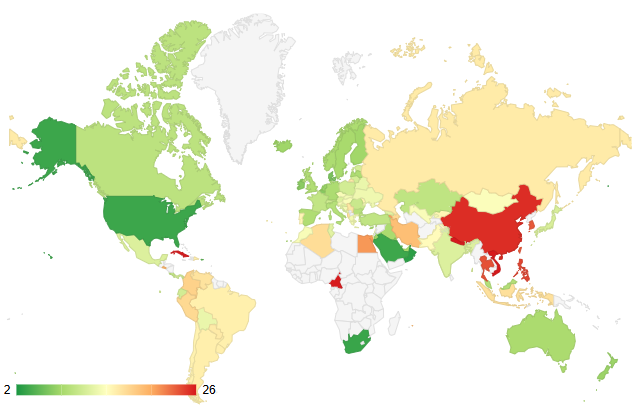

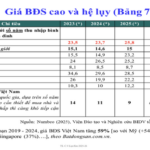

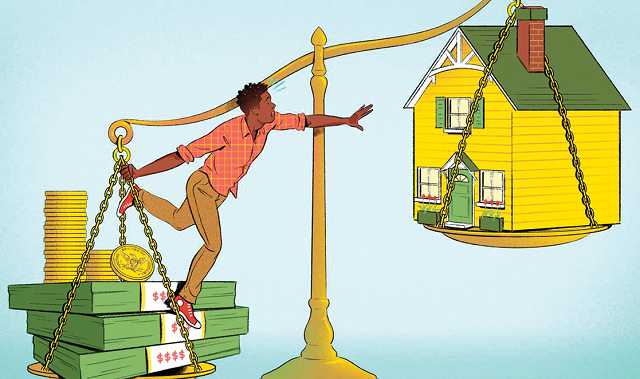

Drawing from Numbeo’s database, SHS Research highlights that Vietnam’s house price-to-income ratio is among the most daunting globally. By mid-2025, this ratio reached 27.3, meaning the average apartment costs over 27 times the annual household income.

In reality, adhering to the financial safety principle of allocating no more than one-third of income to housing, SHS Research estimates Vietnamese households would need to save for 80 years to afford a typical home. Analysts remark, “From youth to old age, owning a home remains a distant dream.”

|

Heatmap of global house price-to-income ratios: Vietnam ranks among countries with the highest housing costs relative to income

(Price to Income Ratio) Source: Numbeo

|

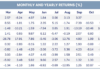

According to SHS Research, while household income grows by one step, housing prices leap three. In Hanoi, from 2014 to 2025, average income rose 6.4% annually, but apartment prices surged nearly 12% yearly, climbing from VND 25 million/m² to VND 75 million/m².

Analysts argue that soaring housing costs have become a structural economic issue. Rising living expenses further erode savings for homeownership. “Addressing this challenge requires policy intervention, not individual effort.”

Recently, property prices rebounded due to legal land clearance, lower interest rates, and expanded credit access. Does this necessitate immediate regulatory intervention to curb prices?

Is suppressing prices the solution?

SHS Research emphasizes viewing real estate within the broader financial asset landscape. Policies should not aim to “crush” asset values, as this defies market principles and risks systemic instability.

Instead, regulation should align housing price growth with income growth. SHS Research advocates for balance, ensuring affordability improves while safeguarding financial stability and avoiding market shocks.

Analysts note, “A nuanced policy preserves asset value for owners while enabling younger generations to enter the market, ensuring homes are shelters, not speculative tools.”

Short-term, SHS Research argues against forcing credit into production, as this sector lacks capacity to absorb funds. The focus should be on expanding the overall economy to strengthen production’s appeal to capital.

Meanwhile, interest-sensitive sectors like real estate and construction can lead recovery. Post-2008, the U.S. economy rebounded as housing revived, spurring construction investment and consumer confidence, with corporate investment following later.

“View real estate and production as a relay race, not a zero-sum game. With proper guidance, these sectors complement each other, driving sustainable growth,” SHS Research concludes.

Long-term, SHS Research advocates for strategic investment in social housing paired with transportation infrastructure. This approach moderates price growth, giving incomes time to catch up. Success lies in sustainable price increases, ensuring affordability for renters and first-time buyers while maintaining market stability.

Additional recommendations include tax tools, demographic-based urban planning, and improved market data for informed policymaking.

– 14:58 25/09/2025

Housing Supply Boom Expected by 2026: Will Home Prices Drop?

The Hanoi real estate market is showing signs of improvement with a rise in supply. However, housing prices remain elevated, posing a significant challenge for residents seeking affordable housing options.

Cracking Down on Land Speculation: Hà Tĩnh Tightens Real Estate Brokerage Regulations in Rural Areas

Recognizing that certain speculative groups, investor networks, and individuals engaged in real estate brokerage have been artificially inflating rural land prices to manipulate the market and profit unfairly, the Department of Construction in Ha Tinh Province has issued an official directive to all relevant units. This directive aims to strengthen regulatory measures and enhance oversight of the real estate market to curb such practices.

Dr. Can Van Luc: Vietnamese Public Servants Need Nearly 26 Years of Work to Afford an Apartment, Compared to Global Average of 15 Years

Dr. Can Van Luc asserts that the real estate market is grappling with significant volatility, as housing prices are rising faster than incomes, making it increasingly difficult for people to afford homes. He urges businesses to restructure, manage risks, and accelerate digital and green transformations. Additionally, he calls on the government to implement measures aimed at reducing overall price levels.

Young Buyers Fuel Surge in Real Estate Purchases

Despite soaring home prices, young adults are entering the real estate market at higher rates than previous generations, particularly in the apartment segment, according to VARS.