MB Securities (MBS) has released its forecast for the profit landscape of various industries and select companies in Q3/2025.

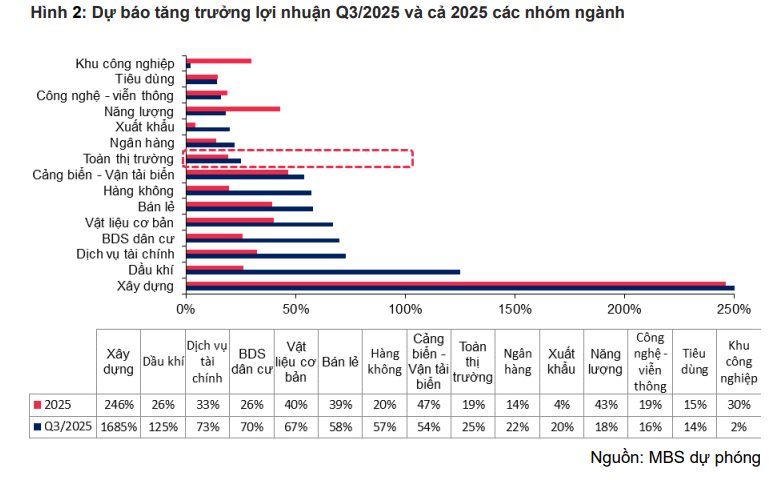

The research team predicts a 25% year-on-year growth in overall market profitability for Q3/2025, driven by a low-interest-rate environment, robust public investment disbursement, and supportive government policies for businesses.

Specifically, the banking sector is expected to see a 21.5% profit increase, outpacing the first half of the year (+16.3%), supported by continued credit growth and stable net interest margins (NIM). Notable sectors with high profit growth in Q3 include: Construction (1,685%), Oil & Gas (125%), Securities (73%), and Residential Real Estate (70%).

Some sectors are projected to have lower profit growth compared to the market, such as Industrial Real Estate (2%) due to investor concerns over new US tariff policies, and Technology & Telecommunications (16%) due to slowing global IT service demand.

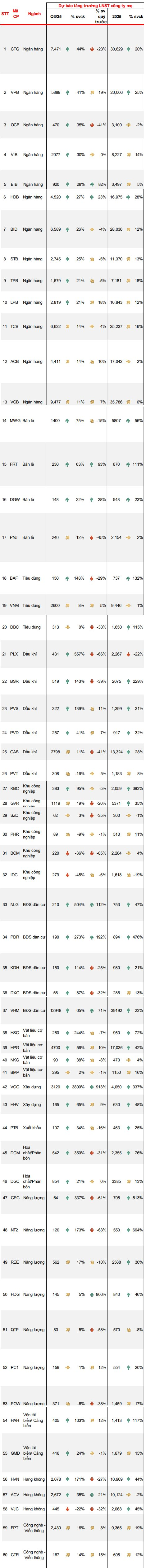

Among the 60 companies tracked by MBS, several stocks are forecasted to achieve “multi-fold” profit growth in Q3/2025, including: PLX, BSR, PVS, NLG, PDR, KDH, HSG, VCG, DCM, NT2, HAH, and HVN. Conversely, companies like VJC, BCM, POW, and IDC are expected to report negative profit growth this quarter.

In the Banking sector, Vietinbank (ticker: CTG) is projected by MBS analysts to achieve the highest net profit growth at 44% year-on-year, reaching 7,471 billion VND. Following closely, VPB, OCB, and VIB are expected to grow by 41%, 35%, and 30%, respectively.

According to MBS, the low-interest-rate environment remains pivotal in driving credit growth, particularly as retail credit shows signs of catching up with corporate credit due to the recovery in consumer and housing loans. Net interest margins (NIM) are expected to remain stable or slightly increase in the second half of the year, thanks to low lending rates and moderate funding pressures.

Notably, the Oil & Gas sector sees impressive growth among major players: Petrolimex (ticker: PLX) with a remarkable 557% increase, Binh Son Refinery (ticker: BSR) at 143%, and Vietnam Petroleum Technical Services Corporation (ticker: PVS) at 139% year-on-year.

In the Real Estate sector, MBS forecasts Nam Long (ticker: NLG) to achieve a profit of 210 billion VND, up 504% year-on-year, driven by continued handovers from the Southgate and Nam Long Can Tho projects. Phat Dat Real Estate (ticker: PDR) and Khang Dien House (ticker: KDH) are also expected to grow strongly at 273% and 114%, respectively.

For Vinhomes (ticker: VHM), analysts anticipate robust net profit growth due to significant unrecorded sales from the previous quarter (138,000 billion VND) from projects like Royal Island, Wonder City, and OCP 2&3. MBS projects VHM to grow by 65% in Q3, achieving 60% of its annual profit target in 9M25.

The Construction sector stands out with Vinaconex (ticker: VCG) achieving a staggering 3,800% profit growth, expected to reach 3,120 billion VND. MBS attributes this to a 2,850 billion VND profit from the divestment of the Cat Ba Amatina project, alongside stable construction revenue from the North-South Expressway project.

In the Retail sector, Q3/2025 profits for The Gioi Di Dong (ticker: MWG) and FPT Retail (ticker: FRT) are projected to grow by 75% and 63%, respectively. Digiworld and PNJ are expected to see more modest growth of 10-20%.

For the Aviation sector, while Vietnam Airlines (ticker: HVN) is forecasted to grow by 171%, Vietjet Air (ticker: VJC) is expected to see a 22% profit decline in Q3/2025. MBS notes that HVN’s passenger volume in Q3 is estimated to increase by 10% year-on-year, with jet fuel prices up 10% from the previous quarter. HVN’s profit growth is driven by a low base effect from the same period last year.