Nam Long Investment Corporation (Stock Code: NLG, HoSE) has announced Resolution No. 30a/2025/NQ/HĐQT/NLG, approving key details regarding a public offering of additional shares to existing shareholders and the allocation of the proceeds.

The company plans to issue 100.12 million shares, representing 26% of its current outstanding shares. The rights ratio is set at 100:26, meaning shareholders holding 100 shares can purchase 26 new shares. These newly issued shares will be unrestricted for transfer.

The offering is scheduled for 2025, pending approval from the State Securities Commission (SSC) and compliance with legal disclosure requirements.

Upon completion, Nam Long’s chartered capital will increase to approximately VND 4,852 billion. At an offering price of VND 25,000 per share, the company expects to raise nearly VND 2,503 billion.

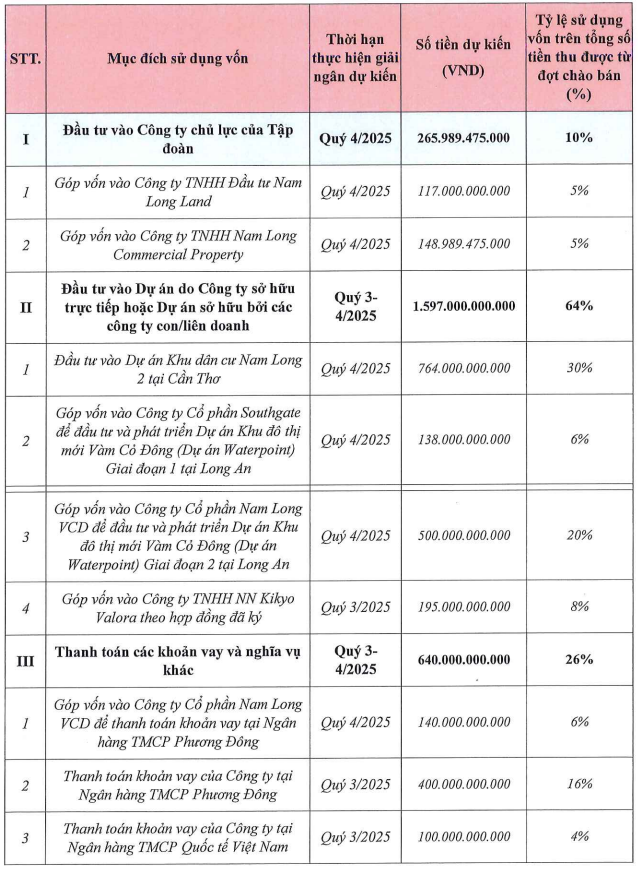

The resolution outlines the following detailed allocation of proceeds:

Source: NLG

This issuance plan was previously approved at the Annual General Meeting (AGM) under Resolution No. 01/2025/NQ/ĐHĐCĐ/NLG on March 19, 2025.

In conjunction with the capital allocation plan, NLG’s Board of Directors has approved capital increases for several subsidiaries:

Nam Long Land LLC (current capital: VND 668.3 billion) will receive an additional VND 117 billion.

Nam Long Commercial Property LLC (current capital: VND 498.7 billion) will receive an additional VND 148.98 billion.

Southgate Corporation (current capital: VND 1,950 billion) will issue 13.8 million new shares, with NLG investing VND 138 billion.

Nam Long VCD Corporation (current capital: VND 2,388.1 billion) will issue 64 million new shares, with NLG investing VND 640 billion.

NNH Kikyo Valora LLC (current capital: VND 583 billion) will receive an additional VND 195 billion.

