Proposed Fee for Real Estate Broker Certification Set at VND 300,000 per Certificate

|

The Ministry of Finance has announced that the issuance of the Circular regulating the collection, payment, and fee structure for the issuance and re-issuance of Real Estate Broker Certification aims to ensure consistency and alignment with real estate business laws, fee and charge regulations, and the state budget.

Fee Structure

According to the Ministry of Finance, the Ministry of Construction has provided cost details for issuing the certification, amounting to VND 307,991 per application for individuals.

The proposed fee structure by the Ministry of Construction (VND 300,000 per new certificate and VND 200,000 per re-issued certificate) is comparable to fees for other professional certifications recently implemented. For example, the Archival Practice Certification fee is VND 300,000 per certificate, with re-issuance costing VND 200,000.

As per Article 9 of the Law on Fees and Charges, the fee structure is not intended to cover costs.

Based on the Ministry of Construction’s proposal, the Ministry of Finance plans to set the following fees for the issuance and re-issuance of Real Estate Broker Certification:

New Real Estate Broker Certification: VND 300,000 per certificate.

Re-issuance of Real Estate Broker Certification: VND 200,000 per certificate.

In cases where re-issuance is due to errors by state agencies or changes in administrative boundaries as per authorized regulations, no fee will be charged for re-issuing the Real Estate Broker Certification under this Circular.

Declaration, Collection, and Payment of Fees

The Ministry of Finance refers to Circular No. 74/2022/TT-BTC dated December 22, 2022, which outlines the methods, deadlines, and declaration procedures for fees and charges under the Ministry’s jurisdiction. This Circular specifies the declaration and payment procedures for both collecting organizations and fee payers. All fee collection circulars reference the declaration and payment procedures outlined in Circular No. 74/2022/TT-BTC.

The 2025 State Budget Law (effective from January 1, 2026) includes all fees and charges collected by state agencies within the state budget scope. Consequently, there are discrepancies between Circular No. 74/2022/TT-BTC and the 2025 State Budget Law regarding fee declaration and payment. The Ministry of Finance is currently revising the content of Circular No. 74/2022/TT-BTC into a Decree to replace Decree No. 120/2016/NĐ-CP and Decree No. 82/2023/NĐ-CP, with plans to annul Circular No. 74/2022/TT-BTC to ensure legal consistency and uniform application of fees and charges.

To maintain uniformity and convenience in implementation, regardless of amendments or the annulment of Circular No. 74/2022/TT-BTC, the Ministry of Finance proposes the following fee declaration, collection, and payment provisions in Article 5 of the draft Circular:

Fee payers must submit fees when applying for the issuance or re-issuance of Real Estate Broker Certification to the fee-collecting organization through one of the following methods:

Non-cash payment into the fee-collecting organization’s dedicated fee account at a credit institution or into the state budget fee account of the fee-collecting organization at the State Treasury.

Payment through the account of another agency or organization receiving funds (applicable for online administrative procedures or public services under the government’s one-stop-shop mechanism). Within 24 hours of receiving the fee, the receiving agency or organization must transfer the full amount to the fee-collecting organization’s dedicated fee account or deposit it into the state budget.

Cash payment directly to the fee-collecting organization.

The fee-collecting organization must remit 100% of the collected fees, including any interest accrued on related account balances during fee collection, into the state budget under the current budget classification. Expenses related to fee collection are covered by the state budget within the fee-collecting organization’s allocated budget, in accordance with state budget expenditure regulations. The fee-collecting organization must declare, collect, and remit fees as per tax management laws.

– 8:43 PM, September 26, 2025

Beware of Fake Facebook Pages Impersonating the Ministry of Finance for Scams

The Ministry of Finance has issued a warning about a fraudulent Facebook page named “Ministry of Finance – Online Application Portal.” This fake page uses the Ministry’s official imagery and information, falsely claiming to represent the government in recovering funds for victims of online scams. Citizens and businesses are urged to remain vigilant and avoid engaging with this deceptive platform.

Beware of Fake Facebook Pages Impersonating the Ministry of Finance for Scams

The Facebook page titled “Ministry of Finance – Document Submission Portal” exploits the Ministry’s imagery and information, falsely claiming to represent the Ministry in “recovering funds” for victims of online scams.

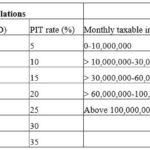

Revamped Personal Income Tax Law: Upcoming Amendments Unveiled

Under the newly proposed Personal Income Tax (PIT) bill by the Ministry of Finance, monthly taxable income will be subject to a progressive tax rate ranging from 5% to 35%.