Vietnam’s stock market experienced a volatile week from September 22nd to 26th, with the VN-Index facing significant downward pressure during the opening session. However, the benchmark index swiftly rebounded to around 1,660 points by the week’s end, driven by robust support from several large-cap stocks. Investor sentiment remained divided across sectors, as selling pressure primarily targeted stocks that had previously surged, such as those in the banking and securities sectors. Conversely, mid-cap and small-cap stocks saw more active participation. By week’s close, the VN-Index gained 2.08 points (+0.13%) compared to the previous week.

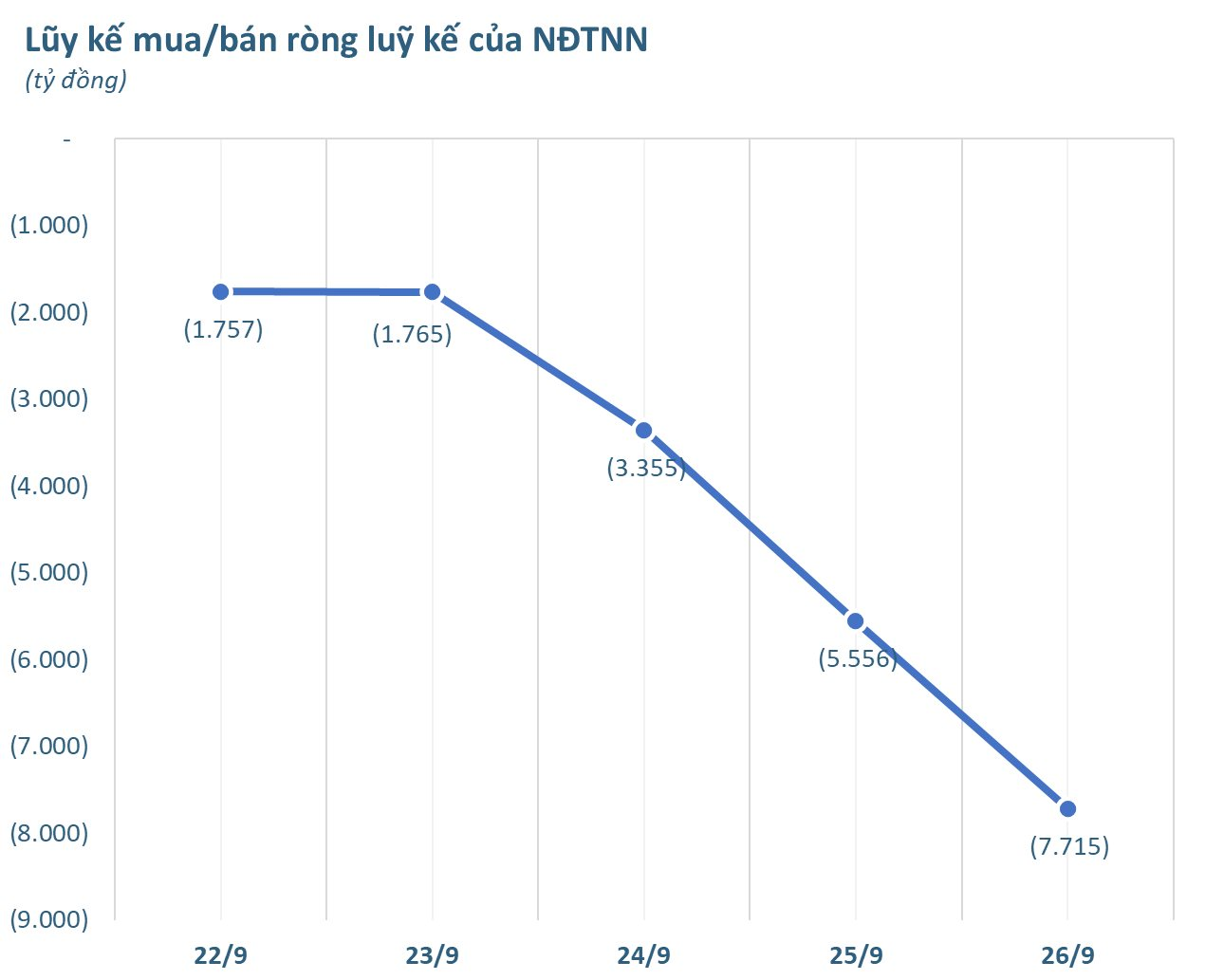

Foreign investors continued their strong net selling trend, offloading thousands of billions of dong. Over the five sessions, they net sold VND 7,715 billion.

On individual exchanges, foreign investors net sold VND 7,363 billion on HoSE, VND 309 billion on HNX, and VND 42 billion on UPCoM.

