SMC’s Extraordinary Shareholders’ Meeting took place on the morning of September 25th.

|

A New Breeze at SMC

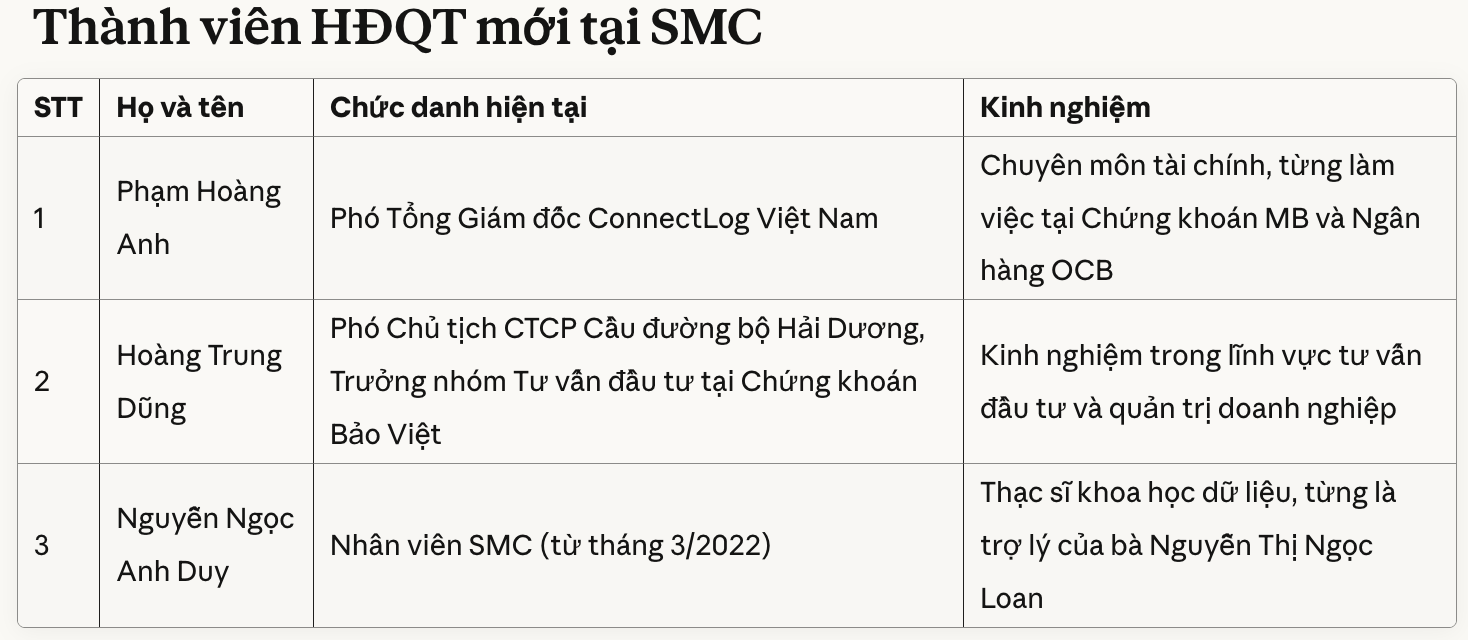

The assembly approved the addition of three new Board of Directors members: Mr. Pham Hoang Anh, Mr. Hoang Trung Dung, and Mr. Nguyen Ngoc Anh Duy.

According to SMC’s Vice Chairwoman, Nguyen Ngoc Y Nhi, Mr. Hoang Anh and Mr. Trung Dung represent a new group of shareholders who now hold over 20% of the company’s shares. She expressed hope that this would bring a “fresh breeze” to help SMC overcome its challenges.

| As per VietstockFinance data, SMC’s two largest shareholders as of the end of 2024 are Hanwa (19.57%) and Mrs. Nguyen Thi Ngoc Loan (14.24%). |

Following the meeting, the new Board of Directors swiftly elected Mr. Pham Hoang Anh as Chairman, bringing a “fresh breeze” to SMC’s leadership.

At the assembly, newly appointed Chairman Pham Hoang Anh stated, “The new shareholder group is highly united and focused on SMC’s development. This group aims to benefit not only shareholders but also partners and customers.”

New Chairman Pham Hoang Anh addressing the assembly.

|

Restructuring Plan Focuses on Three Priorities

SMC, a renowned steel processing and distribution company in Southern Vietnam, has faced difficulties since 2022 due to unrecoverable debts and a weakened real estate market, significantly impacting its cash flow.

SMC’s leaders agreed that the lack of operating capital is the primary obstacle preventing the company from pursuing new projects.

To address this, Chairman Pham Hoang Anh stated that the company’s top priority is resolving outstanding debts and completing ongoing tasks this year. Vice Chairwoman Y Nhi mentioned that the outstanding debt related to Novaland currently stands at 650 billion VND.

Next, SMC plans to overhaul its governance and management systems and renegotiate terms with suppliers and customers to improve business operations.

Finally, there’s a plan to raise capital through a share issuance. “After restructuring, SMC intends to present a capital increase plan to the Board of Directors soon. The company’s current capital is 736 billion VND, which is considered small compared to its scale, given that its revenue once reached 20-21 trillion VND and even in challenging years remained at 8-9 trillion VND,” Mr. Hoang Anh noted.

“I am confident in the success of the restructuring efforts, combining the strengths of both new and old groups, the business acumen of the previous leadership, and SMC’s 37-year foundation,” the new Chairman affirmed.

Regarding immediate solutions, Vice Chairwoman Y Nhi revealed that in Q4 2025, SMC plans to sell two factories in Phu My Industrial Zone to boost cash flow and alleviate financial pressure.

– 13:21 25/09/2025

Mr. Ly Hoai Van Appointed as Acting CEO of BVBank Effective October 1st

On September 25th, Ban Viet Commercial Joint Stock Bank (BVBank, UPCoM: BVB) announced a change in its senior leadership team. Effective October 1st, 2025, Mr. Ly Hoai Van will assume the role and responsibilities of Acting Chief Executive Officer (CEO).

VEFAC Shocks Again with 330% Dividend Advance Proposal, Total Payout Nearing 5.5 Trillion VND

After distributing over VND 7.2 trillion in dividends at a rate of 435% in July, Vietnam Exhibition Fair Center Corporation (VEFAC, UPCoM: VEF) is now proposing an interim dividend payout of 330%, equivalent to nearly VND 5.5 trillion. As the majority shareholder with over 83% ownership, Vingroup stands to be the primary beneficiary.

Steel Company’s Stock Surges 140% in 5 Months Following Debt Recovery from Novaland

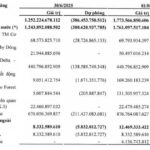

Novaland Group’s debt at SMC, encompassing Delta – Valley Binh Thuan Co., Ltd., Dalat Valley Real Estate Co., Ltd., and The Forest City Co., Ltd., has decreased by nearly VND 287 billion. Specifically, Dalat Valley’s debt reduced by over VND 157 billion, while The Forest City’s debt saw a decline of more than VND 126.5 billion.

SMC Chairman’s Relative Fined for Unauthorized Share Sale

Mr. Nguyen Nghia Dung, brother of Mrs. Nguyen Thi Ngoc Loan—Chairperson of SMC’s Board of Directors—has been fined 100 million VND by the State Securities Commission (SSC). The penalty stems from his sale of 780,000 SMC shares without prior transaction disclosure as required.