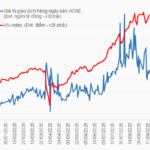

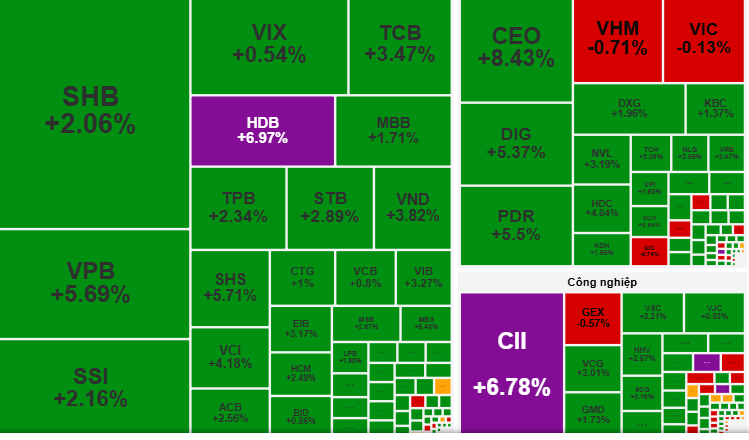

On September 24th’s trading session, bank and real estate stocks surged dramatically.

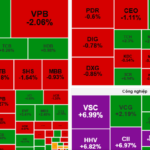

Earlier, the September 24th stock market opened under heavy selling pressure from bank, securities, and Vingroup-related stocks, pushing the VN-Index below 1,620 points. However, bargain hunters emerged mid-morning, narrowing the index’s decline. Real estate and infrastructure investment stocks shone, attracting strong inflows with standout performers like DIG, CEO, and CII.

In the afternoon session, the market dipped initially but rebounded swiftly as buying interest returned to bank and securities stocks. Notably, real estate stocks extended their gains, combined with broad-based buying in bank shares, propelling the VN-Index to a strong finish at 1,657 points, up 22 points (+1.36%).

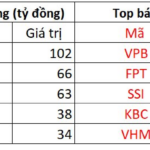

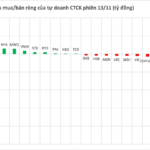

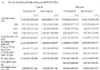

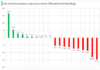

Foreign investors continued heavy net selling, totaling VND 1,509 billion, focused on stocks like VHM, SSI, and VPB. Domestic buying, however, remained robust, driving the index higher despite foreign outflows.

According to VCBS Securities, the VN-Index rebounded from the 1,620 support level, fueled by broad gains among large-cap stocks.

VCBS advises investors to hold stocks with strong upward momentum and consider short-term trading opportunities in stocks showing successful support tests, particularly during market volatility. Key sectors to watch include banking, real estate, steel, and securities.

Rong Viet Securities (VDSC) notes the market found support at 1,620 points and recovered swiftly. Increased liquidity compared to the previous session indicates supply pressures eased near support levels, while buying interest grew on positive signals.

VDSC forecasts the VN-Index could surpass 1,663 points on September 25th. However, potential supply increases may create resistance at this level.

Technical Analysis for the Afternoon Session of September 26: Tug-of-War Around the Bollinger Bands’ Middle Line

The VN-Index persists in its tug-of-war, retesting the Middle line of the Bollinger Bands. The August 2025 low (equivalent to the 1,600-1,630 point range) held firm during the recent correction, underscoring the resilience of this critical support level. Meanwhile, the HNX-Index continues to oscillate sideways within a Triangle pattern, signaling ongoing consolidation.

Where is the Major Stock Market Correction?

Meet Mr. Market, the enigmatic personification of the stock market, known for his wildly unpredictable moods. When euphoric, he prices assets sky-high, and when despondent, he dumps them at rock-bottom values. Many believe they can outsmart Mr. Market and profit from his whims, but the truth is, few ever succeed.

Tomorrow’s Stock Market, September 26: Seizing Investment Opportunities in Attractive Stocks

Vietnamese stocks on September 25 witnessed a divergence in capital flows across sectors, presenting investors with opportunities to strategically allocate funds in the upcoming September 26 session.