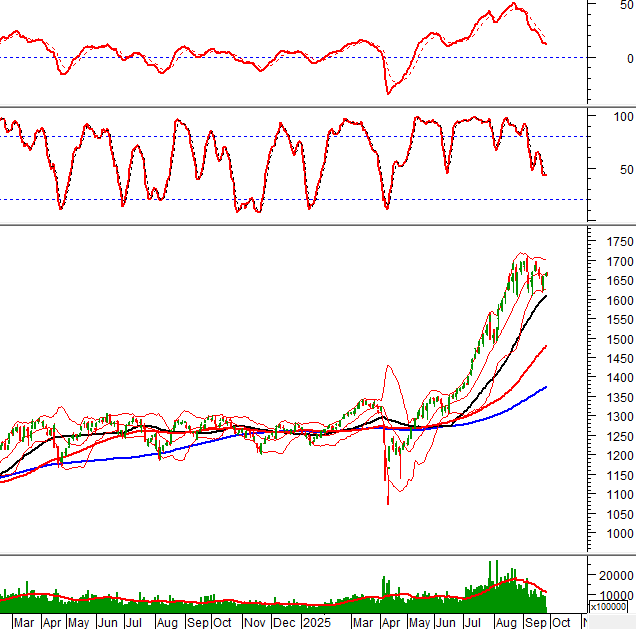

Technical Signals of VN-Index

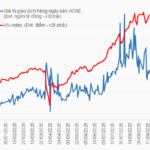

During the morning trading session on September 26, 2025, the VN-Index continued its tug-of-war, testing the Middle line of the Bollinger Bands once again.

The August 2025 low (equivalent to the 1,600-1,630 point range) held firm during the recent correction, demonstrating the strength of this support level. Buying when the index retests this support zone is encouraged.

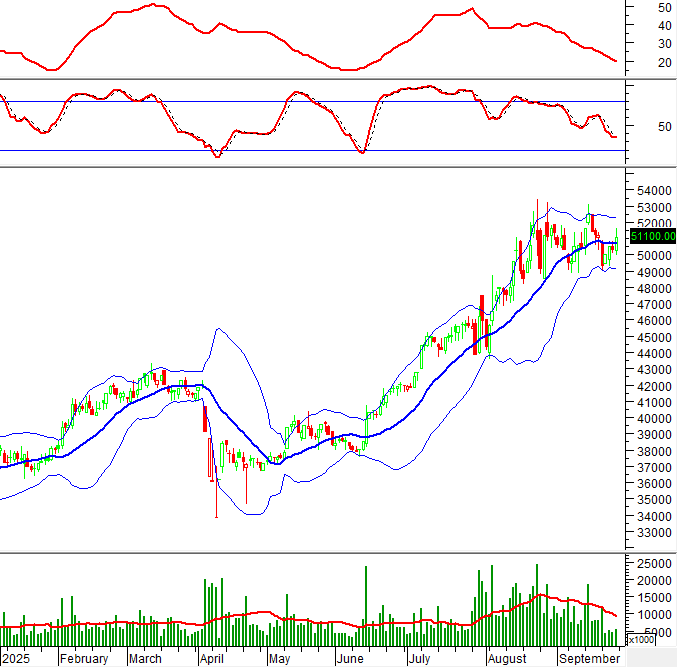

Technical Signals of HNX-Index

In the morning session on September 26, 2025, the HNX-Index persisted in its sideways movement within a Triangle pattern. This consolidation is expected to continue, given the consistently low trading volume.

Should the Stochastic Oscillator or MACD generate buy signals in upcoming sessions, the short-term outlook could turn positive.

AAA – An Phat Green Plastics JSC

On the morning of September 26, 2025, AAA shares surged, accompanied by a Big White Candle pattern and volume exceeding the 20-session average, indicating renewed investor activity.

Currently, AAA has successfully broken out of the Triangle pattern’s upper boundary, with the MACD indicator issuing a buy signal and remaining above zero.

If technical signals remain positive and AAA surpasses the August 2025 high (around 8,700-8,900), the potential price target could reach 9,100-9,300.

CTG – Vietnam Joint Stock Commercial Bank for Industry and Trade

During the morning session on September 26, 2025, CTG shares edged higher, but trading volume remained below the 20-day average, reflecting investor hesitation.

Additionally, the Bollinger Bands have continued to narrow (Bollinger Band Squeeze), while the ADX indicator has declined and remains below the grey zone (20 < ADX < 25).

Furthermore, the Stochastic Oscillator has continued its downward trajectory after issuing a sell signal and is approaching the oversold region. This suggests that the short-term outlook remains uncertain.

(*) Note: The analysis in this article is based on real-time data as of the end of the morning session. Therefore, signals and conclusions are for reference only and may change after the afternoon session concludes.

Technical Analysis Department, Vietstock Advisory Division

– 12:04 September 26, 2025

Where is the Major Stock Market Correction?

Meet Mr. Market, the enigmatic personification of the stock market, known for his wildly unpredictable moods. When euphoric, he prices assets sky-high, and when despondent, he dumps them at rock-bottom values. Many believe they can outsmart Mr. Market and profit from his whims, but the truth is, few ever succeed.

Tomorrow’s Stock Market, September 26: Seizing Investment Opportunities in Attractive Stocks

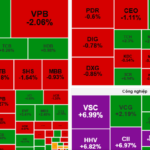

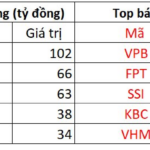

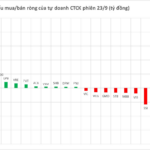

Vietnamese stocks on September 25 witnessed a divergence in capital flows across sectors, presenting investors with opportunities to strategically allocate funds in the upcoming September 26 session.

Market Pulse 25/09: VIC Accelerates, VN-Index Closes Up Nearly 9 Points

After a morning session marked by persistent tug-of-war around the reference point, the market swiftly shifted gears in the afternoon, adopting a highly positive trajectory. At one point, the VN-Index surged by over 10 points, reaching a high of 1,668. VIC emerged as the standout stock, contributing significantly to the market’s gains today.