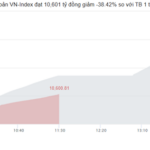

Last week, the VN-Index rose by 2.08 points to reach 1,660.7 points. Trading liquidity continued to decline sharply, with the total market trading value hitting VND 140.87 trillion, a 16% drop compared to the previous week. Similarly, the HNX-Index closed at 276.06 points, down 0.18 points from the prior week. Liquidity on the HNX also plummeted, with total trading value reaching VND 10.607 trillion, a 24% decrease week-on-week.

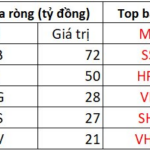

On the HoSE, foreign investors net-sold for five consecutive sessions, offloading 157 million shares worth over VND 7.373 trillion. On the HNX, foreign investors also net-sold for five sessions, trading nearly 10 million shares valued at over VND 311 billion.

On the Upcom market, foreign investors net-sold 1.55 million shares, totaling nearly VND 35 billion. Overall, during the trading week from September 22 to 26, foreign investors net-sold 168.4 million shares across the market, with a total value of VND 7.720 trillion.

Stock Dividends

On October 8, Sao Mai Group Corporation (stock code: ASM) will finalize the list for issuing over 37 million shares to pay dividends for 2024. ASM will distribute a 10% stock dividend, meaning shareholders holding 100 shares will receive 10 new shares.

Sao Mai Group Corporation will issue over 37 million shares to pay dividends for 2024.

The total issuance value, based on par value, exceeds VND 370 billion. The capital will be sourced from the company’s undistributed after-tax profits as of December 31, 2024, as per audited financial statements.

Upon completion, Sao Mai Group’s outstanding shares will increase to over 407 million, raising its charter capital from nearly VND 3.7018 trillion to approximately VND 4.072 trillion.

Tien Thinh Corporation (stock code: TT6) has approved two plans to issue dividend shares and offer shares to existing shareholders, aiming to increase its charter capital to nearly VND 331 billion.

Specifically, Tien Thinh will issue over 2.26 million shares as a 2024 dividend at an 11% rate. The total issuance value, based on par value, is over VND 22.6 billion, funded by undistributed after-tax profits as of December 31, 2024.

Subsequently, Tien Thinh will offer up to 10.26 million shares to existing shareholders at a 100:45 ratio, meaning shareholders holding 100 shares can purchase 45 new shares. The offering price is VND 10,000 per share, with the process expected to begin in Q1/2026.

The total expected proceeds of VND 102.6 billion will be allocated as follows: VND 37.8 billion to repay bank loans, over VND 20.5 billion for purchasing goods, materials, and services, and over VND 51.3 billion for acquiring machinery and equipment.

Share Offerings to Existing Shareholders

DIC Corporation (stock code: DIG) will offer 150 million shares to existing shareholders at VND 12,000 per share, aiming to raise VND 1.8 trillion.

The proceeds will be allocated as follows: VND 600 billion for construction costs of the Cap Saint Jacques complex Phase 3, VND 600 billion for the Vi Thanh project, and VND 600 billion to repay the DIG12301 bond.

DIC Corp will offer 150 million shares to existing shareholders at VND 12,000 per share.

Recently, DIC Corp faced challenges in its share offerings and repeatedly delayed them. In late 2024, the company halted a planned offering of 200 million shares to existing shareholders at a 1,000:327.94 ratio and a price of VND 15,000 per share, which would have raised VND 3 trillion.

Compared to the new plan, the offering price has been reduced from VND 15,000 to VND 12,000 per share, and the number of shares offered has decreased from 200 million to 150 million.

Construction Materials Corporation No. 1 (stock code: FIC), a major shareholder of Hoa An Corporation, has registered to sell 530,000 DHA shares following a failed offering. The transaction will take place from September 29 to October 28 via order matching. If successful, FIC’s ownership in DHA will decrease to nearly 3.06 million shares (20.23% of capital). FIC is expected to raise VND 28 billion from this divestment.

Previously, FIC registered to sell 530,000 DHA shares from August 21 to September 19 but failed due to unmet price expectations. However, during this period, DHA’s share price increased by over 6%.

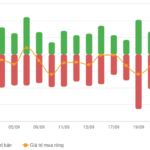

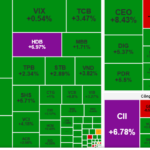

Market Pulse 26/09: VN-Index Experiences Volatile Shifts as Foreign Investors Continue Net Selling Streak

At the close of trading, the VN-Index fell by 5.39 points (-0.32%), settling at 1,660.7 points, while the HNX-Index dropped by 1.59 points (-0.57%), closing at 276.06 points. Market breadth tilted toward the downside, with 432 decliners outpacing 305 advancers. Similarly, the VN30 basket saw red dominate, as 21 stocks declined, 5 advanced, and 4 remained unchanged.

Technical Analysis for the Afternoon Session of September 26: Tug-of-War Around the Bollinger Bands’ Middle Line

The VN-Index persists in its tug-of-war, retesting the Middle line of the Bollinger Bands. The August 2025 low (equivalent to the 1,600-1,630 point range) held firm during the recent correction, underscoring the resilience of this critical support level. Meanwhile, the HNX-Index continues to oscillate sideways within a Triangle pattern, signaling ongoing consolidation.