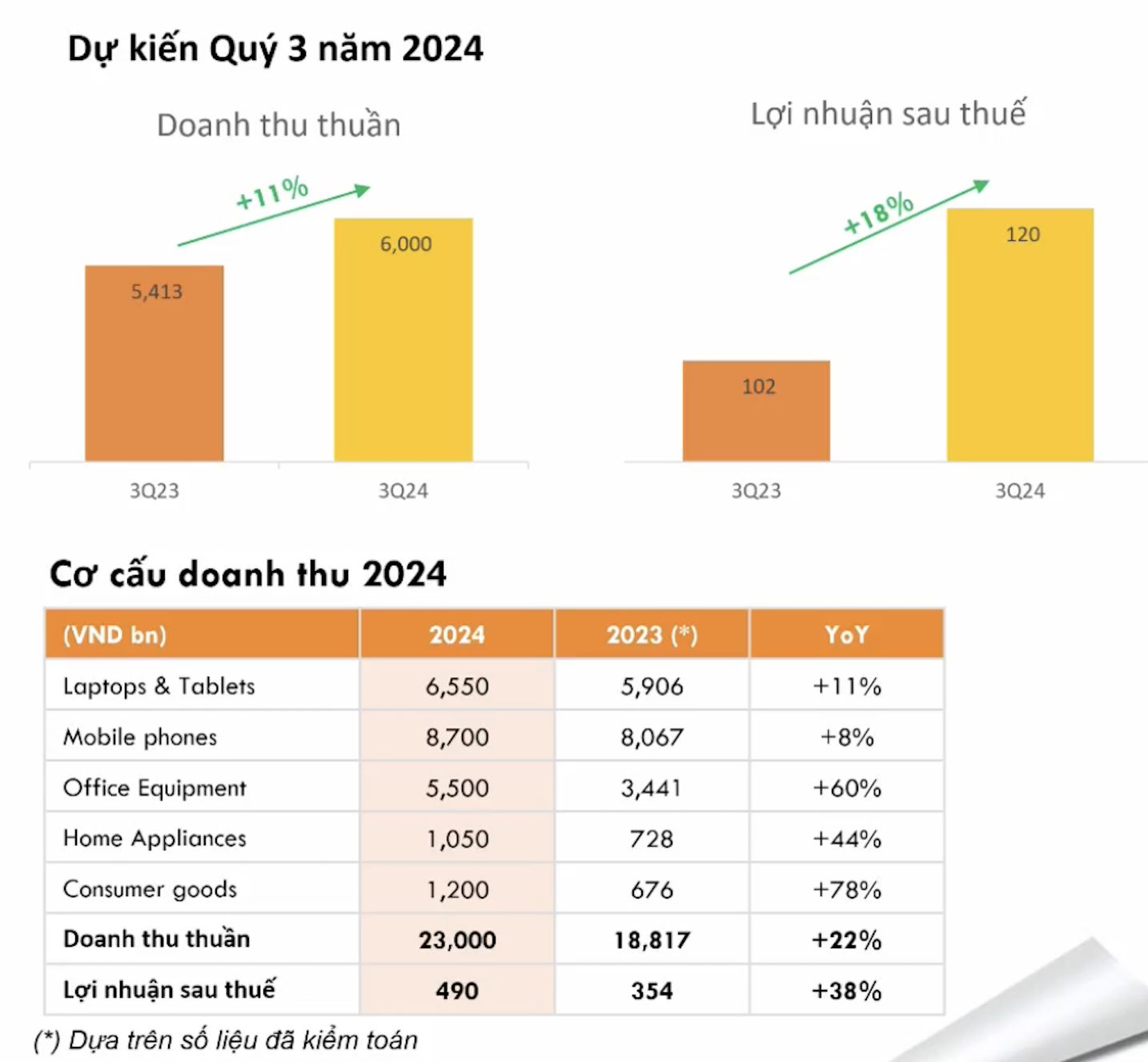

For the first half of 2025, Nam Long reported net revenue of VND 2,064 billion and post-tax profit of VND 207 billion, marking a 4x and 3x increase year-on-year, respectively, driven by strong Q1 performance.

For 2025, the company targets VND 6,794 billion in revenue and VND 701 billion in post-tax profit. As of H1, it has achieved 30.4% of its revenue goal and 29.6% of its profit target.

Sonadezi to Disburse Nearly VND 490 Billion in Dividends at 13% Rate

Sonadezi is set to distribute over VND 489.4 billion in dividends for 2024, with a payout ratio of 13%. The final shareholder registration date is October 8, 2025, and the expected payment date is October 23, 2025.