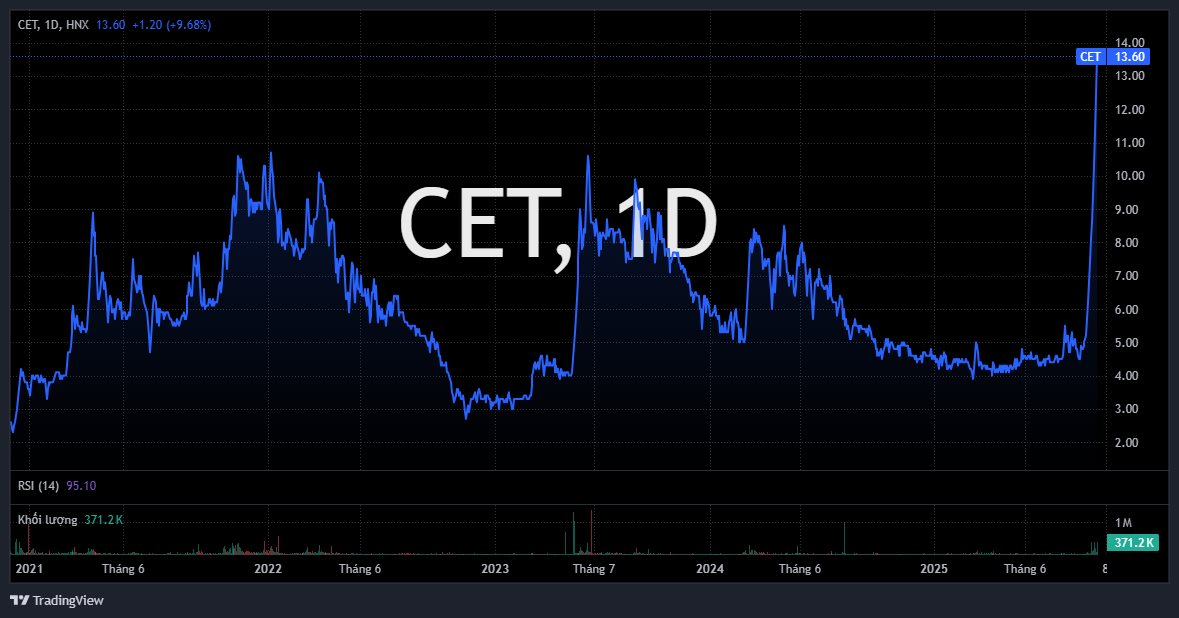

On the stock market, HTC Holding Corporation’s CET shares closed the session on September 25th with a “purple hue,” reaching a price of 13,600 VND per share. This marked the fourth consecutive ceiling session for the stock. Over the last 10 sessions (since September 11th), CET shares witnessed 9 out of 10 sessions hitting the upper limit, pushing the market price to a historic high.

Since the beginning of September, with a market price of 4,800 VND per share, CET has surged by 183% in value (equivalent to 2.8 times) in less than a month.

Explaining the five consecutive ceiling sessions from September 11th to 17th, CET stated that the company’s shares are listed and traded transparently on the HNX. The buying and selling prices of the shares are influenced by market supply and demand factors.

After investigation, the company concluded that the continuous ceiling sessions were due to the objective supply and demand dynamics of the stock market. The trading price is determined by the market and is beyond the company’s control. HTC Holding commits to complying with all legal regulations for publicly listed companies.

Recently, CET was placed under special control by the Hanoi Stock Exchange (HNX) for delaying the submission of its audited semi-annual financial report for 2025 by more than 30 days past the deadline.

Regarding the delay, CET explained that at the time of the scheduled report submission, the company had not yet held its Annual General Meeting. Therefore, the proposal for selecting an independent auditor for the 2025 financial reports had not been approved.

As a remedy, CET held its 2025 Annual General Meeting on September 5th, where the proposals, including the selection of an independent auditor, were approved. The company is currently in negotiations with several auditing firms that meet the criteria set by the shareholders. Once the audit contract is signed, the audited semi-annual financial report for 2025 is expected to be released in October 2025.

Leadership Team Seeks to Exit Entirely

In a related development, the company’s leadership team is rushing to sell off their shares while the market price is at a historic high.

Specifically, Mr. Nguyen The Tai, Chairman of the Board of Directors of HTC Holding, registered to sell his entire holding of 650,000 CET shares, equivalent to a 10% stake. The transaction is expected to take place between September 25th and October 23rd through agreement and order matching methods.

During the same period and using the same transaction methods, two other individuals, Mr. Tran Hoang Anh Tuan, Vice Chairman of the Board of Directors, and his father, Mr. Tran Hoang Cuong, also registered to sell their entire holdings of 1.04 million and 0.97 million CET shares, respectively.

Amidst the leadership’s mass divestment, CET has also seen changes in its board. On September 19th, two members of the Board of Directors for the 2023-2028 term, Mr. Do Van Dat and Ms. Ha Le Thuy Vy, resigned for personal reasons.

HTC Holding, formerly known as Tech-Vina Joint Stock Company, was established in October 2009 with an initial capital of 3 billion VND. The company’s business activities include the production of natural flavor extracts, distilled flavor waters, and wholesale of agricultural and forestry raw materials (excluding wood, bamboo, and rattan) and live animals.

The company’s main product, cinnamon essential oil, is produced at its factory in Lao Cai province. Cinnamon branches, bark, and leaves are sourced from over 8,000 cinnamon-growing households in a 5,000-hectare raw material area, then transported and processed into essential oil. Currently, CET has a chartered capital of 60.5 billion VND.

CET’s business performance has been less than impressive. In Q2/2025, revenue was recorded at 10 billion VND, a 19% decrease compared to the same period last year. The company reported a net loss of 75 million VND due to a significant increase in raw material costs.

VPBankS Sets IPO Price at VND 33,900 per Share, Valuing Company at $2.4 Billion

On September 25th, the Board of Directors of VPBank Securities JSC (VPBankS) passed a resolution approving significant changes to their previously announced initial public offering (IPO) plan. The most notable revision is the official offering price set at VND 33,900 per share, valuing the company at approximately USD 2.4 billion.

Bank Stock Plunges as Brokerage Firms Unload Hundreds of Billions in Surprise Sell-Off on September 24th

Proprietary trading firms reversed their position, offloading a net value of VND 251 billion on the Ho Chi Minh City Stock Exchange (HoSE).