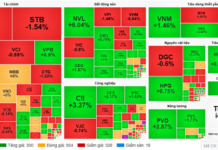

Bank stocks took center stage, with several codes surging significantly. VPB (+5.7%), TCB (+3.5%), VIB (+3.3%), and STB (+2.9%) all rallied, driving the index upward. Notably, VPB and TCB contributed nearly 6 points to the VN-Index. SHB’s liquidity outpaced the overall market, exceeding 3.2 trillion VND.

HDB led the banking group, hitting its ceiling price of 30,700 VND per share following news that HD Securities—an affiliate of HDBank—plans to invest over 1 trillion VND in a cryptocurrency asset exchange platform.

Specifically, HDS aims to raise up to 7.307 trillion VND through a rights issue, with 1.470 trillion VND earmarked for a stake in the cryptocurrency exchange operator as it increases its capital to 10 trillion VND. The company is expected to be named HD Cryptocurrency Asset Exchange JSC.

The market rebounded in the afternoon session, with strong capital inflows, particularly into banking and securities stocks.

Sensitive to market dynamics, securities stocks also reversed course, with SSI, VIX, VND, SHS, VCI, HCM, and MBS all gaining. SSI ranked second in liquidity, with over 1.428 trillion VND traded.

Amid the market recovery, steel, energy, and retail sectors showed positive signals. Notable gainers included CEO (+6.8%). However, real estate stocks were mixed, with CCI (+7.0%), DIG (+5.4%), and PDR (+3.4%) advancing, while VHM fell 1.1%, becoming the market’s largest point loser.

After a series of low-liquidity sessions, capital returned strongly to leading sectors, particularly banking and securities. At the close, the VN-Index rose 22.2 points (1.36%) to 1,657.46, and the HNX-Index gained 4.27 points (1.56%) to 277.28. The UPCoM-Index dipped 0.37 points (0.34%) to 109.65.

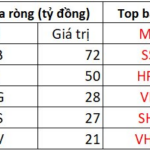

Liquidity increased, with HoSE trading value surpassing 26.7 trillion VND, up 15% from the previous session. Foreign investors remained net sellers, offloading over 1.5 trillion VND, primarily in VHM (245 billion VND), SSI (198 billion VND), VPB (123 billion VND), and VCI (104 billion VND).

Bustling Businesses Distribute Dividends

Sao Mai Group Corporation issued over 37 million shares as dividends, while Tien Thinh Group Corporation distributed more than 2.26 million shares as 2024 dividends at an 11% rate. Meanwhile, DIC Corp offered 150 million shares to existing shareholders at 12,000 VND per share, aiming to raise 1.8 trillion VND.

Foreign Block “Dumps” VND 2.2 Trillion in Vietnamese Stocks in Final Week’s Session, Spotlight on a Single Stock

In the afternoon trading session, VCB emerged as the most heavily bought stock across the entire market, with a net buying value of 72 billion.

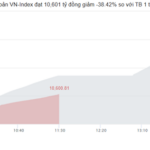

Market Pulse 26/09: VN-Index Experiences Volatile Shifts as Foreign Investors Continue Net Selling Streak

At the close of trading, the VN-Index fell by 5.39 points (-0.32%), settling at 1,660.7 points, while the HNX-Index dropped by 1.59 points (-0.57%), closing at 276.06 points. Market breadth tilted toward the downside, with 432 decliners outpacing 305 advancers. Similarly, the VN30 basket saw red dominate, as 21 stocks declined, 5 advanced, and 4 remained unchanged.