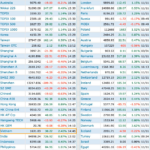

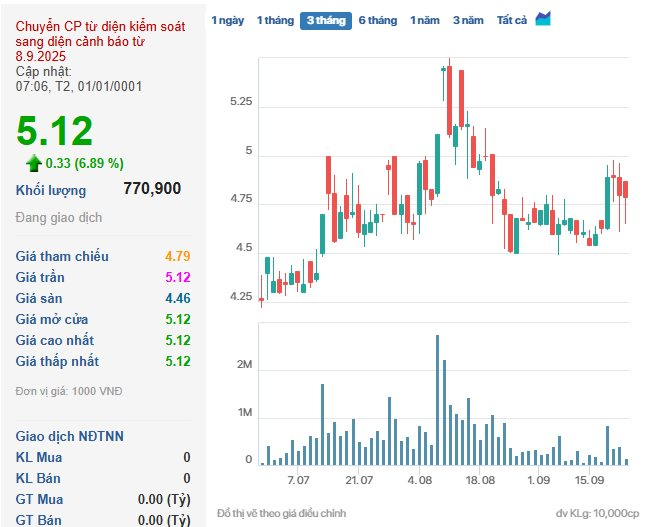

On September 24th, TDH shares surged 6.89% to close at VND 5,120 per share, with trading volume spiking to nearly 770,900 units. Thuduc House’s market capitalization soared to over VND 576 billion.

Prior to this, TDH shares had experienced two consecutive days of decline, dropping 1.84% on September 22nd and 0.21% on September 23rd.

TDH shares of Thuduc House skyrocketed during the September 24th session.

The sharp rise in TDH shares followed the conclusion of an administrative lawsuit appeal hearing on September 23rd, 2025, between Thuduc House and the Ho Chi Minh City Tax Department (now the Regional Tax Department II) and its Director (now the Head of the Regional Tax Department II).

The appellate court upheld the original judgment (No. 133/2025/HCST dated April 24th, 2025), rejecting the appeal filed by the Regional Tax Department II and its Head.

Consequently, the court annulled the Regional Tax Department II’s decisions regarding a VAT refund of VND 365 billion and late payment interest of VND 74.7 billion (as of December 25th, 2020). Additionally, all derivative decisions stemming from these administrative rulings, including the suspension of invoice usage and customs clearance for imports/exports, were also nullified.

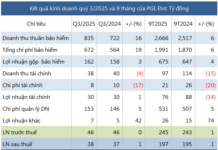

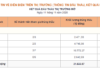

In terms of business performance, Thuduc House reported a 14.3% year-on-year decline in net revenue to VND 25.8 billion for the first half of 2025. However, a significant reduction in cost of goods sold propelled gross profit to VND 11 billion, a 49% increase compared to the same period last year (VND 7.4 billion).

Strong growth in financial income and other profits, coupled with operational cost-cutting measures, resulted in a remarkable turnaround. Thuduc House posted an after-tax profit of VND 18.9 billion, a stark contrast to the VND 33.2 billion loss incurred in the first half of the previous year.

Notably, this marks the first time since 2020 that Thuduc House has achieved a positive semi-annual business result.

As of June 30th, 2025, Thuduc House’s total assets stood at VND 694 billion, a 1.2% increase from the beginning of the year. Current assets amounted to VND 410 billion, with inventory accounting for a significant portion at VND 249.7 billion, followed by short-term receivables of VND 117.3 billion. Cash and cash equivalents decreased by nearly half compared to the start of the year, reaching VND 27.9 billion, comprising VND 15.9 billion in cash and VND 12 billion in cash equivalents.

On the liabilities side, total debt as of June 30th, 2025, slightly decreased compared to the beginning of the year, amounting to VND 602 billion. Short-term debt totaled VND 537.2 billion. Notably, financial debt remained low at just over VND 7 billion, including VND 6.3 billion in short-term loans and VND 750 million in long-term loans.

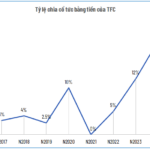

TFC Announces Record-Breaking Cash Dividend Payout

Trang Joint Stock Company (HNX: TFC) has announced a record-breaking cash dividend payout for 2024, marking the highest in the company’s history. Shareholders will receive a 20% cash dividend, equivalent to 2,000 VND per share. The ex-dividend date is set for September 30th.