“Imagine, out of 1,000 global GameFi projects, Vietnam alone accounts for 800,” joked Mr. Nguyễn Ngọc Hưng, Vice Chairman of the Investment Promotion Committee of the Vietnam Blockchain and Digital Asset Association.

But after the frenzy, the market underwent a brutal filtration process. According to ChainPlay’s analysis of 3,279 projects in late 2024, the average lifespan of a GameFi project is only about 4 months, with a staggering 93% classified as “dead” – meaning their tokens lost over 90% of their peak value, and daily active users dropped below 100.

“Even in the DeFi sector, the number of blockchain companies or investment funds still operating today could probably fit on one hand,” Mr. Hưng remarked.

Meanwhile, Vietnam had 17 million digital asset owners as of 2024, with annual transaction values exceeding $100 billion, according to Chainalysis. This makes the country vulnerable to “short-lived” blockchain projects and contributes to its presence on the Financial Action Task Force’s (FATF) grey list.

This context prompted a significant policy shift in Vietnam: on June 12, 2025, the government issued Decision 1131, officially designating blockchain as one of 11 strategic technologies. Just two days later, the National Assembly passed the Digital Technology Industry Law, which for the first time defined and legalized the concept of “digital assets.” These changes create a legal framework for a volatile market, offering blockchain the opportunity to break free from short-term cycles and enter a phase of sustainable development.

To better understand these impacts, we spoke with Mr. Nguyễn Ngọc Hưng (Eric Hưng) – Vice Chairman of the Investment Promotion Committee of the Vietnam Blockchain and Digital Asset Association, and Co-founder of Amnis Finance, a project that successfully raised $4 million from funds like Borderless Capital and OKX Ventures.

Mr. Hưng is also the Co-founder and CEO of Spores Network, a Web3 launchpad, investment fund, and incubator that has facilitated over $40 million in fundraising for more than 200 partners and 3,000 projects in DeFi, GameFi, NFT, AI, and other sectors. With nearly a decade of blockchain experience, he offers candid insights into Vietnam’s market opportunities and challenges.

With the recent policies related to blockchain technology, including the legalization of digital assets, how do you assess the impact of this legal openness on Vietnam’s blockchain market?

Mr. Nguyễn Ngọc Hưng: I believe the designation of blockchain as a strategic technology is accurate. Vietnam has spent 20-30 years in software outsourcing, starting from FPT’s early days. Vietnamese engineers have gained tremendous expertise working on global blockchain projects. In terms of blockchain technology, Vietnam is not behind the world. Many leading global blockchain projects and technologies are backed by Vietnamese engineers or teams. This is our first strength – our human resources.

Second, compared to hardware industries like robotics, semiconductors, or manufacturing, which involve physical production with supply chains, electricity, infrastructure, and raw materials, software technology is borderless. A Vietnamese engineer with just a laptop can work globally, relying primarily on intellectual capabilities, with minimal impact from traditional supply chains.

Third, there’s the issue of trade barriers. For example, the recent U.S. tariff countermeasures did not affect the technology services sector. These are Vietnam’s advantages in keeping pace with the world.

Finally, Resolution 57 and the government’s inclusion of blockchain in 11 strategic technologies, along with the implementation of VBSN and pilot projects in Da Nang and Ho Chi Minh City International Financial Centers, will provide a clear legal framework and practical testing ground for startups.

With Vietnam’s many strengths, why do blockchain projects here still struggle to develop?

Blockchain is inherently challenging. Looking back at Vietnam’s early tech startup era in the 2000s, when major investors like IDG entered the market, tech business models were relatively simple. Whatever succeeded in the U.S. or globally was adapted and localized. For example, Google and chat apps led to Vietnamese search platforms and messaging services, similar to China’s Weibo and Wechat.

Vietnam achieved some success, but blockchain is different. As a global technology, any product must compete internationally with those from the U.S. and Europe, not just within Vietnam. I often compare blockchain startups to Olympic athletes, not just national-level competitors. This creates an intensely competitive environment.

In such a harsh environment, winners typically dominate market share. In most blockchain sectors, from decentralized finance to GameFi, the top 3-5 companies control 90-95% of the market. It’s a winner-takes-all scenario.

