At the High-Level Financial Advisor Forum themed “New Era, New Momentum” held on the afternoon of September 25, Dr. Can Van Luc—a leading economist—painted a comprehensive and multi-dimensional picture of Vietnam’s financial market, highlighting growth drivers alongside risks and challenges.

Dr. Can Van Luc, Economist, sharing insights at the forum. Screenshot.

|

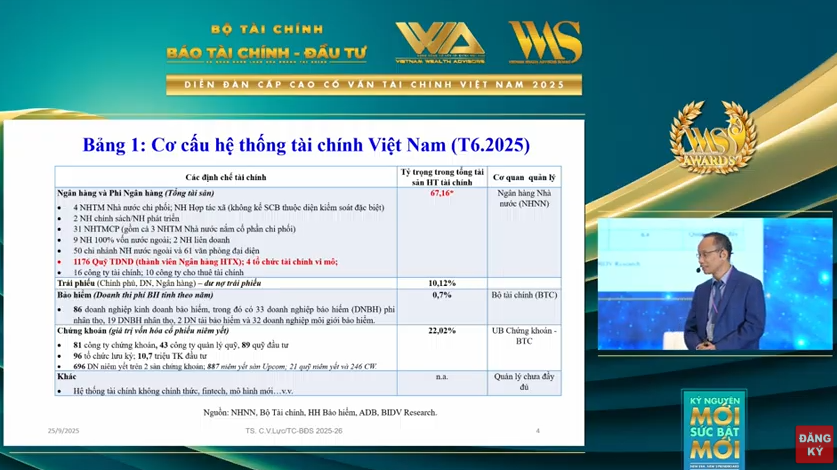

Reflecting on the 15-year journey (2011–2025), Dr. Luc noted that Vietnam’s financial market—anchored by banking, securities, and insurance—has achieved remarkable growth. Total market assets reached VND 30 quadrillion, with an average annual growth rate of 16%, 2.5 times higher than GDP growth. Notably, the stock market led with an impressive 26.6% annual growth.

However, this growth remains imbalanced. Banking dominates with 67% of the total market, followed by securities (22%), bonds (12%), and insurance (0.7%). This disparity is evident in capital allocation: in the first half of 2025, bank credit accounted for 59% of total capital, while equity issuance was only 3.3%. This underscores the urgent need to strengthen the capital market for balance and sustainability.

Screenshot.

|

Drivers and Risks in the Stock Market

Dr. Luc identified five key drivers for the stock market’s future growth:

- Positive macro environment: Projected 8%+ economic growth, attractive interest rates, accommodative fiscal and monetary policies, and stable macroeconomic conditions.

- Bold institutional reforms: Continuous legal framework improvements to support sustainable development.

- Market upgrade expectations: Potential stock market upgrade and positive national credit rating outlook.

- Corporate fundamentals: Strong earnings and prospects of listed companies.

- Global context: Easing global inflation, with the US Federal Reserve and central banks cutting rates, reducing pressure on domestic exchange rates and interest rates.

He also highlighted five risks investors should monitor:

- High valuations: A P/E ratio of 14.5–15 is considered “somewhat elevated.”

- High margin leverage: Surging margin debt poses risks during market corrections or rising interest rates.

- Limited new listings: Few high-quality, large enterprises are going public, concentrating capital in familiar stocks.

- Cybersecurity risks: A significant concern amid rapid digital transformation.

- Potential upgrade delay: Prepare for scenarios if the market upgrade doesn’t materialize this year.

Real Estate Recovery Amid High Prices

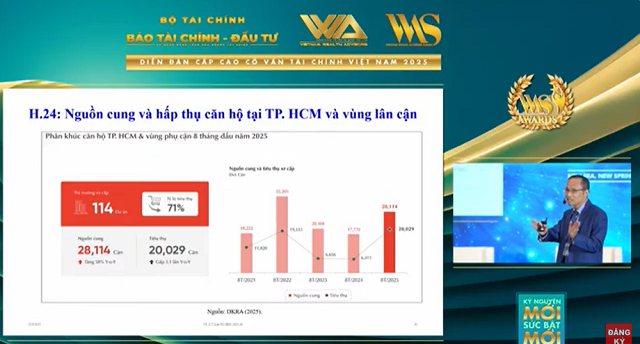

Dr. Luc observed clear signs of real estate recovery, driven by resolved legal bottlenecks, improved credit and bond capital, and strong supply and absorption in Ho Chi Minh City and surrounding areas (supply up 28,000 units in 8 months, absorption triple that of last year).

Screenshot

|

However, irrational pricing is a critical issue. The price-to-income ratio has soared, requiring an average citizen nearly 26 years to afford a mid-range apartment. These high prices pose risks to buyers, banks, and developers alike.

Policies and Solutions

For sustainable financial market development, Dr. Luc proposed key solutions:

For the broader financial market (banking, securities, insurance): Accelerate institutional and legal reforms (including digital asset regulations, digital currency, gold trading platforms, and the International Financial Center in HCMC and Da Nang). Implement securities market development strategies through 2030. Promote state-owned enterprise equitization and listings. Foster professional individual investors, strengthen institutional investors, and enhance financial literacy and consumer protection. Upgrade IT infrastructure and cybersecurity.

For real estate: Focus on institutional reforms, transparent national land and property databases, price stabilization measures, and effective operation of the National Housing Development Fund. Prioritize green and digital transformation in real estate.

Dr. Luc concluded that despite challenges, Vietnam faces unprecedented opportunities. Now is the time for collective action to contribute to the nation’s “new era.”

Three Breakthroughs Driving Vietnam’s Financial Market Momentum

– 11:45 26/09/2025

Introducing HOSE’s New Investment Indexes: Unveiling the VNMITECH and VN50 Growth

On August 11th, the Ho Chi Minh City Stock Exchange (HOSE) introduced new rules for the construction and management of two new investment indices. These indices are designed to track the performance of stocks in the industrial, technological, and growth sectors. The first index, the VNMITECH, focuses on modern industrial and technology stocks, while the second, the VN50 Growth, is tailored towards capturing the growth potential of 50 carefully selected stocks.

“HPX Swaps HQC Shares – A Move to Recover Outstanding Debt”

The real estate market is witnessing a gradual recovery from its slump, and the debt swap agreement between Hai Phat Investment Joint Stock Company (HPX) and Hoang Quan Trading Services Real Estate Consultancy Joint Stock Company (HQC) is a testament to their proactive financial restructuring efforts. This bold move showcases their commitment to sharing growth opportunities and navigating through challenging economic times.