“This year has been a successful yet challenging one for Vietnam’s stock market,” stated Petri Deryng, head of the foreign fund Pyn Elite Fund, in his Q3/2025 letter to investors.

To illustrate the market dynamics, Deryng highlighted the case of FPT, a leading Vietnamese technology conglomerate favored by institutional investors. Despite the VN-Index rising 30% year-to-date, FPT’s shares have declined by 20%, exemplifying underperformance among widely held blue-chip stocks.

Conversely, certain stocks have seen remarkable growth despite limited institutional interest. Notably, select banking and securities firms have thrived, driven by profit transformations or strategic investments poised to capitalize on broader market momentum.

IPO activity has also rebounded after years of stagnation, aided by reforms shortening listing processes from six months to just one. Vingroup subsidiaries, significant components of the VN-Index, have surged on the back of favorable land-use policies and large-scale public projects.

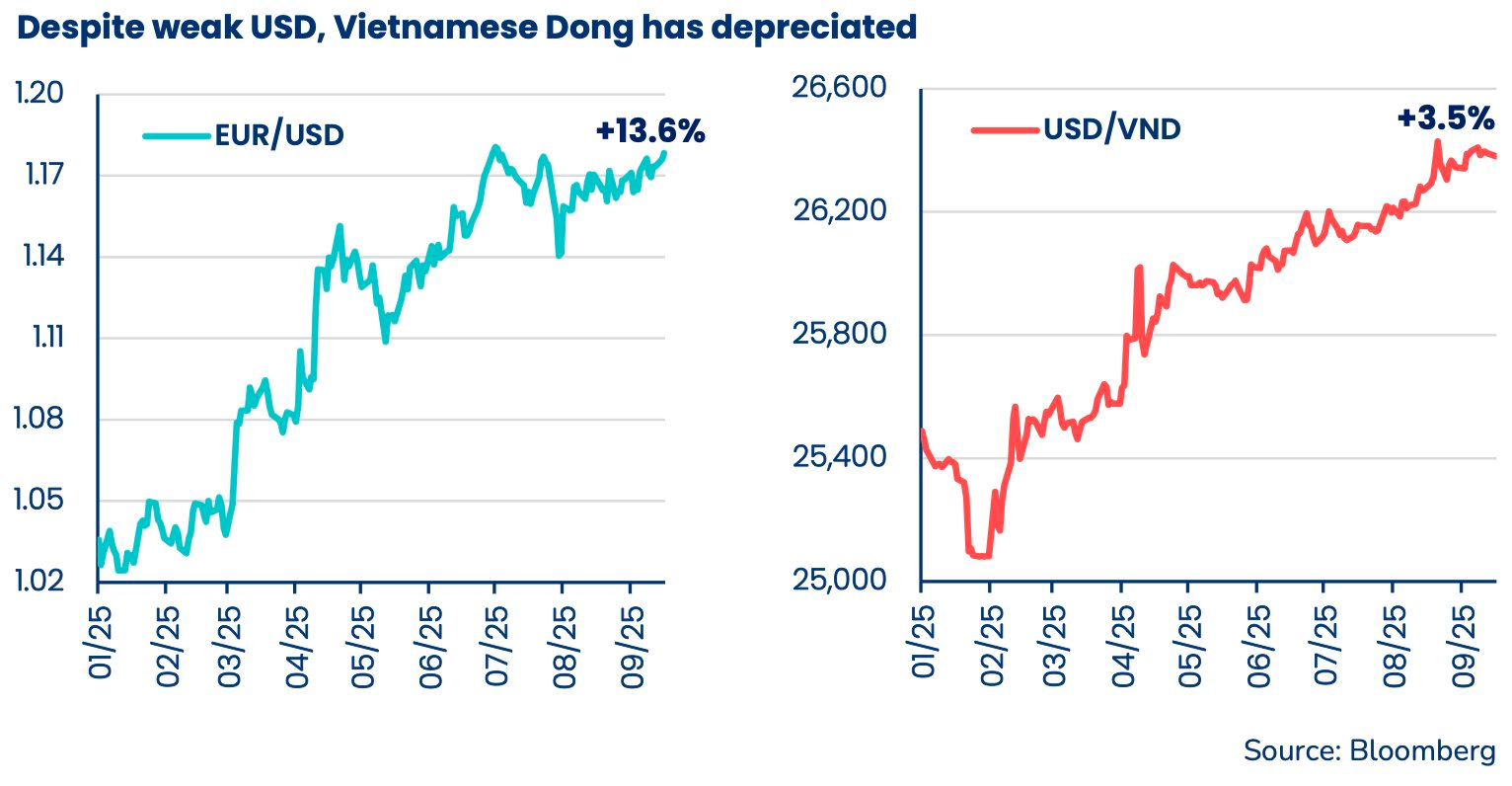

Deryng noted that the euro-denominated returns of prominent Vietnam funds underscore the challenges of stock selection this year. Foreign investors have been impacted by the Vietnamese dong’s (VND) depreciation since early 2025. Despite expectations of VND appreciation following Vietnam’s trade agreement with the U.S., the currency has weakened.

While the VND has depreciated year-to-date, Pyn Elite Fund believes Vietnam’s robust macroeconomic fundamentals could stabilize or even appreciate the currency over the next 12–24 months. The fund also highlights greater risks associated with potential sudden USD weakness.

Strategic Stock Picks Amid Anticipated Market Upgrade

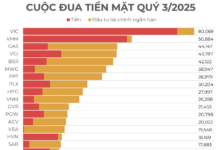

Pyn Elite Fund anticipates FTSE Russell will upgrade Vietnam to Emerging Market (EM) status by October or March 2026 at the latest. In preparation, the fund has increased its allocation to securities firms. Market liquidity surged in August, with daily trading volumes reaching $1.5 billion—double the previous year—prompting this strategic shift.

