Looking back, 2025 emerged as one of the most turbulent periods in global finance since the pandemic, marked by President Trump’s announcement of soaring retaliatory tariffs on what he dubbed “Liberation Day.”

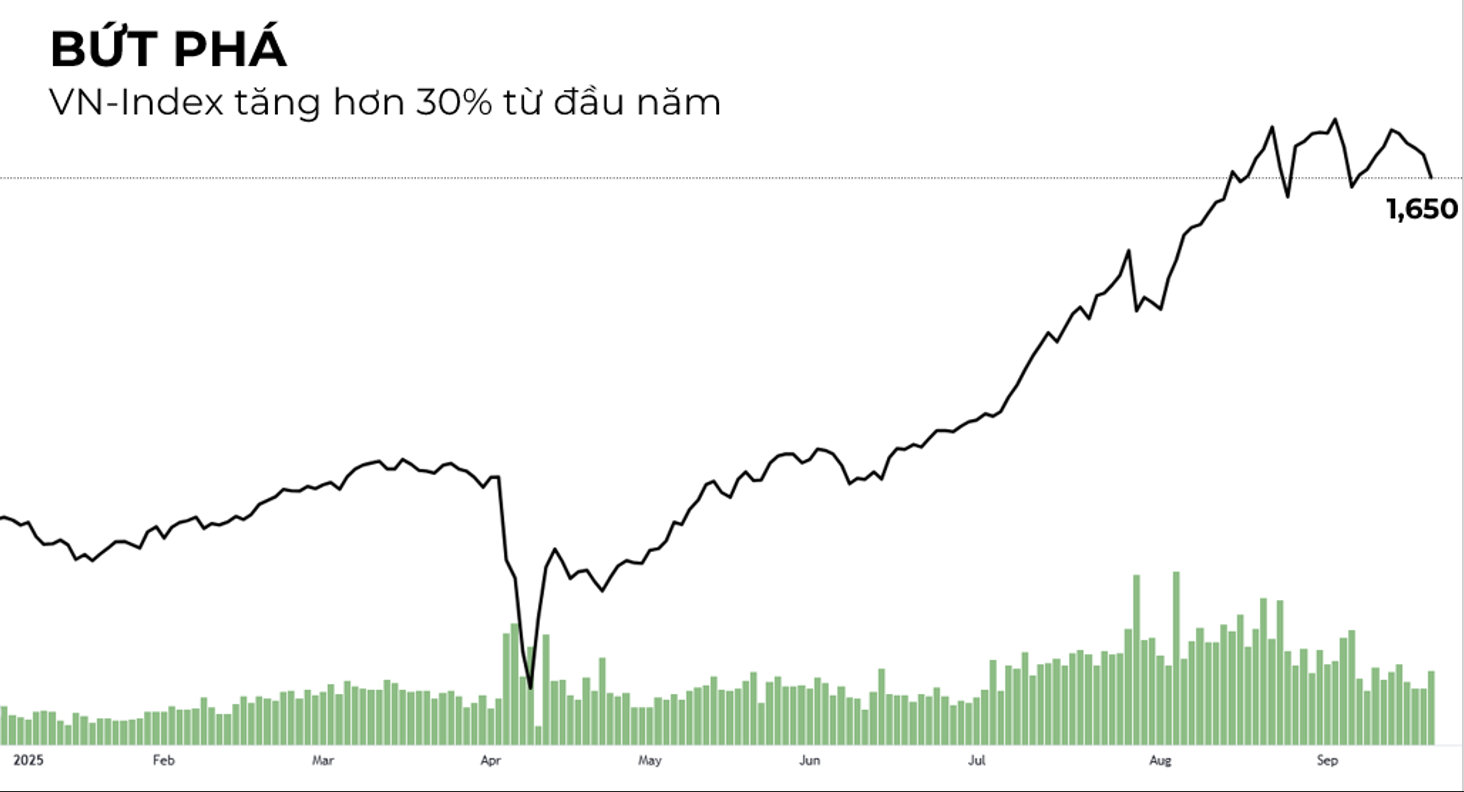

For the first time, Vietnam’s stock market witnessed multiple days of devastating declines, with pale green dominating the trading screens. Yet, what few anticipated was that this marked the beginning of one of the fastest and strongest rallies in history.

From the lows set on April 9—the day Trump reversed his tariff policy—the VN-Index surged relentlessly, hitting a recent high of 1,700 points before cooling to 1,650 on September 19. Compared to the bottom of 1,080 points, Vietnam’s benchmark index has climbed over 600 points, accompanied by record-breaking liquidity. Trading volumes across all three exchanges peaked at over VND 80 trillion, far surpassing the 2022 record of VND 50 trillion.

“It’s been a while since I’ve seen the market this vibrant. I don’t want to be left behind,” shared one investor.

This rally is underpinned by robust economic growth (7.5% in the first half), accommodative fiscal and monetary policies, booming exports, and expectations of a market upgrade.

By late August 2025, credit growth had surpassed 11% year-to-date, outpacing previous years. The government is also accelerating public investment, pledging to fully meet its 2025 targets.

Another critical factor is the success in tariff negotiations. Vietnam swiftly secured a 20% tariff reduction with the U.S., down from 46%, outpacing regional peers. This clarity has empowered businesses to strategize effectively.

Investors are also optimistic about Vietnam’s potential FTSE Russell upgrade in October 2025, as the nation has met all criteria for secondary emerging market status. Confidence is bolstered by statements from senior officials.

