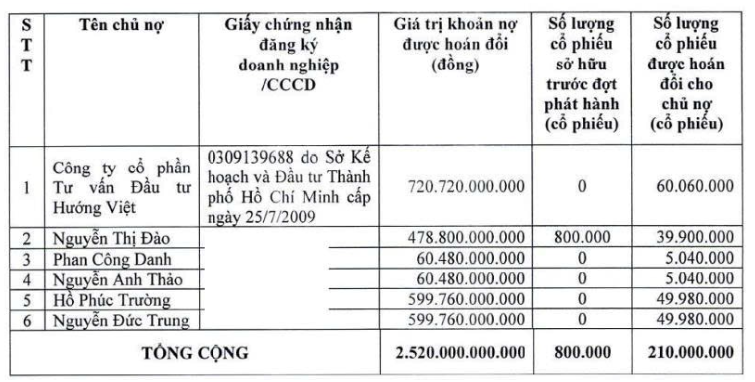

Hoang Anh Gia Lai Joint Stock Company (HAGL, HoSE: HAG) has successfully completed the issuance of 210 million shares at VND 12,000 per share to convert a debt of VND 2,520 billion.

The creditor group participating in this debt conversion includes Huong Viet Investment Consulting Joint Stock Company and five individuals: Ms. Nguyen Thi Dao, Mr. Pham Cong Danh, Mr. Nguyen Anh Thao, Mr. Ho Phuc Truong, and Mr. Nguyen Duc Trung. Following the transaction, this group holds 16.65% of HAG’s shares, with a one-year restriction on share transfer.

The post-issuance ownership structure reveals: Huong Viet received over 60 million shares; Ms. Nguyen Thi Dao nearly 40 million shares; Mr. Ho Phuc Truong and Mr. Nguyen Duc Trung each received approximately 50 million shares.

The creditor group includes Huong Viet Investment Consulting Joint Stock Company and five individuals.

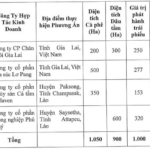

According to the financial report as of June 30, 2025, HAGL’s total liabilities stood at VND 15,630 billion, 1.5 times its equity. Of this, loans amounted to VND 9,320 billion, including VND 2,061 billion in long-term bonds held by the aforementioned six creditors, and VND 1,831 billion related to bond conversion agreements.

The debt conversion is expected to alleviate HAGL’s financial burden and reduce interest expenses in the coming period. In the first six months alone, Doan Nguyen Duc’s enterprise spent VND 360 billion on interest, averaging about VND 2 billion per day.

Despite this, the company reported positive business results with net revenue of VND 3,707 billion, a 34% increase compared to the same period in 2024. The largest contribution came from the fruit segment with VND 3,005 billion, up 47%; while the pig farming segment decreased by 78%, to only VND 134 billion.

After deducting expenses, Doan Nguyen Duc’s HAGL recorded an after-tax profit of VND 880 billion, a 76% increase year-on-year. With this result, HAGL officially eliminated accumulated losses, recording an undistributed after-tax profit of VND 400 billion by the end of Q2/2025.

Previously, Doan Nguyen Duc had repeatedly committed to shareholders about eliminating HAGL’s accumulated losses. At the Annual General Meeting on November 26, 2021, he first acknowledged that abandoning real estate to shift to agriculture was a mistake. At that time, he pledged to eliminate accumulated losses before 2023, then later by June 2024. Although progress was slower than expected, it’s undeniable that Doan Nguyen Duc has made significant efforts in restructuring and reviving HAGL.

“Mountain Tycoon” Accumulates Thousands of Billions in Losses Yet Invests Over 430 Billion VND to Establish Wind and Solar Power Companies

Despite cumulative losses exceeding VND 2.411 trillion and a heavy debt burden, Duc Long Gia Lai remains committed to investing in renewable energy, establishing four new companies in the sector.

The Prodigal Son: A Tale of Triumph as Duc’s Heir Purchases 25 Million HAG Shares

Mr. Doan Hoang Nam, the son of HAGL’s Chairman, Doan Nguyen Duc, has successfully purchased 25 million HAG shares, significantly boosting his ownership stake to 4.92%.

The Prodigal Son’s Strategic Maneuver: Unraveling the Persistent Accumulation of Hoang Anh Gia Lai Shares

“In a recent display of confidence in the company, Doan Hoang Nam, son of business tycoon Bầu Đức, acquired 27 million shares of HAG, the stock of Hoang Anh Gia Lai Joint Stock Company. Valued at approximately VND 426 billion, this transaction signifies a substantial investment. Now, Nam is poised to purchase an additional 25 million HAG shares from August 28 to September 12, boosting his ownership stake to 4.92% of the company’s capital, equivalent to a substantial holding of 52 million HAG shares.”