HUT Shares Surge as Chairman Vu Dinh Do’s Affiliated Firm Acquires 30% Stake

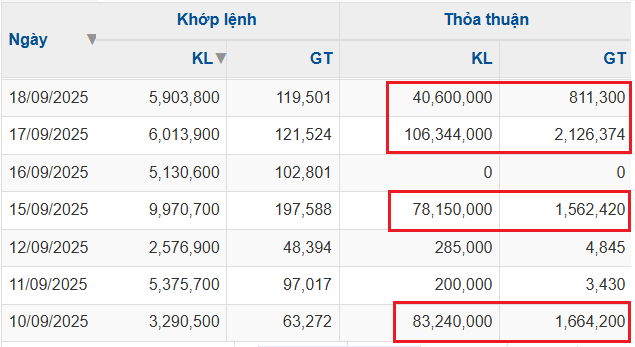

In a September 23 report, VII Holding announced the acquisition of over 302 million Tasco shares, equivalent to 28.32% of its charter capital. Although this falls slightly short of the initial 30% target, the company is in the process of registering transactions and may continue purchasing to reach its goal of 320 million shares.

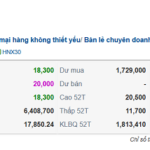

Throughout September, VII Holding executed four major purchases: 83 million shares on September 10, followed by 77.9 million, 106 million, and 35.5 million shares on September 15, 17, and 18, respectively. Market data shows an average transaction price of approximately VND 20,000 per share, closely aligned with closing prices. In total, the company invested over VND 6.1 trillion, becoming Tasco’s largest shareholder.

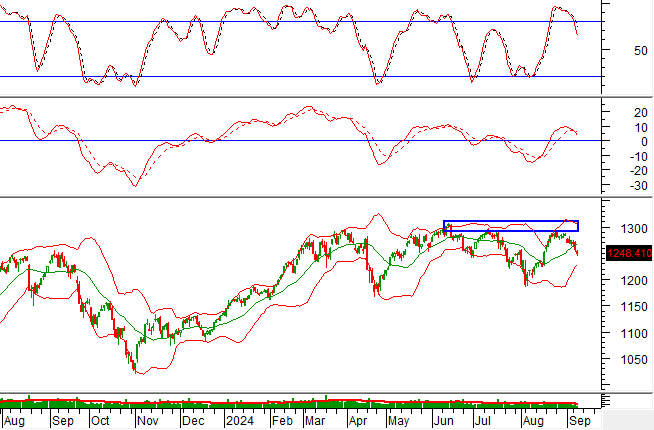

Before VII Holding’s entry, HUT shares had already climbed over 70% from early July to mid-August, surpassing VND 20,000 per share, with liquidity significantly improving in recent months.

Established in May 2024 in Bac Ninh, VII Holding was founded by Vu Dinh Do, Chairman of Tasco’s Board of Directors. He holds a 65% stake and serves as both Chairman and legal representative. Earlier, during the 2024 annual general meeting, Tasco shareholders approved allowing VII Holding to acquire shares from former SVC Holdings (now Tasco Auto) owners without a public tender offer.

According to Mr. Do, VII Holding’s involvement will enhance Tasco’s ownership transparency, shifting from dispersed ownership to long-term institutional investment. “This marks our commitment to clarifying Tasco’s ownership structure,” he told shareholders. He also announced stepping down as Chairman of DNP Holding to focus entirely on Tasco’s strategic development.

Market data confirms large-volume transactions on the same days. Source: VietstockFinance

|

| HUT Share Price Soars Since Early July |

Tasco originated from the Nam Ha Construction Team in 1971, undergoing multiple mergers and name changes before becoming Nam Ha Transportation Works Company and privatizing in 2000. From this foundation, the company emerged as one of Vietnam’s leading private infrastructure investors, known for major BOT and BT projects like National Highway 10 in Nam Dinh, National Highway 1A in Quang Binh, and the Hai Phong BOT.

In 2018, institutional investors held over 30% of Tasco’s shares. However, amid declining financial performance, this stake shrunk to 4.62% by late 2020. Individual investors dominated, with former Chairman Pham Van Dung holding 9.68%. By 2021, following a large private placement, institutional ownership further dropped to 3.15%.

In 2021, Tasco restructured, focusing on three pillars: transportation infrastructure, real estate, and automotive services. Vu Dinh Do was appointed Chairman in April 2022. By year-end, institutional ownership fell to 0.86%, with individuals holding over 99%.

– 11:57 26/09/2025

Mr. Vu Dinh Do’s Company Registers to Purchase Over 320 Million Tasco Shares, Estimated to Cost Over VND 5.8 Trillion

As of the current HUT stock price of VND 18,200 per share, the expected amount that VII Holding would have to pay for over 320 million HUT shares is over VND 5,800 billion.

“Tasco – Your Trusted Auto Repair and Maintenance Specialists”

The Hanoi-listed Tasco Joint Stock Company (HUT) has expanded its automotive industry value chain with the establishment of VETC Auto Parts Company Limited. The new entity will specialize in automotive repair and maintenance services, marking a strategic move by the Group to further enhance its presence and offerings in the automotive sector.

The World’s Top 10 Automobile Manufacturer Joint Venture for Assembly and Distribution in Vietnam: Thai Binh Receives Good News

The total investment for the automobile manufacturing and assembly joint venture project in Thai Binh province is estimated at approximately $168 million.