| CET Stock Price Trends Over the Past Year |

During the period from September 19 to 25, CET’s stock price experienced a remarkable streak of five consecutive ceiling sessions, surging to VND 13,600 per share. This marked a return to its highest price level since 2017. Compared to its historical peak in early August 2017, around VND 17,000 per share, the current price remains 20% lower. Amid this prolonged rally, the company issued a familiar explanatory statement, attributing the price fluctuations to market supply and demand, beyond its control.

Notably, on September 17, while the stock price was consistently rising, Mrs. Bùi Thị Hải Yến sold nearly 1.2 million CET shares via a negotiated transaction. This reduced her ownership from 22.26% to 3%, equivalent to 181,500 shares, and she ceased being a major shareholder. The transaction yielded over VND 7.8 billion, at an average price of VND 6,700 per share, approximately 17% lower than the ceiling price of VND 8,100 per share in the same session.

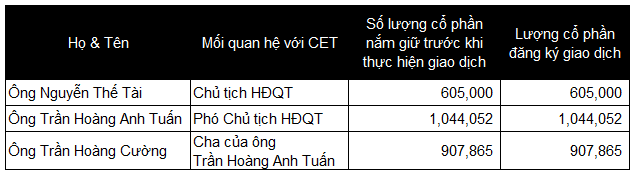

Mrs. Yến was not alone; CET’s leadership, including Vice Chairman Trần Hoàng Anh Tuấn, registered to sell their entire holdings of over 1 million shares (17.26%). Chairman Nguyễn Thế Tài planned to offload 10% of the capital, and Trần Hoàng Cường, Mr. Tuấn’s father, also registered to divest his entire 15.01% stake. All three transactions were registered between September 25 and October 23.

CET’s Leadership and Relatives Seek Capital Withdrawal – Image: Thừa Vân

|

Interestingly, on September 25, the first day of the registration period, the market witnessed 3.1 million CET shares traded via negotiated transactions, valued at over VND 35 billion, averaging VND 11,200 per share. This was 21% lower than the ceiling price of VND 13,600 per share. This volume, equivalent to nearly 52% of the charter capital, suggests the leadership may have completed their divestment in this transaction, though no official announcement has been made by the company.

The price surge occurred despite CET remaining under HNX’s warning list for delayed submission of the 2025 semi-annual audited financial report. This delay stemmed from the company’s inability to hold the 2025 Annual General Meeting (AGM) to approve an auditing firm.

According to the latest update, CET convened its 2025 AGM on September 5 and approved the selection of an independent auditor. The company is currently negotiating with auditing firms and expects to release the 2025 semi-annual audited financial report in October 2025.

In the first half of 2025, CET reported revenue of VND 10.5 billion, an 88% decline year-on-year, and a net loss of VND 273 million, marking the second consecutive semi-annual loss.

– 10:51 26/09/2025