Overview of the “National Industrial Real Estate Forum” Event

The National Industrial Real Estate Forum 2025, held on September 18, 2025, at the Daewoo Hotel in Hanoi, was organized by VNIC – Vietnam Investment Consulting in collaboration with the Southeast Asia Expansion Association. The event attracted over 300 experts and representatives from industrial real estate companies nationwide.

This year’s forum featured prominent participants, including major sponsors such as Southeast Asia Expansion Association, CapitaLand Investment, and Frasers Property Vietnam.

Additionally, the event saw the participation of key industry players, including infrastructure developers like ROX iPARK, Sembcorp Industries, KCN Vietnam, Gilimex IP, and Phú Mỹ Group; construction contractors such as FTA E&C and ANDES E&C; financial institutions like VPBank, IAS Consulting & Auditing, and Yaxin; logistics providers; and investors such as Uni-Trend Vietnam, VMG Technical & Outsource Service, and Thiên An Plastic.

Under the theme “Adapting to Change – Shaping the Future,” VNIREF 2025 addressed critical market issues, including the impact of global tariffs, FDI relocation trends, and strategies to attract FDI in the new era. The event provided a comprehensive overview of Vietnam’s industrial real estate market in the first nine months of 2025, with a special focus on the northern region.

Analysis of the 2025 Industrial Real Estate Market

At VNIREF 2025, experts assessed the industrial real estate market’s performance. According to Mr. Phạm Đức Toàn, VNIC’s representative, the market is showing clear signs of global tariff impacts on investment and development.

In 2025, the industrial land supply is projected to reach 19,100 hectares, an 11.8% increase from the previous year, driven by new developers. The occupancy rate remains high at 83%, with average rental prices rising slightly by 1.5% to $140/m². Provinces like Bắc Ninh, Hải Phòng, Hưng Yên, and Thái Nguyên continue to attract significant investment.

Meanwhile, the warehouse and industrial factory sector saw robust growth, with a supply of 15 million m², up 36.4% from 2024. The occupancy rate stands at 79%, and average rental prices remain stable at $4.7/m²/month. Demand is led by sectors such as electronics, semiconductors, machinery, packaging, and renewable energy, reflecting positive shifts in the supply chain.

Experts note that industrial land demand is slowing due to global political uncertainties, prompting businesses to adjust their investment strategies. Many large corporations are leasing smaller areas to test the market, while some SMEs are expanding investments abroad. However, this trend is unlikely to be sustainable, and there is no solid evidence of long-term demand growth for warehouse rentals or continued stagnation in the industrial land market.

In 2025, the U.S. tightened tariffs and maintained its “America First” policy, significantly impacting global trade and Vietnam. At VNIREF 2025, experts analyzed how tariffs are fragmenting supply chains, increasing costs, and forcing businesses to adjust production and export strategies. However, challenges also present opportunities, as the “China + 1” trend and U.S. tax policies drive investment shifts, making Vietnam an attractive destination for manufacturing, electronics, and logistics.

During the event, Mr. Harry Yan, Executive Director and Head of Southeast Asia Logistics at CapitaLand Investment, shared insights on developing infrastructure to attract FDI in the new era.

He highlighted CapitaLand’s focus on building modern, integrated infrastructure in industrial zones, optimizing logistics connectivity, and providing comprehensive support services. This strategy not only attracts FDI but also enhances competitiveness and promotes sustainable growth in Vietnam’s industrial real estate market. According to Mr. Yan, Vietnam’s inherent advantages position it as a top destination amid global supply chain restructuring.

VNIREF 2025 concluded with a strategic partnership signing ceremony between VNIC, the Southeast Asia Expansion Association, ROX iPARK, and VPBank. This agreement marks a significant step in market development, service diversification, and a commitment to fully support FDI in the new phase.

Vietnam’s FDI Inflows Hit Highest Level Since 2009

Foreign direct investment (FDI) in Vietnam’s manufacturing sector surged to nearly $12 billion in the first half of this year, marking a 32% increase year-on-year and accounting for over 56% of total registered capital. This is the highest level since 2009, creating significant opportunities for the industrial real estate market.

The New Industrial Revolution: Kinh Bac Leads the Pack in the Industrial Real Estate Race

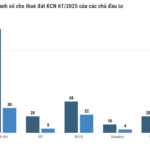

The industrial real estate sector remains resilient in the face of US tariff policies, as evidenced by the Vietcap Securities Company’s report on the performance of listed industrial park investors in the first half of 2025. Despite the challenges, these investors maintained stable land leasing revenues, showcasing the enduring demand for industrial properties.

The Tech Giants’ New Hub: Bac Ninh, Hai Phong, and Thai Nguyen

The North is thriving with its advanced transportation infrastructure and competitive industrial land prices, making it the frontrunner in attracting FDI projects, particularly from major technology corporations.