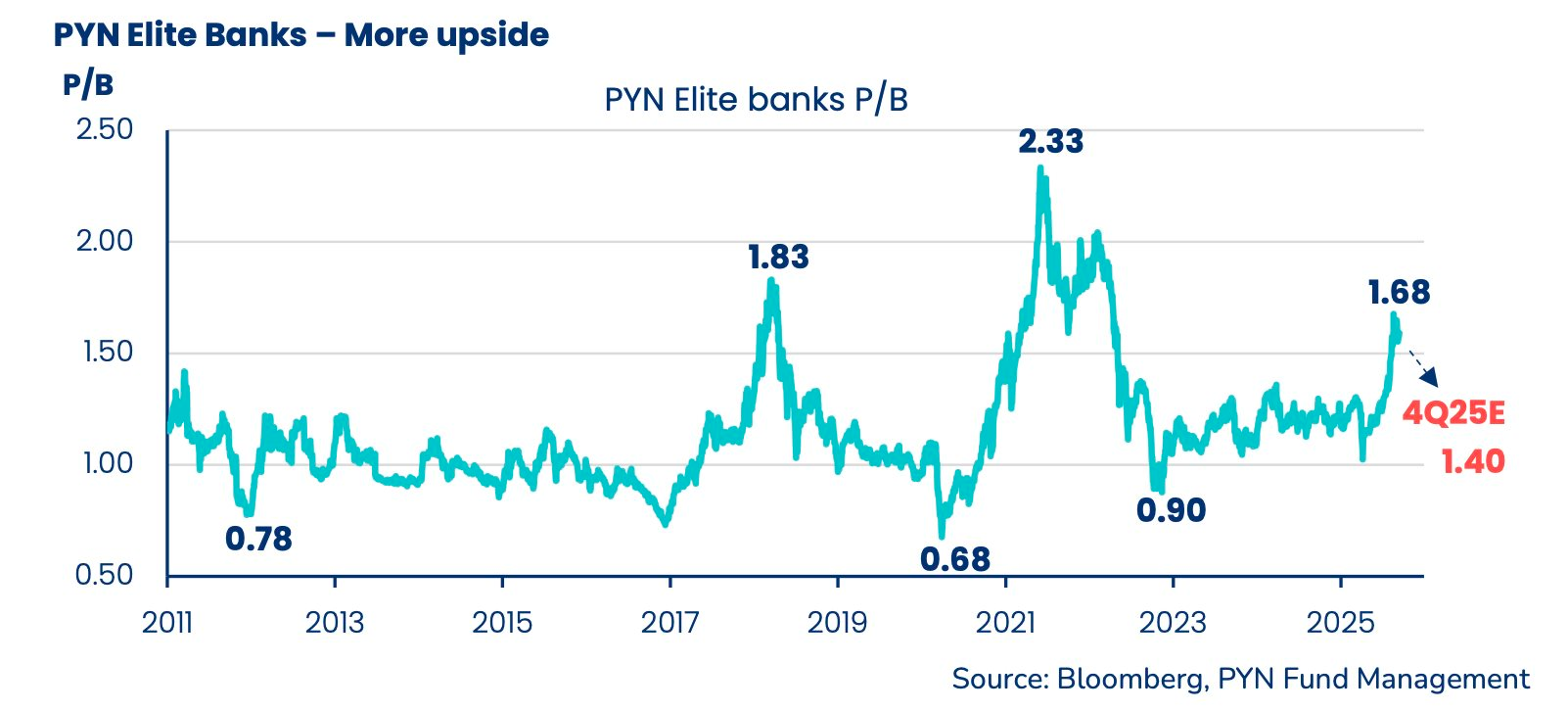

Banking stocks remain a significant portfolio component. Profit growth is rebounding as domestic economic activity accelerates and provisioning needs decline relative to prior years. Banks are also expected to recognize additional income through reserve releases and collateral recoveries.

Based on current valuations, Pyn Elite Fund projects the year-end P/B ratio for its banking holdings to fall to 1.4, dropping further to 1.2 next year. However, the fund anticipates market sentiment will drive valuations above 2.0 as share prices continue to rise.

On the macroeconomic front, the government has implemented aggressive measures targeting over 10% annual GDP growth in the next five years. Initiatives include major infrastructure projects, bureaucratic streamlining, and accelerated financial market reforms. Even credit quota removals for banks are under consideration.

Substantial public investment is expected to stimulate private sector activity, encouraging companies to pursue new opportunities and embrace risk. Robust economic growth will support strong earnings prospects for listed firms, sustaining positive stock market momentum as profit growth drives share price appreciation and maintains attractive valuations.

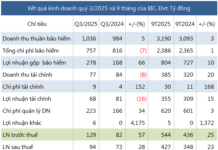

SSI Launches Share Offering to Raise Capital to Nearly VND 25,000 Billion, Margin Demand Surges 30-40% Yet Remains Manageable

On the afternoon of September 25th, SSI Securities Corporation (HOSE: SSI) held an extraordinary shareholders’ meeting in 2025, approving a plan to issue additional shares to existing shareholders. The proceeds from this offering will be allocated to enhance margin lending capital and invest in bonds, deposit certificates, and other securities as determined by the Board of Directors.

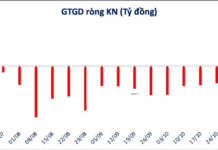

Market Pulse 25/09: VIC Accelerates, VN-Index Closes Up Nearly 9 Points

After a morning session marked by persistent tug-of-war around the reference point, the market swiftly shifted gears in the afternoon, adopting a highly positive trajectory. At one point, the VN-Index surged by over 10 points, reaching a high of 1,668. VIC emerged as the standout stock, contributing significantly to the market’s gains today.