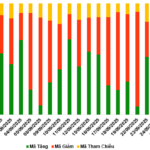

After a tumultuous morning session, a strong rally in VIC shares propelled the VN-Index upward in the afternoon. The VN-Index closed the September 25th session up 8.63 points at 1,666. Trading volume remained robust, with over VND 27,800 billion changing hands on the HOSE.

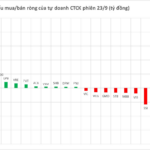

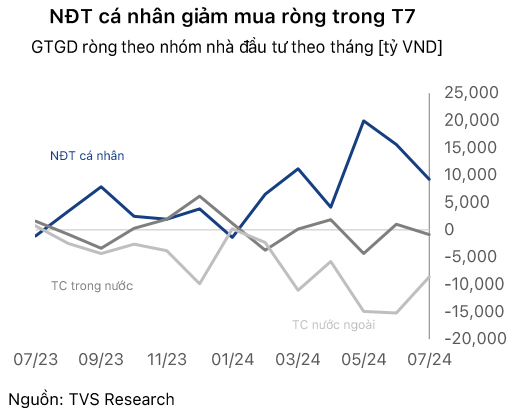

Foreign investor activity was a drag, as they were net sellers to the tune of VND 2,200 billion across the market.

On the HOSE, foreign investors were net sellers of VND 2,062 billion.

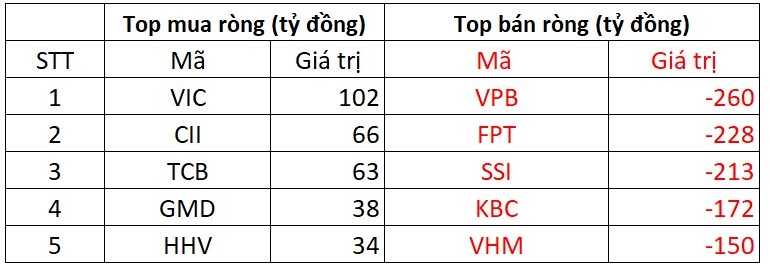

On the buying side, VIC was the most heavily purchased stock by foreign investors on the HOSE, with over VND 102 billion invested. CII followed closely behind, attracting VND 66 billion in foreign buying. TCB and GMD also saw significant foreign inflows, with VND 63 billion and VND 38 billion, respectively.

Conversely, VPB was the most heavily sold stock by foreign investors, with VND 260 billion offloaded. FPT and SSI also saw significant selling pressure, with VND 228 billion and VND 213 billion sold, respectively.

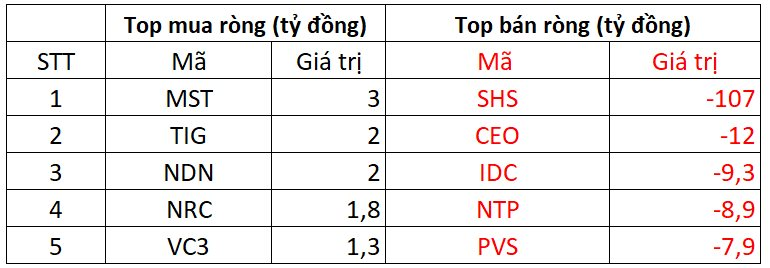

On the HNX, foreign investors were net sellers of VND 141 billion.

On the buying side, MST saw the strongest foreign buying on the HNX, with VND 3 billion invested. TIG followed closely behind with VND 2 billion in foreign inflows. Foreign investors also allocated a few billion dong each to NDN, NRC, and VC3.

On the selling side, SHS faced the strongest selling pressure from foreign investors, with nearly VND 107 billion sold. CEO, IDC, and NTP also saw notable selling, with VND 9-13 billion offloaded from each.

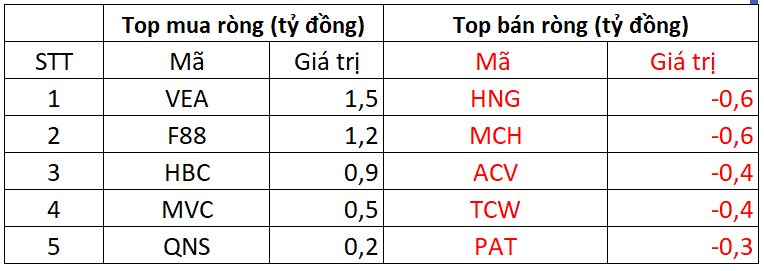

On the UPCOM, foreign investors were net buyers of VND 3 billion.

On the buying side, VEA attracted VND 1.5 billion in foreign investment. F88 and HBC also saw modest foreign buying, with a few billion dong invested in each.

Conversely, HNG saw VND 0.6 billion in foreign selling. Foreign investors also offloaded MCH, ACV, and others.

Market Pulse 25/09: VIC Accelerates, VN-Index Closes Up Nearly 9 Points

After a morning session marked by persistent tug-of-war around the reference point, the market swiftly shifted gears in the afternoon, adopting a highly positive trajectory. At one point, the VN-Index surged by over 10 points, reaching a high of 1,668. VIC emerged as the standout stock, contributing significantly to the market’s gains today.

Technical Analysis for the Afternoon Session of September 25: Holding Strong Above Key Support Levels

The VN-Index is currently fluctuating as it retests the middle band of the Bollinger Bands. However, the index has found stability after successfully testing the previous August 2025 low (around the 1,600-1,630 point range). Meanwhile, the HNX-Index shows even stronger momentum, with the Stochastic Oscillator generating a clear buy signal.