Annual Price Increases of Several Percent

According to the latest report from the Ministry of Construction, in the first 9 months of 2025, apartment prices in Hanoi and Ho Chi Minh City remained high, with an upward trend compared to the same period last year.

In Hanoi, the average primary price reached 70–80 million VND/m², up 5.6% from Q1/2025 and 33% from the same period in 2024. Some luxury projects recorded very high prices, ranging from 150–300 million VND/m².

In Ho Chi Minh City, the average primary price was around 75 million VND/m², stable compared to the beginning of the year, but up 36% from the same period last year. Some high-end projects had prices starting from 150 million VND/m².

According to a report by One Mount Group, the primary apartment price in Hanoi in Q2 reached approximately 80 million VND/m², up 5.6% from the previous quarter and a sharp increase of 24% compared to the same period in 2024.

CBRE Vietnam’s recent Hanoi real estate market report also stated that the average primary apartment price at the end of Q2 was around 79 million VND/m² (excluding VAT, maintenance fees, and discounts), up 6% quarterly and 33% year-on-year.

Prices of many apartments in Hanoi continue to rise. (Photo: Minh Đức)

Many new projects from central to suburban Hanoi launched in the first half of this year also recorded new prices, ranging from 80–170 million VND/m².

A survey showed that the Galia Hanoi project (Yên Sở Ward) by Tân Á Đại Thành had an average price of 80 million VND/m²; the Greenera Southmark project (Thanh Trì District) by Tân Hoàng Minh had an expected price of 80–90 million VND/m²; the LongBien Central project by Taseco Land had a tentative price of 118 million VND/m².

Projects like The Matrix One Phase 2 by MIK Group had an average price of 116–166 million VND/m²; Sun Feliza Suites (Cầu Giấy District) by Sun Group had an expected price of 160 million VND/m²…

Not only the primary market but also the secondary market saw prices start to rise again in the past month, according to the latest survey by PropertyGuru Vietnam.

Specifically, at the An Binh Plaza project, both listing and transaction prices increased over the past month. For example, 2-bedroom, 1-bathroom apartments with 50-year ownership, priced at 3.3–3.5 billion VND/unit in February 2025, are now listed at 3.6–3.8 billion VND/unit.

At the Home City project, 2-bedroom, 2-bathroom apartments with over 70 m² also increased by 200–350 million VND compared to early May, from 6.2–6.3 billion VND/unit to 6.5–6.7 billion VND/unit. The Hanoi Center Point project, with 2-bedroom, 2-bathroom units, now has prices exceeding 6 billion VND/unit, with no units priced at 5.7–5.8 billion VND/unit after the Lunar New Year.

Why Are Apartment Prices Rising?

Explaining the continuous rise in apartment prices, experts cite one of the primary reasons as the scarcity of supply. Mr. Phạm Đức Toản, CEO of EZ Property, noted that the market has not seen any new projects truly licensed for sale recently. Most projects currently on sale are leftover inventory from large developers.

Sharing the same view, Mr. Nguyễn Văn Đính, Vice Chairman of the Vietnam Real Estate Association, also stated that the apartment supply in Hanoi is genuinely limited. The number of projects has been increasingly restricted in recent years, while demand from customers, especially young families, remains high.

According to experts, the scarcity of supply and the imbalance between supply and demand are the reasons for the high apartment prices. (Photo: Công Hiếu)

Additionally, according to Mr. Đính, another reason is the imbalance in product structure in the market, pushing up prices for primary and secondary segment apartments. This results in those with real housing needs losing access.

Mr. Nguyễn Quốc Hiệp, Chairman of GP. Invest, also affirmed that the rise in Hanoi apartment prices in recent times stems from the scarcity of supply, amidst projects facing legal bottlenecks.

Furthermore, he noted that current apartment prices do not reflect true value, as some projects, after accounting for costs like land rental, materials, and labor, do not justify such high prices.

Another reason for the high apartment prices is the supply-demand imbalance.

Mr. Trần Minh Tiến, Director of the Market Research and Customer Insight Center at One Mount Group, analyzed: The difference in supply structure and product segments is the main reason for the rapid increase in Hanoi apartment prices.

In Hanoi, new supply in Q2 focused on high-end and luxury segments. Notably, 4 luxury projects with large volumes launched had an average price of over 80 million VND/m² (excluding VAT and maintenance fees), contributing to the high average selling price.

In reality, Mr. Tiến stated that no mid-range projects were launched in Hanoi this quarter. Apartments with softer prices (below 65 million VND/m²) were only scattered in eastern Hanoi urban areas or adjacent regions.

As for the secondary market, Mr. Tiến observed a clear shift of capital from low-liquidity land plots to handed-over apartments. Stability, rental potential, quality of life, and complete legal status are factors maintaining the appeal of resale apartments.

Mr. Tiến believes that if the recovery momentum continues in the coming quarters, secondary apartments will remain a pillar in maintaining liquidity for the entire real estate market in 2025.

Moreover, according to experts, another reason for the high housing prices is the currently high input costs. The input costs for a commercial housing project now include: 25% for land, with projects closer to the city center having higher land costs, prime locations accounting for 40–50% of the cost, and property value.

Additionally, investment procedure costs account for about 5–10% of total costs, potentially rising to 15% if procedures are prolonged. Capital costs account for about 5–10%, and construction costs (materials, labor, machinery) are rising due to escalating prices and increased labor costs. Given this cost structure, apartment prices are expected to continue rising and are unlikely to decrease.

Not only primary apartment prices are rising, but secondary prices are also increasing sharply. Explaining this, the leadership of Home Plus Real Estate Investment Company stated that the continuous rise in secondary apartment prices has multiple causes. After a sideways trend in Q1 and Q2/2025, the secondary apartment market resumed its upward trend in Q3 due to investors’ “FOMO” (fear of missing out) psychology. Particularly, the launch of new projects with high prices also strongly impacted the old apartment market.

“In the first half of the year, numerous apartment projects from inner to outer Hanoi were launched, with prices ranging from 100–170 million VND/m², which is the main reason for the continued rise in old apartment prices. However, the increase in old apartment prices is only seen in a few urban areas with good amenities,” the leader noted.

West Lake West Real Estate Booms Thanks to Rare Feng Shui Location

Nestled along the auspicious axis of Ba Vì – West Lake, Jade Square embodies the pinnacle of luxury living in Hanoi’s elite circles. Its prime location, steeped in feng shui principles, harnesses the prosperous energy of this golden coordinate, elevating it to a symbol of sophistication and prestige in the West Lake area.

70 Years in Review: Which Products Have Proven to Hold Their Value in Hai Phong?

The real estate market in Hai Phong, shaped by 70 years of development alongside the city, has established a clear principle: enduring value belongs to projects that combine strategic locations, cohesive planning, and elite communities. From bustling historic streets to modern urban developments, this formula consistently proves true.

Post-Merger with Ho Chi Minh City: The Surge in Binh Duong (Former) Apartment Prices Fueled by Satellite City Population Relocation Strategy

Following the merger, the newly expanded Ho Chi Minh City has unlocked vast development potential, emerging as a cutting-edge megacity and a powerhouse for finance, manufacturing, logistics, and innovation. This transformation maximizes the natural, geographic, and infrastructural advantages of all three localities.

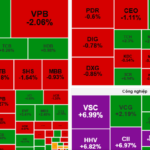

Tomorrow’s Stock Market, September 26: Seizing Investment Opportunities in Attractive Stocks

Vietnamese stocks on September 25 witnessed a divergence in capital flows across sectors, presenting investors with opportunities to strategically allocate funds in the upcoming September 26 session.