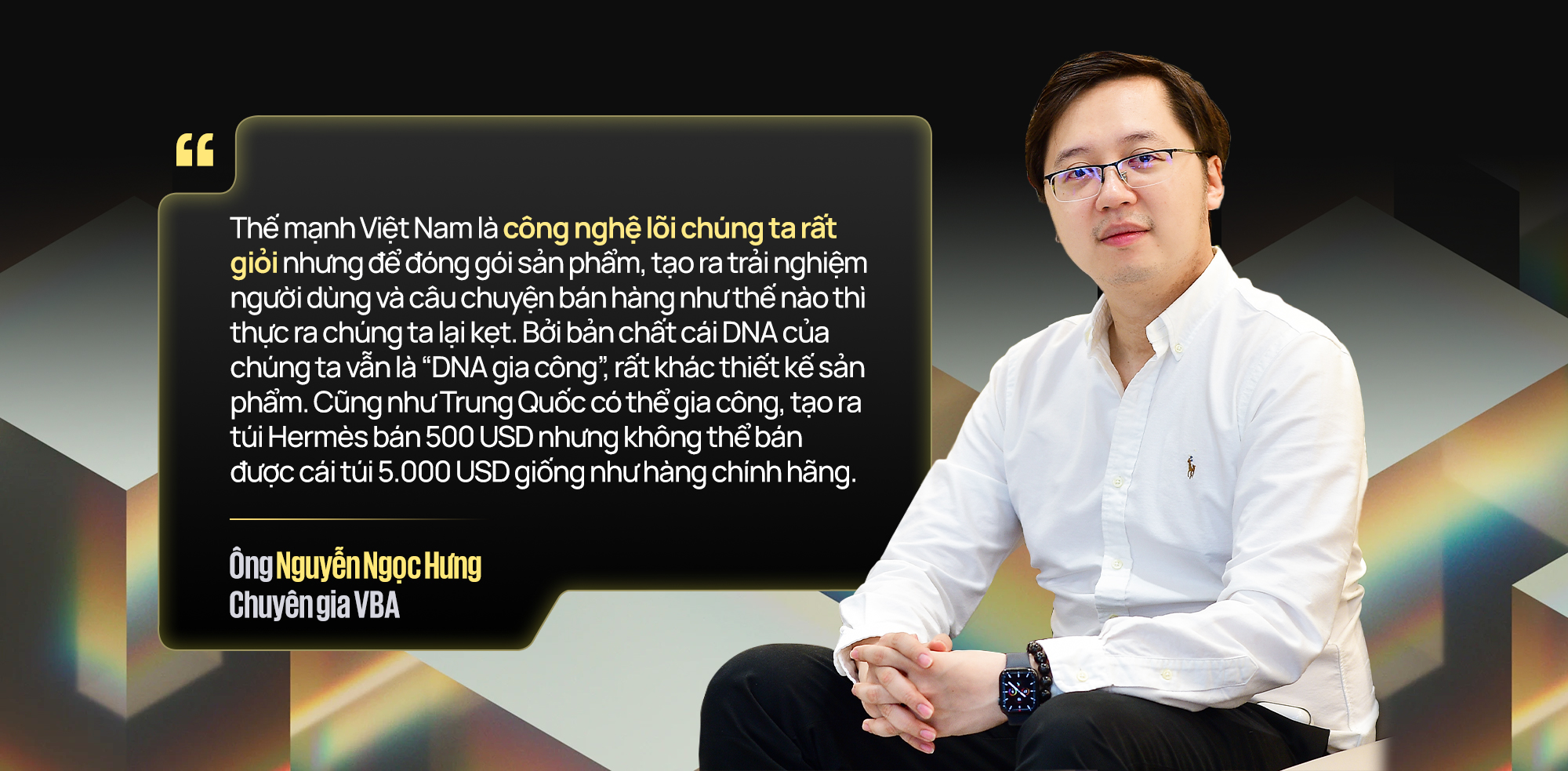

Vietnam’s strength lies in core technology, but we struggle with product packaging, user experience, and sales strategies. Our “outsourcing DNA” differs from product design. Just as China can manufacture Hermès bags for $500 but not sell them for $5,000 like the original, we face challenges in product packaging, sales, marketing, storytelling, user experience, supply chains, and distribution.

Additionally, blockchain has its downsides. During market booms, money flows too easily, leading some young entrepreneurs to overestimate their abilities. For instance, during the 2020-2021 GameFi peak, Vietnam reportedly had 800 projects out of 1,000 globally. Funding was so easy that a simple pitch deck, whitepaper, or demo video could secure millions.

This resulted in many underqualified teams failing after receiving large sums. There are two typical cases: some, tempted by greed, engage in fraud, while others lack the skills to compete. Success rates are low.

Even in DeFi, only a handful of blockchain companies or funds remain today. Sometimes failure is due to industry trends. For example, 90-95% of 2020-2021’s GameFi and NFT projects have vanished, despite past successes.

