Eastern District Maintains Liquidity Amid Market Fragmentation

Amid the fragmented landscape of Ho Chi Minh City’s real estate market, the Eastern District stands out with its stable demand, vibrant transactions, and robust liquidity, particularly in the high-end segment.

According to Q2/2025 data from the Ministry of Construction, nationwide real estate transactions (including apartments, private houses, and land plots) reached 157,021, a 116.6% increase compared to Q1/2025. Specifically, the apartment and private house segment recorded 34,461 successful transactions, a 2.61% rise from Q1/2025.

In Ho Chi Minh City, especially the Eastern District, apartment prices showed a positive trend, increasing by approximately 36% year-on-year. Meanwhile, DKRA Consulting’s Q2/2025 report on the city’s townhouse and villa market highlighted a significant uptick in primary market demand, tripling compared to Q2/2024, driven by anticipated provincial mergers.

Ring Road 3, a vital artery enhancing inter-regional connectivity in HCMC’s Eastern District. Photo: PCM

Positioned as a new strategic core post-merger, the Eastern District commands 70% of the city’s infrastructure investment budget. Key projects like Ring Road 3 and the An Phú interchange, alongside future initiatives such as Metro expansions and the HCMC-Long Thành-Dầu Giây expressway, are set to boost urban economic growth and sustainably elevate property values in the medium to long term.

Parallel Demand for Owner-Occupied and Rental Properties

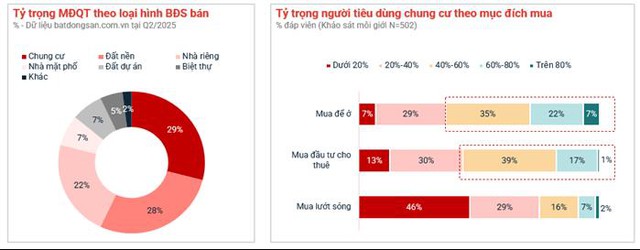

A survey of 502 real estate consultants on batdongsan.com.vn revealed that over 40% of transactions were driven by both owner-occupiers and investors seeking rental yields, while speculative flipping accounted for less than 20%. This shift underscores a transition from short-term speculation to long-term, value-driven investment strategies.

Sustained interest in apartments for rental purposes remains high. Photo: Batdongsan.com.vn

CBRE Vietnam notes that buyers now prioritize lifestyle ecosystems, seeking not just homes but holistic living experiences. Rental potential, coupled with sustainable health-focused amenities (ESG), is a critical investment criterion. Buyers are willing to trade for quality living spaces offering superior on-site amenities, reputable developers, robust legal frameworks, and convenient transportation access.

Among completed projects, Masteri Centre Point shines as a standout. Located in the heart of Grand Park (formerly Thu Duc City), it boasts a rare compound layout, a thriving resident community, and fully legalized pink book ownership. Investors benefit from flexible options, including bare-shell or fully furnished units, paired with 12-month rental guarantees for immediate cash flow post-handover.

Masteri Centre Point: A Secure Investment Anchor

In a cautious investor climate marked by abundant supply, liquidity has become a key metric for safety and sustainable returns. Beyond price appreciation, investors prioritize rental performance and utilization. Masteri Centre Point perfectly aligns with these market preferences.

The project maintains 70-80% occupancy, thanks to its secluded compound design, established resident community, and Masterise Homes’ quality assurance. Rental rates for two-bedroom units average VND 11-15 million (15-30% higher than nearby properties), yielding a 3.5% annual return—a competitive figure in today’s market.

The Vietnam Real Estate Brokerage Association reports typical rental yields below 4%, with many projects hovering around 2%. While 3.5% isn’t groundbreaking, it offers a secure capital allocation and steady income stream relative to other financial instruments.

Masteri Centre Point’s modern living spaces maximize natural light. Photo: H.T.A

Additionally, its status as a rare compound within Grand Park positions it for future appreciation, leveraging direct connectivity via Ring Road 3 to the city center and surrounding provinces.

Upcoming infrastructure—including the An Phú and Mỹ Thủy interchanges, Ring Roads 2 and 3, and surrounding road upgrades—will catalyze a new growth cycle for Eastern District property values. Amid limited high-end compound supply in emerging urban cores, established projects like Masteri Centre Point hold distinct advantages.

Over 30 on-site amenities cater to every need, earning resident accolades. Photo: H.T.A

In summary, Masteri Centre Point serves as both a stable income generator and a strategic mid-term investment, underpinned by proven rental demand and clear legal titles. With hundreds of pink books already issued, its value proposition is further solidified for forward-thinking investors.

Post-Merger with Ho Chi Minh City: The Surge in Binh Duong (Former) Apartment Prices Fueled by Satellite City Population Relocation Strategy

Following the merger, the newly expanded Ho Chi Minh City has unlocked vast development potential, emerging as a cutting-edge megacity and a powerhouse for finance, manufacturing, logistics, and innovation. This transformation maximizes the natural, geographic, and infrastructural advantages of all three localities.

Vingroup Invests 3.2 Trillion VND in Cần Giờ’s 29km Temporary Channel: Enabling Simultaneous Operations for 22,000-Ton and 5,000-Ton Vessels

The Can Gio coastal urban area has received detailed 1/500 planning approval from the Ho Chi Minh City People’s Committee in March 2025. This development will be complemented by a metro line connecting downtown Ho Chi Minh City to Can Gio, alongside Vingroup’s investment in an offshore wind power system located 20km from the shore.

Chairman of HoREA Le Hoang Chau: To Lower Housing Prices, All Costs Must Be Reduced Simultaneously, Including a Special Type of Expense

Mr. Le Hoang Chau, Chairman of the Ho Chi Minh City Real Estate Association, asserts that to effectively lower housing prices, the primary focus must be on reducing costs across the board. This includes land use fees, construction expenses, and input costs such as sand, gravel, steel, cement, electricity, and fuel. Additionally, Mr. Chau emphasizes the need to reduce a critical yet often overlooked cost: compliance expenses associated with legal and regulatory requirements.