According to a recent report by Vietcap Securities, Vietnam Construction and Import-Export JSC (VCG) is projected to achieve a 17% year-on-year growth in gross revenue for 2025, primarily driven by its construction segment.

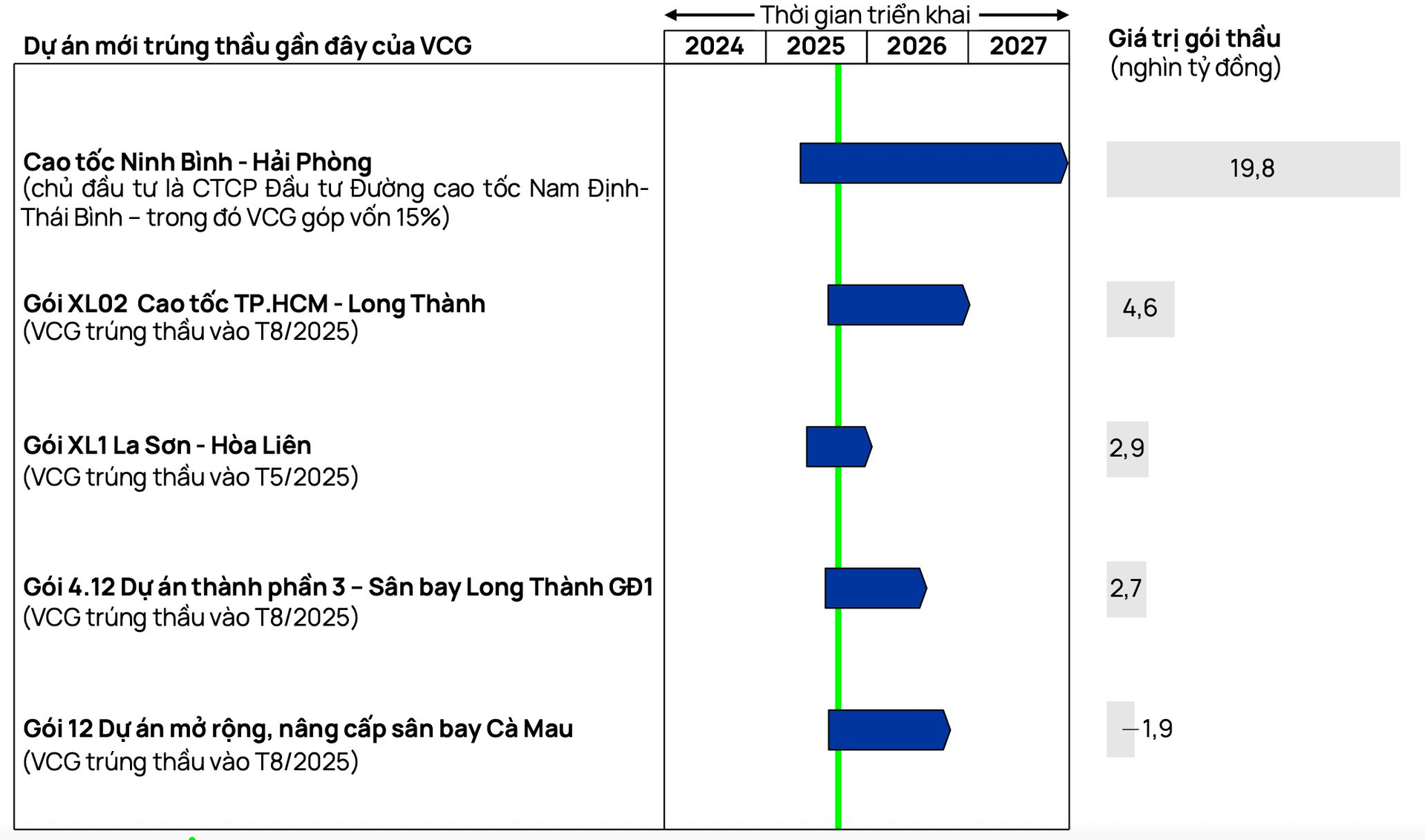

Amidst the accelerated public investment, VCG has secured multiple construction contracts recently, resulting in a current backlog of approximately VND 27 trillion, slated for execution until 2027. Notable projects include the Ninh Binh – Hai Phong Expressway (VND 19.8 trillion), the XL02 Ho Chi Minh City – Long Thanh Expressway (VND 4.6 trillion), the XL1 La Son – Hoa Lien Expressway (VND 2.9 trillion), and Phase 1 of Long Thanh Airport’s Component 3 (VND 2.7 trillion).

In the real estate sector, revenue is expected to be driven by the following projects: (1) Green Diamond, fully deliverable by 2025; (2) Vera Diamond City, scheduled for delivery between 2025-2028; and (3) Thien An Urban Area, anticipated for delivery by late 2025-2027. Vera Diamond City and Thien An Urban Area are projected to recognize the majority of their revenue in 2026.

Additionally, the industrial park production segment is poised for growth, led by (1) Hoa Lac 2 Industrial Park (currently completing technical infrastructure for leasing) and (2) Son Dong Industrial Cluster (expected to start generating revenue from 2026). The leasing segment is primarily supported by Vinaconex Diamond Tower, while the education and clean water business segments are forecasted to grow steadily.