Some sectors, like DeFi, have seen global success for Vietnamese projects. Long-term prospects are optimistic as market filtration creates a cleaner startup and investment environment. By 2025, surviving blockchain teams have proven their resilience, no longer relying on “easy money.” This is why open infrastructure like VBSN is essential – to support integration, reduce costs, and create a level playing field for Vietnamese startups.

Why did once-hot sectors like GameFi and NFTs fade, while DeFi gained acceptance?

Market acceptance ultimately determines a product’s success. So far, GameFi and NFTs haven’t gained widespread global adoption outside small blockchain communities. Since 2017, blockchain’s applications have evolved. Initially, the focus was on core technology and enterprise use cases like supply chain tracking.

Then came GameFi and NFTs, and now the focus is back on DeFi. Blockchain’s essence is a ledger system, evolving from single-entry (stone/paper) to double-entry (invoices) and now triple-entry (blockchain), recording sender, receiver, amount, and purpose. Bitcoin, as blockchain’s first application, requires global data storage.

DeFi’s resurgence aligns with blockchain’s financial design. As traditional finance moves to Web3, DeFi becomes relevant. Financial applications require tamper-proof technology like blockchain to ensure trust.

DeFi has demonstrated sustainability since 2019-2020. With the U.S. stablecoin law, I expect significant growth in decentralized finance. Stablecoins, bridging traditional and digital finance, will drive global financial flows. Blockchain’s core value is cross-border finance, making DeFi’s prospects promising.

As DeFi grows, how will it impact traditional finance, especially banks and securities firms expanding into digital assets?

Stablecoins will revolutionize payments, replacing SWIFT’s inefficiencies. Traditional bank transfers can take weeks and cost hundreds of dollars, but stablecoin transfers take seconds and cost pennies, even for large amounts.

This transforms cross-border trade finance, replacing letters of credit with blockchain-based stablecoin systems. Countries like the U.S., Japan, and China are adopting central bank digital currencies (CBDCs), reshaping global payments.

Stablecoins also reduce intermediary fees. Visa and Mastercard charge 2% per transaction, but stablecoins can significantly lower these costs. Even Amazon is considering its own stablecoin for global payments.

Beyond payments, blockchain enhances data management and settlement systems, already adopted by financial institutions. Centralized crypto exchanges are another focus for banks. Vietnam’s stablecoin pilot in Da Nang offers opportunities to test technology and create nationally relevant solutions (payments, trade, data management).

What opportunities do stakeholders have in this evolving landscape?

In the past 3-6 months, many tech companies and financial institutions have engaged with blockchain projects for consulting and technology needs. Building a blockchain ecosystem involves not just exchanges but also payment solutions, decentralized finance, wallets, and more, creating numerous opportunities.

Similar to the stock market’s ecosystem of exchanges, brokerages, lending, custody, and analysis, blockchain and digital assets will develop comparable structures. This also attracts international investment, provided legal frameworks are clear.

With 85% of Vietnamese assets in real estate and 15% in bank deposits/stocks, digital assets offer portfolio diversification. Policymakers aim to shift capital from real estate to productive sectors, and blockchain can facilitate this by channeling investment into innovation.

With Vietnam’s plans for new technology testing in Da Nang and Ho Chi Minh City International Financial Centers, what opportunities and challenges does this present for blockchain and digital assets?

