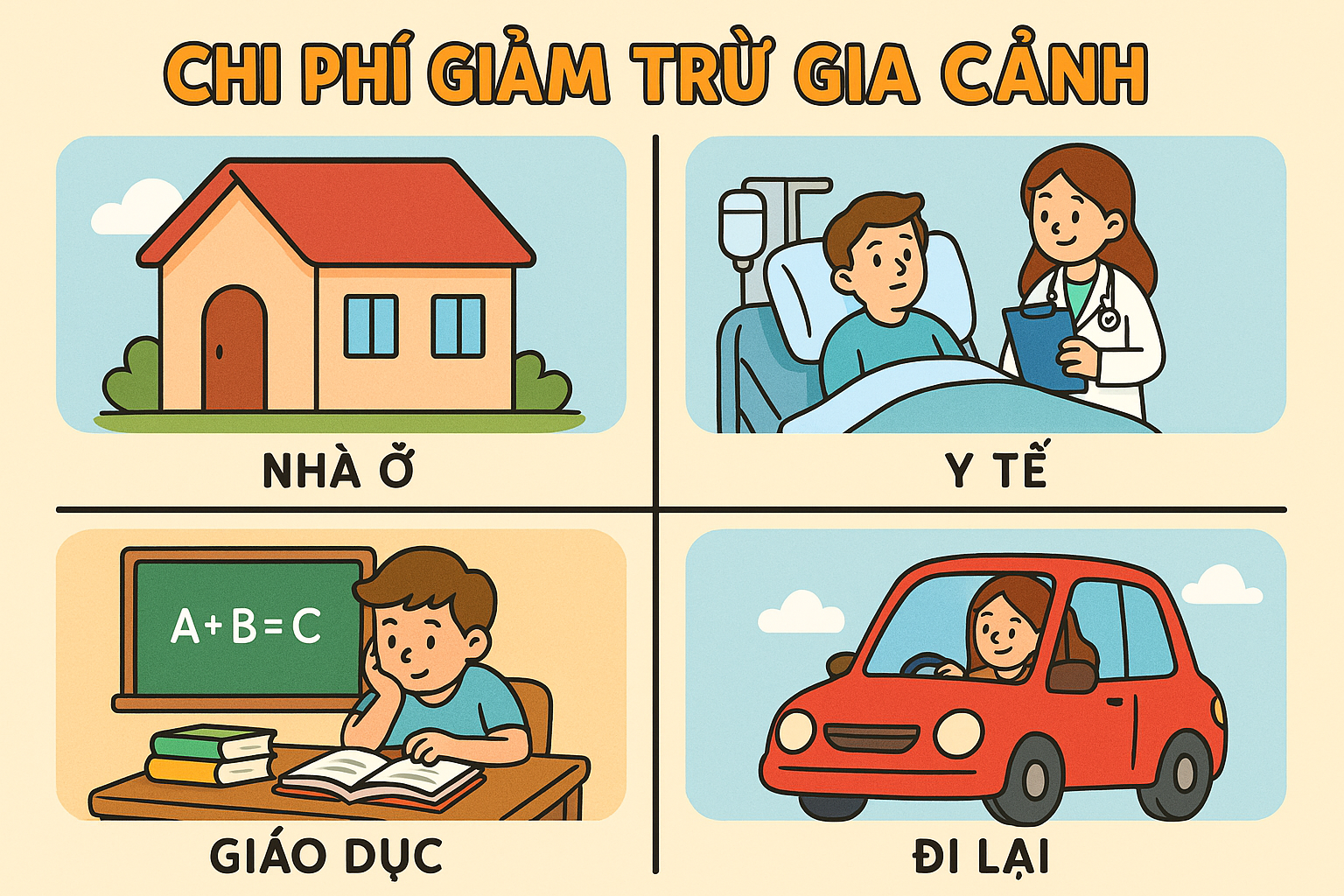

The Vietnamese Government Office proposes maintaining the standard deduction package as outlined in the draft Law on Personal Income Tax. Additionally, they suggest introducing an expanded deduction package, covering expenses such as housing, transportation, healthcare, and education for taxpayers and their dependents (exceeding basic costs). This also includes student loan repayments and unforeseen expenses due to natural disasters, fires, or theft affecting homes, assets, or vehicles, requiring repairs or replacements.

However, these expenses must be supported by invoices and documents as per legal requirements and should not be covered by other sources.

The Ho Chi Minh City Tax Consultancy and Agency Association agrees with the proposal but suggests limiting education expenses to taxpayers and their children, while healthcare costs should only apply to taxpayers and dependents they are legally obligated to support. The Association also proposes expanding deductions to include rental expenses and other essential costs for taxpayers.

Echoing this sentiment, Vietcombank recommends adding interest expenses on loans from credit institutions for healthcare, education, and social housing purchases to the deductible list. According to Vietcombank, many individuals borrow from banks to cover healthcare and education costs, resulting in significant interest payments.

Proposals for Various Expenses to be Deducted in Personal Income Tax Calculations

The bank argues that these are actual expenses and should be deductible to accurately reflect taxpayers’ income. If the deduction for social housing loan interest is approved, it would make housing more accessible for low-income earners, aligning with the National Assembly’s Resolution No. 161/2024/QH15 on promoting social housing loans.

To ensure proper implementation and prevent abuse, confirmation from banks or land registration authorities, possibly integrated through electronic identification numbers, is necessary.

Similarly, LAWS Vietnam LLC highlights that interest on loans for a first home is a significant burden for young families. They propose including interest expenses on loans for social housing or first commercial homes in the deductible list for personal income tax calculations.

Regarding housing loan deductions, Lawyer Nguyen Duc Nghia, Deputy Director of the Small and Medium Enterprise Support Center, Ho Chi Minh City Business Association, emphasizes that interest on first-home loans is a substantial burden for many families. Deductions for such interest would support the need for stable housing.

He suggests that the Law on Personal Income Tax could set a maximum deductible loan amount, such as interest on a debt balance of 1 billion VND. For healthcare and education expenses, deductions should be allowed at appropriate levels. For instance, families with members suffering from severe illnesses requiring long-term, expensive treatments should be considered for higher healthcare deductions.

Proposed Income Tax Exemption for Vietnamese Flight Attendants Working with Foreign Airlines

In a recent proposal for the revised Personal Income Tax Law, suggestions have been made to include Vietnamese flight attendants working for foreign airlines in the tax-exempt category.

Revised Title:

Amended Personal Income Tax Law: Does It Lack Support Mechanisms for Freelancers?

Taxpayers have expressed concerns regarding the proposed personal income tax (PIT) regulations, highlighting a lack of support mechanisms for freelancers. The current policy on taxing financial investment income remains unclear and lacks legal framework, posing potential risks for citizens. Additionally, the taxation of cryptocurrency assets continues to raise significant uncertainties.

Personal Income Tax on Gold Transactions: Can It Curb Speculation and Narrow Price Gaps?

After a series of price hikes, with a difference of approximately $1,700 per tael since the beginning of the year, gold has emerged as an attractive investment channel, offering lucrative returns. Experts support the proposal to impose personal income tax (PIT) on gold transactions. However, the implementation of this tax should follow a gradual roadmap, distinguishing between investment and accumulation activities to prevent any shock to the public.