The Outstanding Green Credit Bank Award is part of the Vietnam Outstanding Bank Awards 2025. This annual award, organized by IDG Vietnam in collaboration with the Vietnam Banks Association, evaluates the quality of outstanding banking/fintech services through user surveys and assessments by the award’s judging panel, comprising representatives from government agencies, ministries, associations, and financial and technology experts.

VietinBank, with its strategic focus on promoting sustainable development financing solutions, has been honored as the Outstanding Green Credit Bank 2025 for the second consecutive year. This award underscores VietinBank’s pioneering role in implementing government and State Bank policies to advance green credit and foster sustainable development (SD).

Specifically, VietinBank has developed a Sustainable Finance Framework aligned with international standards set by ICMA, LMA, and APLMA. This framework was recognized as “reliable and impactful” by Morningstar Sustainalytics, a global leader in ESG research and ratings. It serves as a critical foundation for VietinBank to deliver unified and consistent green financial products and services.

Additionally, the bank has introduced specialized products and services to promote a green economy and circular economy, including financing for renewable energy projects, rooftop solar power, waste-to-energy solutions, green buildings, green exports, electric vehicle charging stations, and green deposit products. As of Q2/2025, VietinBank’s green credit outstanding balance increased by 17% compared to the end of 2024, supporting the sustainable development efforts of nearly 1,000 businesses across various sectors and scales.

This marks the second consecutive year the bank has received this prestigious award.

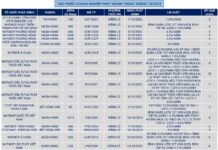

VietinBank Launches 99 Exclusive L/C Subscription Packages for Import-Export Businesses

Unlock unparalleled value with VietinBank’s 99 L/C subscription packages, starting at just 10 million VND. Designed for businesses utilizing import L/C services, these packages offer exceptional fee policies, ensuring cost-effectiveness and streamlined financial operations. Elevate your import transactions with VietinBank today.

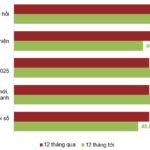

The Green Business Conundrum: Why Are Firms Struggling to Go Eco-Friendly?

Amidst the looming threat of the EU’s Carbon Border Adjustment Mechanism (CBAM) and the rising ESG demands from international investors, a stark paradox confronts Vietnamese businesses: while “greening” strategies have emerged as a top priority for many, the supply of green industrial real estate remains scarce. This leaves them operating in “grey” factories that fall short of sustainability standards.

“Unlocking Finance: Navigating the Challenges of Green Credit for Businesses”

The green finance market in Vietnam is hotter than ever, with a staggering 170% growth in the past year. Despite the increasing interest from businesses and financial institutions, the cost conundrum looms large, presenting a significant barrier. This challenge has prevented the path to accessing this sustainable source of capital from being truly open and inclusive.

Claim Your Government Gift – Double the Joy with VietinBank

Embracing the joyous spirit of the country’s 80th anniversary of the August Revolution and National Day on September 2nd, the government is gifting 100,000 VND to every Vietnamese citizen. This generous gesture is being directly transferred to bank accounts, ensuring a swift, secure, and transparent process.