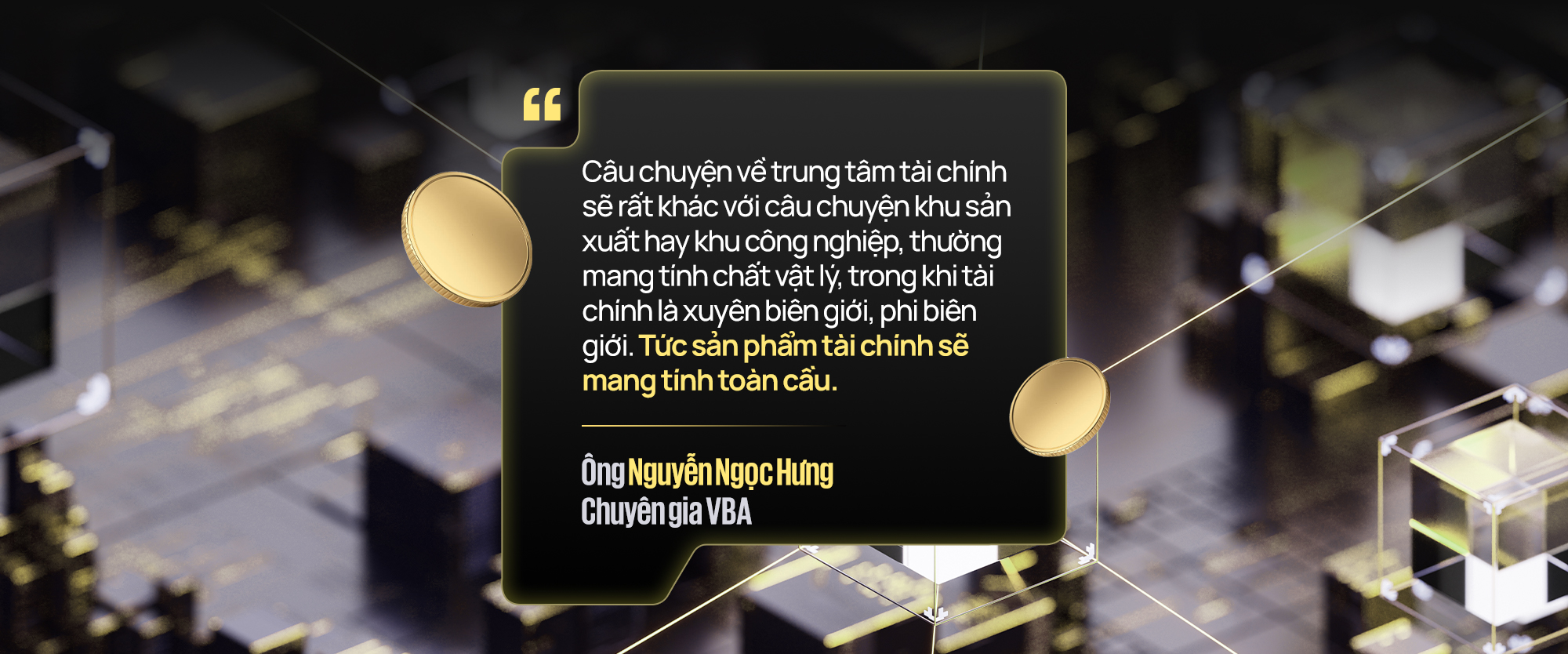

These financial centers represent a significant step. Unlike manufacturing zones, financial centers deal with global, borderless products. Vietnam must compete with established hubs like Singapore, Hong Kong, and London by offering attractive legal frameworks, investment mechanisms, and operational clarity.

Blockchain and digital assets, being cross-border financial tools, require clear regulations for investors and talent. Success depends on creating an appealing, transparent environment.

How can Vietnam attract quality investment while managing risks in this new financial landscape?

As a FATF grey-list country, Vietnam must enforce KYC, AML, and anti-terrorist financing measures. A balanced legal framework is essential – open yet regulatory, protecting participants while fostering innovation.

Blockchain trends are unpredictable, and even investors make mistakes. Restricting investment to specific sectors could hinder progress. Instead, Vietnam should attract top investors and experts, creating a transparent, protective environment that encourages participation and innovation.

With nearly 20 million crypto asset owners in Vietnam, many of whom are inexperienced, how can the market grow sustainably?

Every market starts this way. Vietnam’s stock market 20 years ago saw investors carrying cash for OTC trades, knowing only stock codes. Similarly, crypto investors need education. A transparent, regulated market with vetted assets (like Bitcoin, Ethereum) can protect consumers while allowing innovation.

Accredited investor models, similar to the U.S., can offer broader opportunities for professionals while safeguarding retail investors. Balancing protection and innovation, as seen in SEC’s sandbox approach, is key.

What opportunities do traditional companies have in this market?

This is an inclusive opportunity. AI and blockchain are transformative technologies. Traditional businesses can leverage stablecoins for efficient cross-border payments, reducing costs. Tokenizing real assets, like real estate, can unlock new value.

Blockchain can also revolutionize capital raising, both domestically and internationally, through Vietnam’s financial centers. This ecosystem benefits all players, from startups to established firms, by creating new financial tools and markets.

Thank you!

Time to Craft Your Post-Upgrade Adaptation Story

After a seven-year wait marked by numerous delays, Vietnam’s stock market is closer than ever to achieving an upgrade to Secondary Emerging Market status by FTSE Russell. Decisive actions from regulators have ignited significant expectations, while simultaneously raising a critical question for investors and the entire market: What comes next after the upgrade? How should stakeholders prepare to capitalize on opportunities and navigate challenges post-upgrade?