Property prices along the Q13 axis surge post-merger.

Property Prices Along the Q13 Axis Surge Post-Merger

Recent data from CBRE Vietnam highlights a significant uptick in property supply near Ho Chi Minh City’s borders, with primary apartment prices setting new benchmarks in the final months of the year.

Specifically, property prices in former Binh Duong rose by 14% annually; Dong Nai saw a 15% increase; and former Long An experienced a staggering 90% annual growth. These prices are projected to climb further, averaging 10-20% annually until 2027. Areas adjacent to core hubs like District 1 (former HCMC), including Di An, Binh Hoa, and An Phu wards, are expected to see even faster price increases.

According to CBRE, population decentralization, infrastructure development, and administrative mergers are key drivers of this price surge. Historically, property values have risen sharply along major infrastructure routes, with no signs of slowing down.

Property prices along QL.13 skyrocket. (Illustrative image)

For instance, along QL.13—slated for expansion to 60 meters by early 2026—and the metro line 2 (Thu Dau Mot – Hiep Binh Phuoc) project, property prices have surged. Since the expansion announcement, prices along this axis have risen by 20% annually.

Five years ago, land prices along QL.13 (Hiep Binh – Binh Trieu section) ranged from VND 45-55 million/m². Today, they’ve soared to VND 100-180 million/m². Even inner-area plots, just 300-500 meters from the frontage, now fetch VND 60-80 million/m²—nearly doubling in 3-4 years.

Similarly, along the segment from the former Binh Duong gate to Thu Dau Mot, prices have risen from VND 40-45 million/m² in 2023 to VND 50-60 million/m², with some projects reaching VND 65-70 million/m². In wards like Binh Hoa and Lai Thieu (HCMC), few projects remain below VND 50 million/m². Prices are expected to rise further, aligning with those in District 9 and Thu Duc (former HCMC), especially with robust infrastructure investments post-merger.

Recently, apartment projects priced around VND 55 million/m² in Binh Hoa and Lai Thieu wards, near major infrastructure, have seen strong liquidity. Demand comes not only from locals and HCMC investors but also from northern investors (10-15%).

For example, The Emerald 68 by Le Phong – Coteccons, launching on September 28, has garnered significant interest. Its reasonable pricing (VND 52-60 million/m²), flexible payment plans, and prime location along QL.13 with metro line 2 access position it for future growth.

Nearby projects like La Pura and The Habitat, priced similarly, have also attracted considerable attention. Prices below VND 55 million/m² are unlikely to persist in the near future.

Infrastructure Boost

Data from Batdongsan.com.vn shows a 32% increase in interest for Eastern HCMC properties in Q1/2025, coinciding with the city’s land clearance progress for QL.13 expansion. According to Dinh Minh Tuan, Director of Batdongsan.com.vn’s Southern region, historical metro projects indicate that property prices along such strategic routes can rise 10-15% annually for three years post-completion.

Reports from CBRE and Savills Vietnam confirm Eastern HCMC’s market leadership in price growth and liquidity. In 2024, Eastern housing prices rose by 18.6%, outpacing HCMC’s average of 15%. In Q1/2025, prices climbed another 6-7%, primarily for properties directly connected to or near national highways and metro lines.

At the “From HCMC to Satellite Cities: New Opportunities for Real Estate” seminar, Vo Huynh Tuan Kiet, CBRE Vietnam’s Residential Marketing Director, emphasized that infrastructure connectivity drives urban expansion and population decentralization.

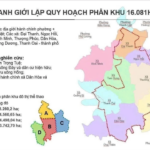

HCMC properties have historically surged with metro and highway infrastructure. (Illustrative image)

Post-merger, the new HCMC emerges as Vietnam’s largest economic hub, reshaping regional property prices. Data reveals a significant shift from the core center to satellite cities like former Binh Duong, Dong Nai, and Long An (Tay Ninh).

Four key factors are expected to shape HCMC’s market: the new HCMC supermetropolis plan, expanded growth poles; transportation & TOD systems like metros, highways, and inter-regional connections; updated land price lists; and new property taxes.

According to Dr. Ngo Viet Nam Son, an urban planning expert, the merged HCMC holds greater socio-economic potential. The supermetropolis will enhance international connectivity, from logistics to border-city networks and TODs linked to public transit.

HCMC is set to develop new urban hubs: Binh Duong’s industrial zone; Thu Thiem and Thu Duc’s financial-tech center; the Thi Vai – Cai Mep – Can Gio port cluster; and the Can Gio – Vung Tau – Long Hai – Ho Tram coastal tourism chain. “These projects must prioritize quality of life, offering comprehensive amenities, employment, and community spaces, not just housing,” Dr. Son stressed.

Over 2,200 Projects Stalled, Totaling $6 Trillion in Investment

Over 2,200 projects, totaling 6 quadrillion VND in capital, are currently stalled. Unlocking these bottlenecks, alongside flexible fiscal and monetary policies, digital transformation, and green growth, is key to achieving the ambitious GDP growth target of 8.3-8.5% by 2025.

“Ho Chi Minh City Chairman: Slow Land Clearance? Ward and Commune Leaders Held Accountable”

Chairman of the Ho Chi Minh City People’s Committee, Nguyen Van Duoc, emphasized that land clearance is a critical step in infrastructure development.