VPS Securities JSC has announced the materials for its second extraordinary shareholders’ meeting of 2025, scheduled for September 29, 2025, at the company’s headquarters located at 65 Cam Hoi Street, Hai Ba Trung District, Hanoi.

During this assembly, VPS will present three share issuance plans to its shareholders. These include issuing shares to existing shareholders to increase equity capital from retained earnings (bonus shares), an initial public offering (IPO), and a private placement of shares to raise additional capital.

Firstly, VPS plans to issue 710 million bonus shares from retained earnings. The rights ratio is 1:1.245, meaning for every share held, shareholders will receive an additional 1.2 new shares.

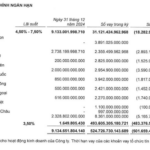

The capital for this issuance is sourced from the mid-year 2025 financial report, comprising 85.4 billion VND from the supplementary capital reserve fund, 103 billion VND from the financial and business risk reserve fund, and 6,911 billion VND from undistributed after-tax profits.

The purpose of this issuance is to expand the company’s operational capital and financial capacity, supporting margin lending and advance payment for securities sales.

The issued shares will be unrestricted for transfer. The issuance is expected to take place in Q4/2025 or 2026. Upon completion, VPS’s chartered capital will increase from 5,700 billion VND to 12,800 billion VND.

Secondly, VPS plans to IPO up to 202.3 million shares to the public, equivalent to 15.81% of the company’s chartered capital post-bonus share issuance. All IPO shares will be unrestricted for transfer.

The IPO is scheduled for Q4/2025 – Q1/2026, following approval from the State Securities Commission (SSC).

The VPS Board of Directors proposes that the shareholders’ meeting authorizes the Board to determine the offering price, provided it does not fall below the book value as per the 2025 semi-annual financial report.

The expected proceeds from the offering at par value are 2,023.1 billion VND. VPS plans to allocate 74% of the capital for margin trading, 20% for IT infrastructure investment, and 6% for human resource development.

VPS seeks shareholder approval to register and deposit all shares with the Vietnam Securities Depository (VSDC) and list them on the Ho Chi Minh City Stock Exchange (HoSE) post-IPO.

If VPS fails to meet the listing requirements after the IPO, the company will register for trading on the Unlisted Public Company Market (UPCoM).

Thirdly, VPS plans to issue 161.85 million shares in a private placement to professional investors. The offering price will not be lower than the market price at the time of issuance or the latest book value.

The issuance is expected to take place in 2025–2026, with a one-year transfer restriction on the issued shares.

If all three share issuance plans are completed, VPS’s chartered capital will increase from 5,700 billion VND to 16,442 billion VND.

Regarding personnel, the upcoming meeting will elect one additional Board of Directors member and one additional member of the Supervisory Board for the remainder of the 2025–2030 term.

VPS has nominated John Desmond Sheehy as an independent Board member and Nguyen Khanh Ngoc as a Supervisory Board member.

Previously, Board member Indronil Sengupta and Supervisory Board member Nguyen Thi Van Huyen resigned for personal reasons.

Established in 2006, VPS Securities originated as Vietnam Prosperity Bank Securities (VPBS), a subsidiary of VPBank. In December 2015, VPBank divested 89% of its stake in VPBS. By 2018, VPBS rebranded as VPS Securities, shifting its focus from proprietary trading to brokerage services and margin lending. This strategic shift led VPS to become the market leader in brokerage market share in Q1/2021.

Since then, VPS has maintained its top position in brokerage market share for 18 consecutive quarters across all four markets: HoSE, HNX, UPCoM, and derivatives.

In Q2/2025, VPS continued its market leadership with 15.37% market share on HoSE, 18.82% on HNX, 16.57% on UPCoM, and 46.39% in derivatives.

Trade Stocks with TCBS and Get Up to 40 Million VND Cashback

Embark on your stock trading journey with TCBS and unlock a treasure trove of exclusive benefits. New investors enjoy unlimited commission-free trades, cashback rewards of up to 40 million VND, and highly competitive margin lending rates.

VNDirect Securities Plans to Issue Over 432 Million Shares, Aiming to Boost Capital to Nearly VND 20 Trillion

At the upcoming extraordinary general meeting, VNDirect’s Board of Directors will present to shareholders a revised plan for the private placement of shares, along with an additional proposal for a rights issue to existing shareholders.