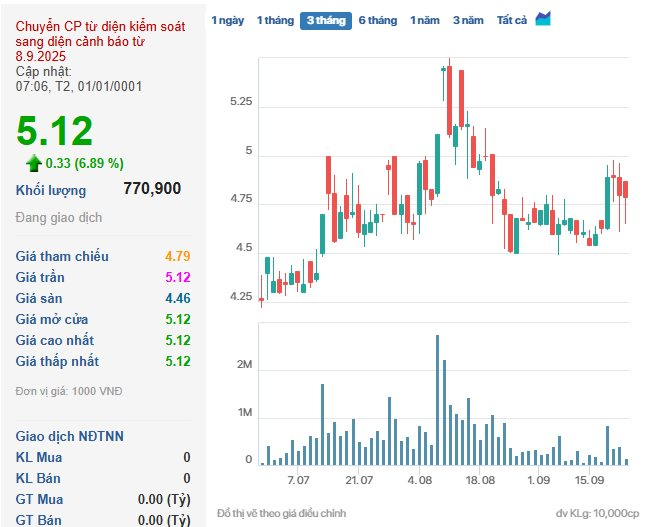

On September 24th, TDH shares surged 6.89% to close at VND 5,120 per share, with trading volume spiking to nearly 770,900 units. Thuduc House’s market capitalization soared to over VND 576 billion.

Prior to this, TDH shares had experienced two consecutive days of decline, dropping 1.84% on September 22nd and 0.21% on September 23rd.

TDH shares of Thuduc House skyrocketed on September 24th.

The surge in TDH shares followed the conclusion of an administrative lawsuit appeal hearing on September 23rd, 2025, between Thuduc House and the Ho Chi Minh City Tax Department (now the Regional Tax Department II) and its Director (now the Head of the Regional Tax Department II).

The appellate court upheld the original judgment (No. 133/2025/HCST dated April 24th, 2025), rejecting the appeal filed by the Regional Tax Department II and its Head.

Consequently, the court annulled the Regional Tax Department II’s decisions regarding a VAT refund of VND 365 billion and late payment interest of VND 74.7 billion (as of December 25th, 2020). Additionally, all derivative decisions, including the suspension of invoice usage and customs clearance for imports/exports, were also nullified.

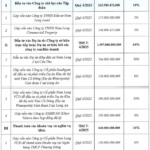

In terms of business performance, Thuduc House reported a 14.3% year-on-year decline in net revenue to VND 25.8 billion for the first half of 2025. However, a significant reduction in cost of goods sold led to a 49% surge in gross profit to VND 11 billion.

Strong growth in financial income and other profits, coupled with operational cost-cutting measures, resulted in a remarkable turnaround. Thuduc House posted an after-tax profit of VND 18.9 billion, a stark contrast to the VND 33.2 billion loss incurred in the same period last year.

Notably, this marks the first time since 2020 that Thuduc House has achieved a positive semi-annual business result.

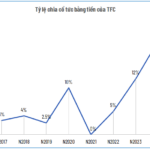

As of June 30th, 2025, Thuduc House’s total assets stood at VND 694 billion, a 1.2% increase from the beginning of the year. Current assets amounted to VND 410 billion, with inventory accounting for a significant portion at VND 249.7 billion, followed by short-term receivables of VND 117.3 billion. Cash and cash equivalents decreased by nearly half to VND 27.9 billion, comprising VND 15.9 billion in cash and VND 12 billion in cash equivalents.

On the liabilities side, total debt as of June 30th, 2025, slightly decreased to VND 602 billion. Short-term debt accounted for VND 537.2 billion. Notably, financial debt remained low at just over VND 7 billion, including VND 6.3 billion in short-term loans and VND 750 million in long-term loans.

Real Estate Firm Wins Landmark Tax Case Against Revenue Authority

Thuduc House’s stock soared to its daily limit following the court’s ruling in their favor regarding a VAT refund case, securing a substantial 365 billion VND and additional interest for late payment.