Following the issuance of Resolution No. 5/2025/NQ-CP on September 9, 2025, by the Vietnamese government regarding the pilot implementation of the cryptocurrency market in Vietnam, numerous major players have swiftly taken proactive steps to enter the arena.

Reports indicate that several companies, including Technocom Securities (TCBS), SSI, VPBank Securities, MB, HD Securities, VIX Securities, and HVA Investment Corporation, have actively participated by establishing legal entities and investing in organizations operating domestic digital asset exchanges.

Most recently, HD Securities Corporation (HDS), in which HDBank holds a 30% stake, has sought shareholder approval for a plan to issue 365 million shares to existing shareholders, aiming to increase its charter capital to over VND 5.1 trillion. Notably, HD Securities plans to allocate VND 1.47 trillion to invest in a company operating in the cryptocurrency exchange sector, tentatively named HD Cryptocurrency Exchange Joint Stock Company. This move will be executed after the company raises its charter capital to VND 10 trillion.

Prior to HDS’s announcement, several major securities companies had already invested in establishing cryptocurrency exchange operators, gearing up for the competition. Among them is the Vietnam Prosperity Cryptocurrency Exchange Joint Stock Company (CAEX), founded with an initial charter capital of VND 25 billion.

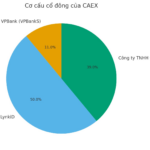

CAEX is registered to operate in the field of providing services related to cryptocurrencies. In its shareholder structure, VPBank Securities (VPBankS) contributes 11% of the capital, equivalent to VND 2.75 billion. The remaining capital of CAEX is contributed by LynkiD Corporation with 50% and Future Land Investment Company Limited with 39%. The company is headquartered on the 4th floor of 5 Dien Bien Phu, Ba Dinh District, Hanoi.

Previously, Vietnam Prosperity Bank (VPBank), the parent company of VPBankS, announced that it is finalizing procedures to participate in the pilot implementation of a cryptocurrency exchange. To execute this, VPBank will mobilize blockchain experts, financial specialists, cybersecurity professionals, and leading consulting firms to develop the project.

In late August, the VIX Cryptocurrency Exchange Joint Stock Company (VIXEX) was established on August 26 with a charter capital of VND 1 trillion. The founding shareholders include VIX Securities with 15%, FTG Vietnam Corporation with 64.5%, and 3C Communication – Computer – Control Corporation with 20.5%.

Earlier, Techcom Cryptocurrency Exchange Joint Stock Company (TCEX)—an enterprise within the Techcombank ecosystem—was established in May 2025. The company started with an initial capital of VND 3 billion, which was quickly increased to VND 101 billion.

In reality, some companies have been preparing for this game for years, notably SSI Securities, which established SSI Digital Technology Corporation (SSI Digital – SSID) in 2022. Recently, SSID, along with SSI Fund Management Company, signed a cooperation agreement with Tether, U2U Network, and Amazon Web Services (AWS) to promote the development of a digital financial infrastructure ecosystem, blockchain, and cloud computing in Vietnam.

Beyond securities companies, Military Commercial Joint Stock Bank (MB) has also signed a technical cooperation Memorandum of Understanding (MOU) with Dunamu, the operator of Upbit, South Korea’s largest cryptocurrency platform. Through this MOU, Dunamu will serve as MB’s primary strategic partner. Both parties will closely collaborate, sharing technology and infrastructure to advance Vietnam’s digital financial ecosystem.

Specifically, Dunamu will support MB in establishing a cryptocurrency exchange in Vietnam and participate in developing regulations, systems, and investor protection mechanisms related to digital assets. Additionally, Dunamu will transfer Upbit’s world-leading technology (ranked top 3 globally) and provide comprehensive operational expertise.

Furthermore, a less familiar name, HVA Investment Corporation (HVA Group, stock code HVA), has unveiled plans to launch the DNEX Digital Asset Exchange in Da Nang with a cooperative capital scale of VND 10 trillion. Accordingly, DNEX Digital Asset Exchange Joint Stock Company was established on September 9. Notably, the General Director of DNEX is Mr. Nguyen Chi Cong, born in 1984, a member of HVA’s Board of Directors.

The newly established company has a charter capital of VND 2 billion, with three founding shareholders: Fundgo Fund Management Corporation contributing 30%, Trustpay Corporation contributing 30%, and Digital Asset Management Technology Corporation contributing 40%. Two of these three shareholders are enterprises where Mr. Nguyen Chi Cong serves as both director and legal representative.

Moreover, numerous other enterprises have demonstrated their commitment to entering this new investment market. Although not explicitly labeled as an “exchange,” Hoa Binh Securities (HBS) invested in VIMEXCHANGE Cryptocurrency and Digital Asset Trading Joint Stock Company in May. VIMEXCHANGE has a charter capital of VND 10 trillion, with HBS contributing VND 500 billion, equivalent to 5% of the capital. The largest shareholder is VIMEDITMEX Pharmaceutical Corporation with VND 5 trillion, holding 50% of the capital. Other participants include Bao Tin Manh Hai Jewelry and Gold Joint Stock Company and Hoa Binh Investment and Development Joint Stock Company.

Vietnam’s cryptocurrency market is in its initial stages, and the list of organizations eager to participate is already comprehensive. Not only are technology companies and blockchain startups involved, but securities firms, commercial banks, and other enterprises are also joining. All organizations are preparing for a long-term race in a new “playground” with the potential to shape the future of digital capital.

SSI Chairman Nguyen Duy Hung: Five Years Ago, I Thought Bitcoin Could Drop to Zero, But Now It’s a Completely Different Story

Unlocking the growth potential of digital assets, SSI has assembled a tech-savvy team poised for seamless execution, while garnering significant interest from the investor market.

The Surprising Background of the VND 2 Billion ‘Core’ Investor, Contributing 50% Capital to a VND 25 Billion Crypto Asset Exchange Company Alongside VPBank

VPBank Securities JSC (VPBankS) holds an 11% stake in CAEX, equivalent to VND 2.75 billion. The remaining capital is contributed by LynkiD JSC (50%) and Future Land Investment LLC (39%).