“I’m quite confident about the upgrade,” the Finance Minister told Reuters at a London conference, where he also met with FTSE Russell and the London Stock Exchange (LSE).

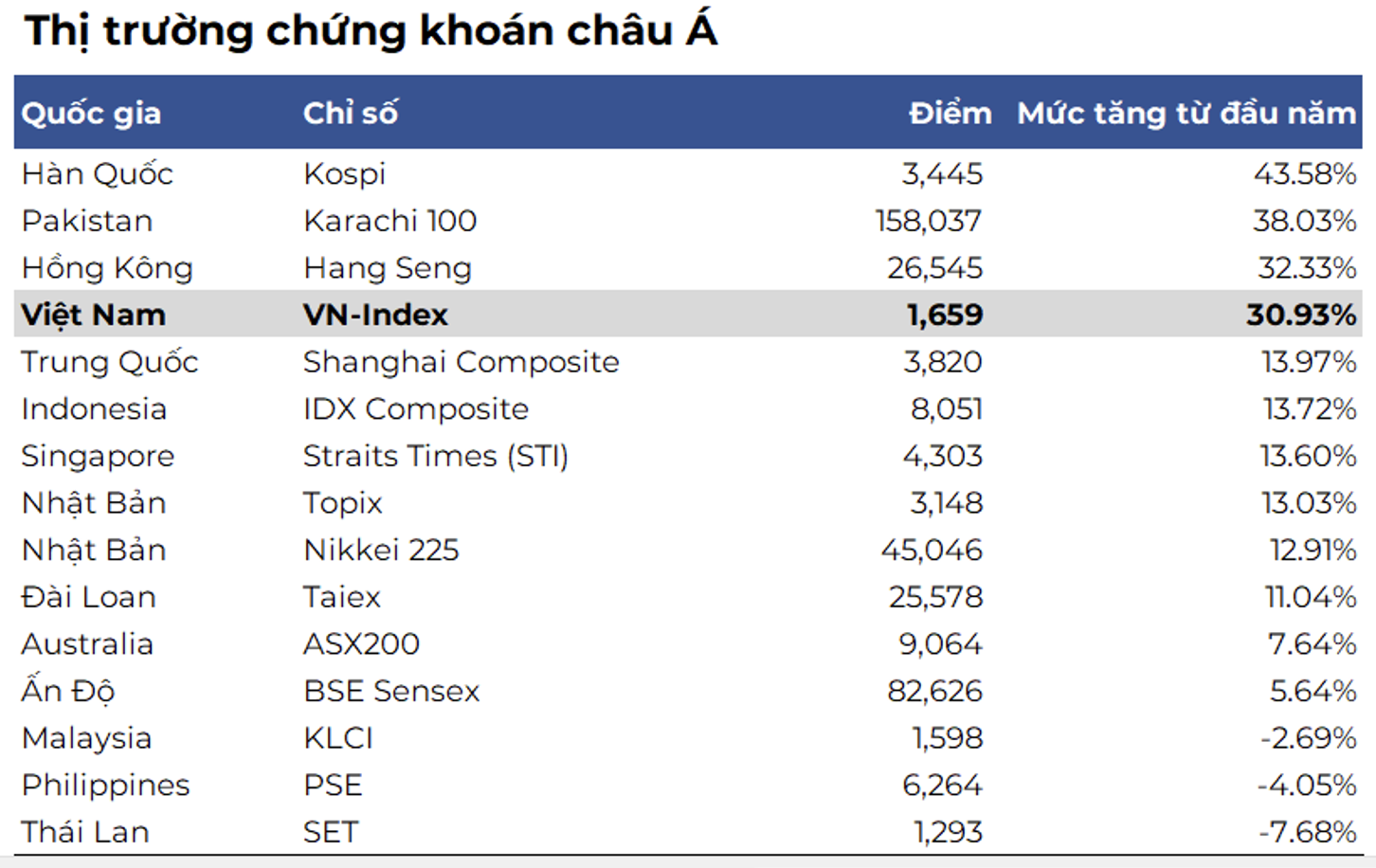

Vietnam’s Stock Market Ranks 4th in Asia

Vietnam’s rally has mirrored broader gains in Asian equities. As of September 19, the MSCI Asia-Pacific Index surged over 20% to a record 220.71 points, outperforming the S&P 500 by 10 percentage points.

Regionally, Vietnam’s market ranks 4th, trailing only South Korea (43.58%), Pakistan (38.03%), and Hong Kong (32.33%). Notably, major markets like Thailand (-7.68%), the Philippines (-4.05%), and Malaysia (-2.69%) declined.

Data as of September 19

|

“We’ve seen a relief rally across Asian markets, which were deeply concerned about U.S. tariffs,” said Nick Twidale, Head of Market Analysis at AT Global Markets in Sydney. “Those fears haven’t materialized, significantly boosting sentiment.”

The recovery is fueled by ample liquidity from Asian central bank rate cuts, AI fervor, and a weaker USD driving capital inflows.

Vu Minh Duc, Research Director at Vietcap Securities, forecasts the VN-Index reaching 1,800 next year and surpassing 2,000 by 2027.

“Vietnam is strongly positioned with trade advantages, political stability, and market upgrade potential. This rally still has room to run,” added Tyler Manh Dung Nguyen, Market Strategist at Ho Chi Minh City Securities.

– 12:37 25/09/2025