The offering is slated for 2025 or Q1/2026. Priced at VND 11,000 per share, the company aims to raise VND 1.1 trillion. Funds will be allocated as follows: infrastructure investment and system development (20%); proprietary trading and securities investment (30%); and margin lending, advance payment services, and other lawful activities (50%).

At VND 10,000 per share, Haseco expects to raise VND 1 trillion. Half of the proceeds will fund proprietary trading, while the other half will support margin lending. Full disbursement is planned post-offering, anticipated in 2025 or Q1/2026.

Haseco has disclosed a list of 17 professional securities investors, including four key executives: Mr. Đào Lê Huy (Chairman, 6.25 million shares); Mr. Nguyễn Tuấn Anh (Independent Director, Audit Committee Chairman, 6.25 million shares); Mr. Ninh Lê Sơn Hải (Acting CEO, 6.15 million shares); and Ms. Ngô Thị Song Ngân (Director, Deputy CEO, Compliance Officer, 6.15 million shares).

Mr. Đào Lê Huy, Ms. Ngô Thị Song Ngân, and Mr. Nguyễn Tuấn Anh were appointed to the Board on June 26, 2025. On the same day, Mr. Ninh Lê Sơn Hải became Acting CEO after stepping down as Chairman.

Mr. Hải joined the Board in September 2024 during an extraordinary shareholders’ meeting. Previously, he served as IT Deputy Manager at Haseco. From 2019 to 2024, he held senior roles at FPT IS, including Director of Digital Banking Center 3. He also led the 2021 HOSE Overload Resolution Project as Deputy Director.

|

Recent Haseco Leadership Changes

Source: Haseco’s 2025 Semi-Annual Financial Report

|

– 11:32 AM, September 27, 2025

Hoàng Anh Gia Lai Successfully Eliminates Over 2.5 Trillion VND in Debt

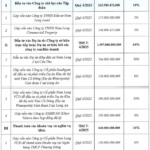

Hoàng Anh Gia Lai successfully swapped 210 million HAG shares with Huong Viet Investment Consulting Joint Stock Company and five individual investors: Ms. Nguyen Thi Dao, Mr. Phan Cong Danh, Mr. Nguyen Anh Thao, Mr. Ho Phuc Truong, and Mr. Nguyen Duc Trung. This swap corresponds to the conversion of a debt totaling over 2.5 trillion VND.

Nam Long Plans Capital Increase for Subsidiary Companies

Nam Long has revised its detailed plan for utilizing the VND 2.5 trillion raised from the issuance of over 100 million shares. The company intends to allocate these funds primarily for investment and capital contributions to its subsidiaries.