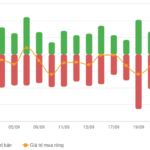

Market liquidity decreased compared to the previous session, with the order-matching volume of the VN-Index reaching over 899 million shares, equivalent to a value of more than 24.8 trillion VND; the HNX-Index reached over 96.5 million shares, equivalent to a value of more than 2.1 trillion VND.

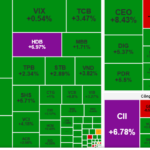

The VN-Index opened the afternoon session on a positive note as buying pressure returned, helping the index recover. However, sudden selling pressure emerged, dominating and causing the index to reverse and close in the red. In terms of impact, VPB, HDB, BID, and MBB were the most negatively influential stocks on the VN-Index, contributing to a decline of over 2.7 points. Conversely, VIC, CTG, KDH, and KBC maintained their green status, adding over 6.4 points to the index.

| Top 10 Stocks Impacting VN-Index on September 26, 2025 (in points) |

Similarly, the HNX-Index experienced a rather pessimistic trend, negatively influenced by stocks such as SHS (-3.14%), MBS (2.99%), HUT (-2.13%), PVS (-1.45%), and others.

| Top 10 Stocks Impacting HNX-Index on September 26, 2025 (in points) |

At the close, the market declined by 0.17%, with red dominating most sectors. The energy sector saw the sharpest decline at 1.2%, primarily due to stocks like BSR (-1.61%), PLX (-0.71%), PVS (-1.45%), and PVD (-1.52%). The communication services and finance sectors followed with declines of 0.9% and 0.78%, respectively. Conversely, the real estate sector was among the few to maintain green, with the strongest market increase of 1.31%, led by VIC (+3.8%), BCM (+0.45%), KDH (+2.37%), and KBC (+1.9%).

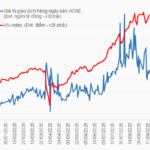

In terms of foreign trading, foreign investors continued to net sell over 2,080 billion VND on the HOSE, focusing on stocks like SSI (319.11 billion), HPG (170.81 billion), VIX (170.22 billion), and SHB (166.16 billion). On the HNX, foreign investors net sold over 101 billion VND, concentrated in SHS (101.41 billion), PVS (17.01 billion), MBS (4.52 billion), and VC3 (960 million).

| Foreign Net Buying and Selling Trends |

Morning Session: VN-Index Retreats to 1,660 Points

Increased selling pressure pushed the main indices further into the red by the end of the morning session. At the midday break, the VN-Index fell by 6 points to 1,660 points, while the HNX-Index reached 276.27 points, down by 0.5%. Market breadth favored sellers, with 401 stocks declining and 269 advancing.

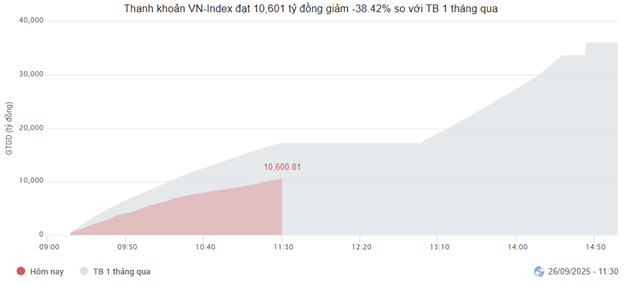

Market liquidity showed no signs of improvement. The trading value on the HOSE this morning exceeded 10 trillion VND, a 27.86% decrease from the previous session. The HNX recorded a volume of nearly 50 million units, equivalent to over 960 billion VND.

Source: VietstockFinance

|

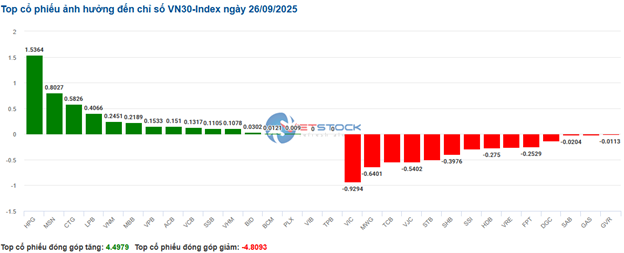

In terms of influence on the VN-Index, TCB and VPB had the most negative impact, collectively reducing the index by over 1 point. Conversely, CTG was the sole positive contributor with an equivalent impact.

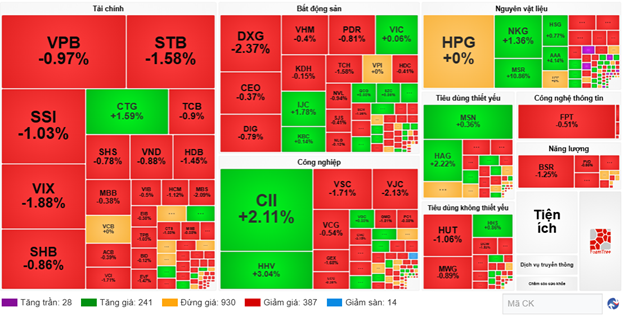

Divergence continued to dominate, with sectors fluctuating within narrow ranges. The communication services sector temporarily lagged, adjusting by 0.85% due to negative performances from VGI (-0.71%), FOX (-1.69%), CTR (-0.77%), and SGT (-2.83%).