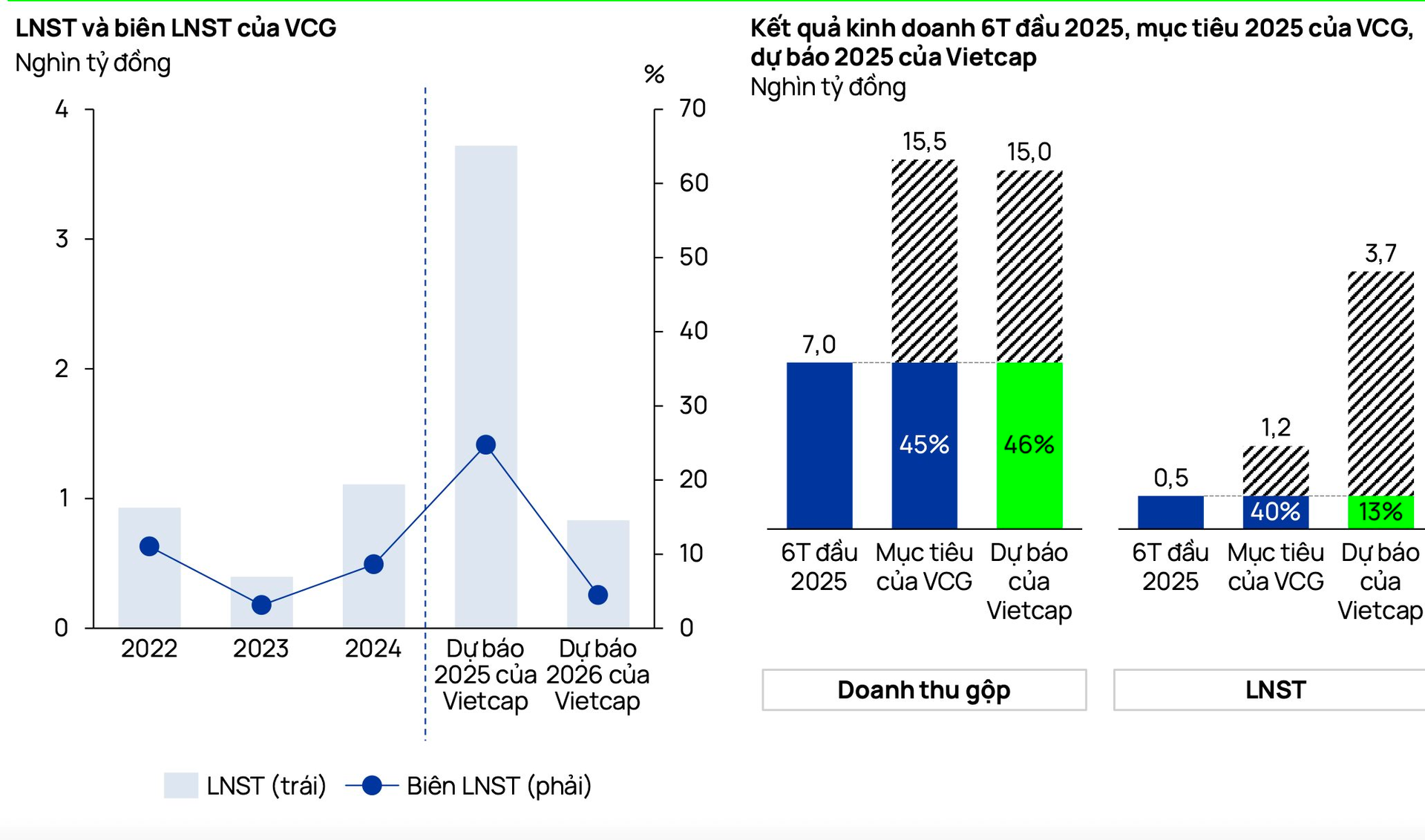

Vietcap forecasts VCG’s gross profit margin to decline from 15% in 2024 to 10% in 2026, primarily due to the increasing revenue share from the construction segment, which typically has lower margins. Industrial and residential construction companies are expected to benefit from lower steel and cement prices, while infrastructure construction faces cost pressures from sand and gravel, albeit mitigated by reduced asphalt prices. As VCG operates across all three segments, its gross profit margin faces mixed impacts. VCG aims to maintain a minimum 2% margin in the short term.

Vietcap anticipates VCG to realize VND 3.7 trillion from the divestment of its subsidiary VCR in the second half of 2025, significantly boosting its financial revenue for the year. VCR is the developer of the Cat Ba Amatina tourism urban area (172 hectares), which accounted for 94% of VCR’s total assets as of Q2/2025. VCG’s divestment from VCR comes amidst a sluggish post-COVID-19 recovery in the hospitality real estate market. In the first half of 2025, VCR reported a net loss of VND 10.6 billion.

With the significant financial gain, Vietcap projects VCG’s net profit to reach VND 3.7 trillion in 2025, a 236% increase year-on-year, before declining to approximately VND 832 billion in 2026. Notably, VCG has historically set ambitious targets, with actual revenue and net profit achieving only 66% and 70% of goals, respectively, from 2021-2024.

In terms of valuation, VCG’s stock is currently trading at a trailing 12-month P/E ratio of 22.9. Vietcap believes VCG’s valuation will continue to benefit from the government’s intensified public investment efforts.

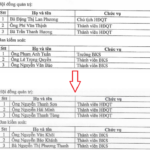

VCG is one of Vietnam’s leading construction companies, with the construction segment contributing 72% of its 2024 revenue. Its largest shareholder is Pacific Holdings, an entity associated with VCG’s long-standing leadership.

Over 2,200 Projects Stalled, Totaling $6 Trillion in Investment

Over 2,200 projects, totaling 6 quadrillion VND in capital, are currently stalled. Unlocking these bottlenecks, alongside flexible fiscal and monetary policies, digital transformation, and green growth, is key to achieving the ambitious GDP growth target of 8.3-8.5% by 2025.

Latest Developments in Central Vietnam’s Largest Real Estate Scandal

The Vice Chairman of Da Nang City inspected three projects by Bach Dat An, aiming to accelerate progress and safeguard the legal rights of land buyers.