The Vietnamese stock market experienced a tumultuous weekend session, dominated by a sea of red. By the close of trading on September 26th, the VN-Index had shed 5.39 points, settling at 1,660.7. Trading volume also took a hit, with matched orders on the Ho Chi Minh City Stock Exchange (HoSE) reaching approximately VND 24.8 trillion.

Foreign investors continued their selling spree, offloading a net VND 2,159 billion across the market. Here’s a breakdown:

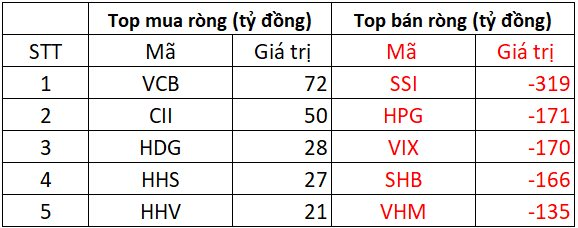

On HoSE, foreign investors net sold approximately VND 2,044 billion

On the buying side, VCB led the market with a net purchase of VND 72 billion, followed by CII at VND 50 billion. HDG, HHS, and HHV were also net bought, with values ranging from VND 21 billion to VND 28 billion.

Conversely, SSI saw the heaviest selling pressure, with foreign investors offloading roughly VND 319 billion. HPG, VIX, SHB, and VHM also faced significant net selling, each exceeding VND 100 billion.

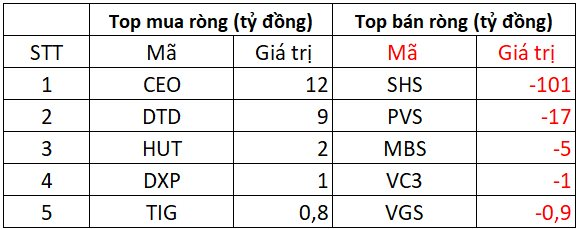

On HNX, foreign investors net sold nearly VND 101 billion

CEO emerged as the top buy on HNX, attracting a net inflow of VND 12 billion, followed by DTD at VND 9 billion. HUT, DXP, and TIG also saw modest net buying, ranging from a few hundred million to VND 2 billion.

SHS bore the brunt of selling pressure, with foreign investors dumping VND 101 billion. PVS and MBS followed suit, with net selling of VND 17 billion and VND 5 billion, respectively. VC3 and VGS witnessed lighter selling, each around VND 1 billion.

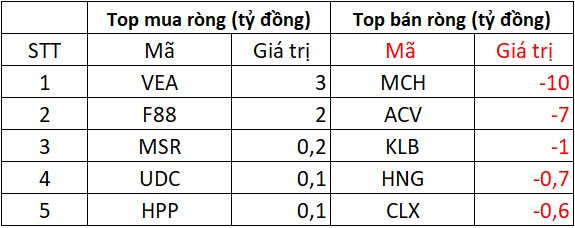

On UPCOM, foreign investors net sold VND 15 billion

VEA and F88 were the top buys on UPCOM, with net purchases of VND 2-3 billion each. MSR, UDC, and HPP also saw minor net buying, ranging from a few hundred million dong.

MCH and ACV faced the most selling pressure, with net outflows of VND 7-10 billion. KLB, HNG, and CLX experienced lighter selling, ranging from a few hundred million to VND 1 billion.