Closing the session on September 25th, the VN-Index rose by over 8 points, settling at 1,666 points.

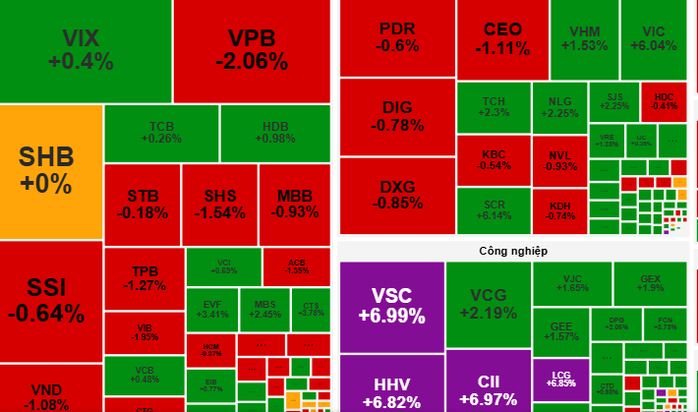

The morning session on September 25th opened with the VN-Index climbing 4 points, driven by strong buying interest in banking stocks. However, selling pressure on several large-cap stocks within the Vingroup and banking sectors, along with individual stocks like HVN and FPT, narrowed the gains. The real estate and public investment sectors continued to attract capital, with standout performers including DIG (+2.79%), PDR (+2.55%), and CII (hitting the ceiling price).

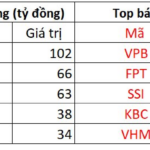

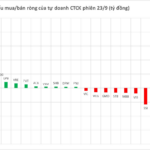

In the afternoon session, buying momentum returned to Vingroup stocks, allowing the VN-Index to extend its gains. Yet, capital flows showed clear divergence, shifting away from real estate and toward public investment and energy sectors. The overall index fluctuated within a narrow range but maintained its upward trend. Foreign investors continued to net sell heavily, reaching 2,062 billion VND, focusing on stocks like VPB, FPT, and SSI.

By the close, the VN-Index had risen by more than 8 points, ending at 1,666 points, confirming the dominance of buying interest in the market.

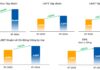

VCBS Securities Company assessed that the market is in a phase of tug-of-war and accumulation, characterized by low liquidity. Investors should maintain their available stock ratios and leverage market volatility to explore investment opportunities in retail, banking, and securities stocks that are attracting capital.

Meanwhile, Dragon Capital Securities (VDSC) noted that liquidity on September 25th slightly decreased, indicating that supply pressures remain moderate. “Capital needs to absorb stronger supply to confirm the market’s upward trend. Investors should monitor supply and demand dynamics and avoid chasing high-priced stocks,” VDSC advised.

VPS Launches IPO, Aiming to Offer Over 200 Million Shares

On September 24th, the Board of Directors of VPS Securities JSC approved and issued an updated proposal, supplementing materials for the second extraordinary shareholders’ meeting of 2025. Notably, the leadership plans to seek shareholder approval for an initial public offering (IPO).

Market Pulse 25/09: VIC Accelerates, VN-Index Closes Up Nearly 9 Points

After a morning session marked by persistent tug-of-war around the reference point, the market swiftly shifted gears in the afternoon, adopting a highly positive trajectory. At one point, the VN-Index surged by over 10 points, reaching a high of 1,668. VIC emerged as the standout stock, contributing significantly to the market’s gains today.