Additionally, large-cap sectors like real estate and finance exerted significant pressure on the overall index, with most stocks trading in the red, including VHM (-0.4%), BCM (-0.45%), VRE (-1.7%), NVL (-0.94%), KSF (-2.96%), DXG (-2.37%), TCH (-1.58%); VPB (-0.97%), STB (-1.58%), SSI (-1.03%), VIX (-1.88%), VCI (-1.71%), and MBS (-2.09%).

On the flip side, the materials sector led the gains with nearly 1%, driven by strong performances from stocks like KSV (up to the ceiling), MSR (+10.86%), NKG (+1.36%), PRT (+3.54%), AAA (+4.14%), ACG (+1.1%), and HGM (+2.58%).

Source: VietstockFinance

|

Foreign investors continued to net sell, with a value exceeding 1.2 trillion VND across all three exchanges. Selling pressure concentrated on SSI, with a value of 126.92 billion VND. Meanwhile, VCB led the net buying with a value of only 22.34 billion VND.

| Top 10 Stocks with Strongest Foreign Net Buying and Selling in the Morning Session of September 26, 2025 |

10:40 AM: Weak Liquidity Persists, VN-Index Continues to Fluctuate

Investor hesitation persisted, causing the main indices to continue fluctuating around the reference level. As of 10:30 AM, the VN-Index slightly declined, trading around 1,666 points, while the HNX-Index also dipped, trading around 277 points.

Stocks in the VN30 basket showed a relatively balanced mix of green and red. Specifically, HPG, MSN, CTG, and LPB contributed 1.53 points, 0.8 points, 0.58 points, and 0.4 points, respectively, to the overall index. Conversely, VIC, MWG, TCB, and VJC faced selling pressure, reducing the VN30-Index by over 2.6 points.

Source: VietstockFinance

|

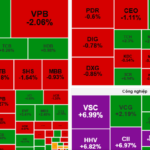

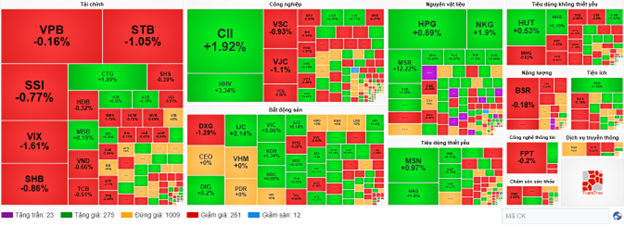

The industrial sector maintained a strong upward trend, despite some divergence, with a majority of stocks advancing. Notable performers included ACV (+1.38%), MVN (+1.92%), HHV (+3.34%), and CII (+1.92%). Stocks like VJC, HVN, GEX, and GEE still faced selling pressure, but their declines were insignificant.

Additionally, the materials sector attracted attention, with KSV hitting the ceiling, HPG rising by 0.69%, MSR surging by 11.76%, and HSG increasing by 1.03%. On the decline, stocks like GVR, DGC, DPM, and DCM also traded in the red, but their decreases were minimal.

In contrast, the energy sector performed less favorably, with heavyweights like VHM, VIC, and VRE exerting significant pressure. Meanwhile, most other stocks, such as KDH (+1.04%), KBC (+0.41%), SJS (+0.55%), and BCM (+0.59%), showed positive movements.

Compared to the opening, divergence continued, with over 1,000 stocks referenced and a near balance between buyers and sellers. There were 275 advancing stocks and 281 declining stocks.

Source: VietstockFinance

|

Opening: Financial Sector Opens Cautiously

The VN-Index and HNX-Index opened this morning’s session fluctuating around the reference level, indicating lingering caution. However, there were positive contributions from the industrial and real estate sectors.

The financial sector currently restrains overall market growth, with red dominating. Selling pressure concentrated on SSI (-0.64%), VIX (-0.81%), SHB (-0.86%), and STB (-1.41%).

Meanwhile, the industrial sector stood out with early green across most stocks. Notably, CII continued its positive trend with a 4.79% increase. Other stocks like HHV, VSC, VGC, and VCG also showed optimistic early session movements.

Additionally, the real estate sector, though slightly divergent, saw green dominating. Specifically, SJS rose by 1.1%, VHM by 1.51%, CEO by 0.37%, and DIG by 0.59%.

– 15:25 26/09/2025

Stock Market Week 22-26/09/2025: Foreign Investor Hurdles

The VN-Index paused its recovery in the final session of the week as buying momentum failed to sustain the upward trend. Liquidity remained subdued, while persistent net selling pressure from foreign investors continued to pose a significant challenge to market resilience.

Technical Analysis for the Afternoon Session of September 26: Tug-of-War Around the Bollinger Bands’ Middle Line

The VN-Index persists in its tug-of-war, retesting the Middle line of the Bollinger Bands. The August 2025 low (equivalent to the 1,600-1,630 point range) held firm during the recent correction, underscoring the resilience of this critical support level. Meanwhile, the HNX-Index continues to oscillate sideways within a Triangle pattern, signaling ongoing consolidation.

Where is the Major Stock Market Correction?

Meet Mr. Market, the enigmatic personification of the stock market, known for his wildly unpredictable moods. When euphoric, he prices assets sky-high, and when despondent, he dumps them at rock-bottom values. Many believe they can outsmart Mr. Market and profit from his whims, but the truth is, few ever succeed.