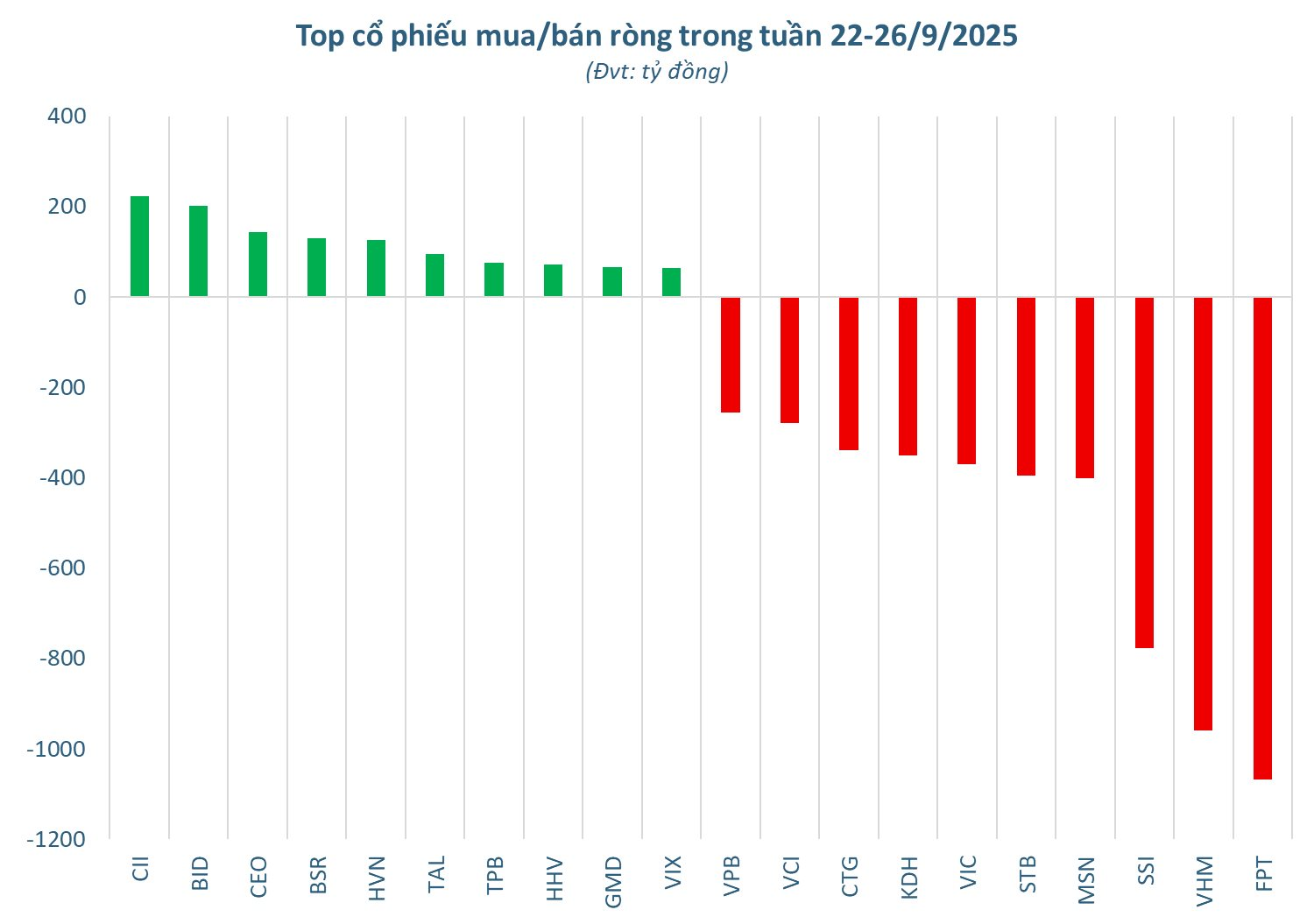

Analyzing individual stocks, FPT emerged as the most heavily net-sold stock during the week, with a value of VND 1,067.2 billion, significantly outpacing other stocks. VHM followed with net sales of VND 958.9 billion, while SSI (VND 777.4 billion) and MSN (VND 401.9 billion) also faced substantial selling pressure. Other large-cap stocks, including STB (VND 396.2 billion), VIC (VND 369.5 billion), KDH (VND 350.6 billion), and CTG (VND 339 billion), experienced notable capital outflows. VCI, VPB, KBC, and MWG recorded net sales ranging from VND 250 billion to over VND 280 billion each.

On the buying side, CII led with net purchases of VND 221.9 billion. BID followed with VND 200.9 billion, while CEO (VND 143.5 billion) and BSR (VND 129 billion) also attracted significant foreign interest. HVN (VND 125.9 billion), TAL (VND 95.7 billion), and TPB (VND 74.9 billion) saw notable buying activity. Additionally, stocks like HHV, GMD, VIX, ANV, and HHS recorded net purchases ranging from VND 50 billion to over VND 70 billion.

Bustling Businesses Distribute Dividends

Sao Mai Group Corporation issued over 37 million shares as dividends, while Tien Thinh Group Corporation distributed more than 2.26 million shares as 2024 dividends at an 11% rate. Meanwhile, DIC Corp offered 150 million shares to existing shareholders at 12,000 VND per share, aiming to raise 1.8 trillion VND.

“All Recent Reforms Aim to Elevate Vietnam’s Market Status, Says Mr. Bui Hoang Hai (SSC)”

At the Vietnam Financial Advisors Summit (VWAS) held on the afternoon of September 25th under the theme “New Era, New Momentum,” Mr. Bui Hoang Hai, Vice Chairman of the State Securities Commission (SSC), emphasized that market upgrading is not merely an endpoint but a means to achieve a more transparent, stable, and efficiently operating market. This transformation aims to provide investors with greater opportunities to pursue profitable returns.