily due to higher utilization of Southeast Region plants like Phu My and Nhon Trach 1&2, rebounding from low levels last year. Meanwhile, renewable energy (RE) mobilization grew by 11%, driven by increased capacity, with RE remaining a prioritized power source.

In the first nine months of 2025, MBS analysts highlight several key policies addressing long-standing industry challenges, including the adjusted Power Purchase Agreement (PPA) framework, pricing mechanisms for power sources, bidding processes, Direct Power Purchase Agreements (DPPA), and incentives for rooftop solar self-consumption.

Notably, Resolution 70 issued by the Politburo on September 16, 2025, outlines critical goals such as clean energy transition, transparent market mechanisms, and reduced monopolies.

“Moving into late 2025 and 2026, key developments to watch include formal resolutions for non-compliant RE projects, DPPA mechanism refinements, draft pricing frameworks for Battery Energy Storage Systems (BESS), and pilot two-part tariff mechanisms,” the report states.

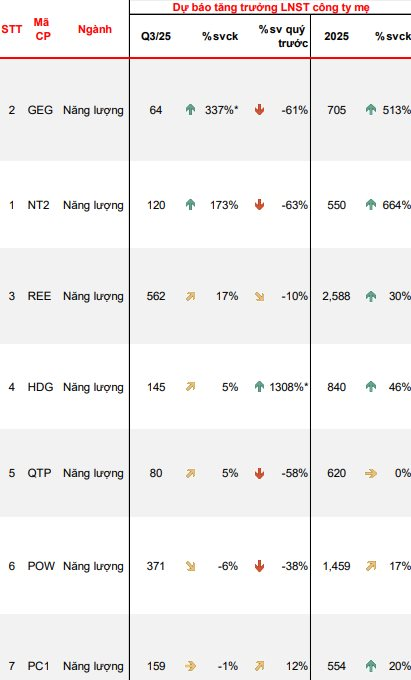

Top-Performing Companies in 2025

Note: Growth calculated in absolute terms due to previous quarters’ net losses

Q3/2025 profits among tracked electricity companies show significant variation. For Gia Lai Electricity JSC (GEG), parent company net profit is projected at VND 64 billion, a strong recovery from last year’s VND 27 billion loss. Full-year 2025 profit is forecast to surge 513% to VND 705 billion.

Nhon Trach 2 Power JSC (NT2) is expected to report Q3 profits of VND 120 billion, up 173% year-on-year, with full-year 2025 profits reaching VND 550 billion, a 664% increase.

Refrigeration Electrical Engineering JSC (REE) projects more modest growth of 17% in Q3 to VND 562 billion and 30% for 2025 to VND 2,588 billion.

For Ha Do Group (HDG) and Quang Ninh Thermal Power JSC (QTP), MBS forecasts 5% profit growth in Q3/2025.

Conversely, PV Power and PC1 are expected to post negative growth this quarter.

Singapore Conglomerate Invests Over $240 Million in Wind Power Project in Gia Lai

Gia Lai Province has officially issued the Investment Registration Certificate for the Van Canh Binh Dinh Wind Power Plant project, with a total investment capital exceeding 5.7 trillion VND. The project is anticipated to be completed and operational by…

Singapore Conglomerate Invests Over $228 Million in Wind Energy Project in Gia Lai

On September 20th, Mr. Nguyễn Văn Châu, Deputy Director of Gia Lai Province’s Department of Finance, signed an Investment Registration Certificate for the Vân Canh Bình Định Wind Power Plant project in Canh Liên commune. The project is owned by Nexif Ratch Energy Se Asia PTE. LTD., a company led by Singapore-based billionaire Cyril Dissescou.

Eighty-Two-Year-Old Chairman and the Do Family: The Quiet Real Estate Empire Behind Billion-Dollar Wind Power Projects

Less known than industry giants, Tai Tam Group, a family-owned enterprise rooted in Hanoi’s rental real estate market, has quietly amassed a renewable energy portfolio with a registered investment capital exceeding 50 trillion VND.