Credit Flow Accelerates into Real Estate

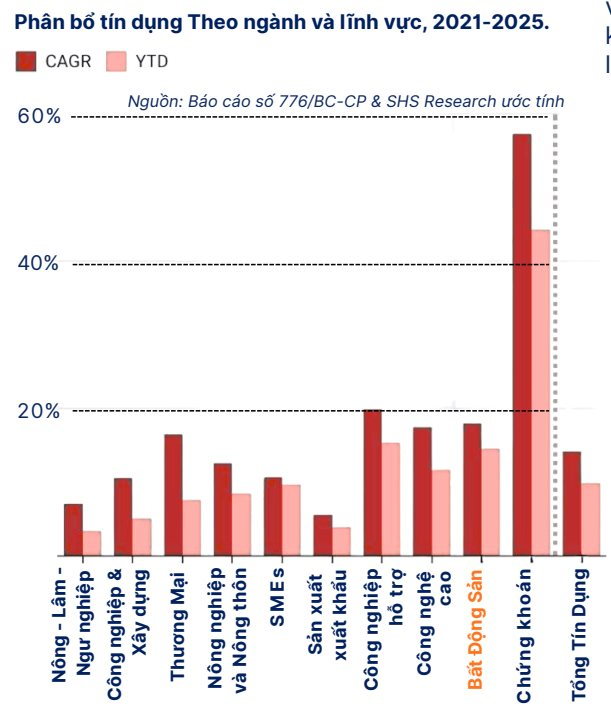

In a recent analysis report by SHS, experts highlight the fact that in recent months, credit has been accelerating into real estate. As of the end of Q2/2025, real estate debt reached 3.18 million billion VND, equivalent to 18.5% of the total debt of the entire economy. Of this, more than half (approximately 1.65 million billion) is for real estate business loans, up 13% from the end of 2024, much faster than the overall credit growth of 9.9%.

Among joint-stock commercial banks, the trend is even more pronounced. In just six months, real estate business loans have increased by nearly 20%, significantly higher than manufacturing or trade. Industry reports also confirm that capital is primarily flowing to project developers to complete constructions rather than directly to homebuyers. It can be understood that banks choose to lend to projects where capital can be immediately “absorbed,” helping to clear inventory and create jobs in related sectors.

Industrial and Agricultural Enterprises Show Little Interest in Borrowing

Conversely, credit for pure production and business has grown very slowly. Many industrial and agricultural enterprises show little interest in borrowing, despite lower interest rates. According to SHS, the reason is that they do not see an outlet. Exports are weak, domestic purchasing power is sluggish, and inventories are high.

In this context, borrowing more only increases financial burdens, especially when products are hard to sell. Many enterprises choose to downsize or even sell assets to pay off old debts rather than take on new loans. In other words, the bottleneck is not on the bank’s side but on the demand side for credit. When market prospects are not bright, enterprises are unwilling to take risks, even with available capital and low interest rates.

However, SHS asserts that real estate is not “stealing” the share from production but rather the production sector is not yet capable of absorbing the entire credit pie. Banks have ample capital, even surplus, but enterprises are not eager to borrow.

As the Chairman of HUBA admitted: “Capital is no longer difficult; the difficulty is that enterprises do not need to borrow.” In other words, banks are not refusing, but enterprises are not yet willing. And when the absorption capacity of production is weak, capital naturally flows to other channels with remaining gaps, such as securities or real estate.

According to SHS, it is also necessary to frankly acknowledge that in lending decisions, banks calculate very practically between risk and profit. If a production project has feasible prospects and assured profits, banks will be willing to accompany it because, in the long term, this is a safer customer group. But the reality is the opposite; appraising a real estate project is often much easier than appraising a factory project. Land and constructions can be mortgaged and liquidated with stable values, while machinery and equipment depreciate quickly, and production outlets are uncertain.

Moreover, real estate loans are often disbursed in smaller installments according to progress, making it easier for banks to control; whereas loans for building factories often require large, one-time disbursements over decades. Putting oneself in the bank’s position, the “preference” for real estate is not necessarily biased but financially logical.

Therefore, administrative orders alone cannot “push” capital into areas that are not yet capable of absorbing it. If real estate is overly restricted, capital may not flow into production but remain idle in banks or flow into unofficial, hard-to-control channels.

A Relay Race: Real Estate Kicks Off the First Lap, Production Takes the Next

Economics has the concept of “Escape Velocity,” meaning that to escape stagnation, an initial strong push is needed. In the current context, this push cannot be expected immediately from the private production sector, which is tightening investment. Conversely, sectors sensitive to interest rates, such as real estate, construction, or consumption, can play the role of the “locomotive” first.

When the market is difficult, enterprises contract, but real estate can become the “locomotive” to spark recovery.

Instead of viewing the relationship between real estate credit and production business as a competition, it should be seen as a relay race: real estate starts the first lap, and production takes the next. If properly guided, these two sectors will not cancel each other out but will complement each other, creating momentum for sustainable growth.

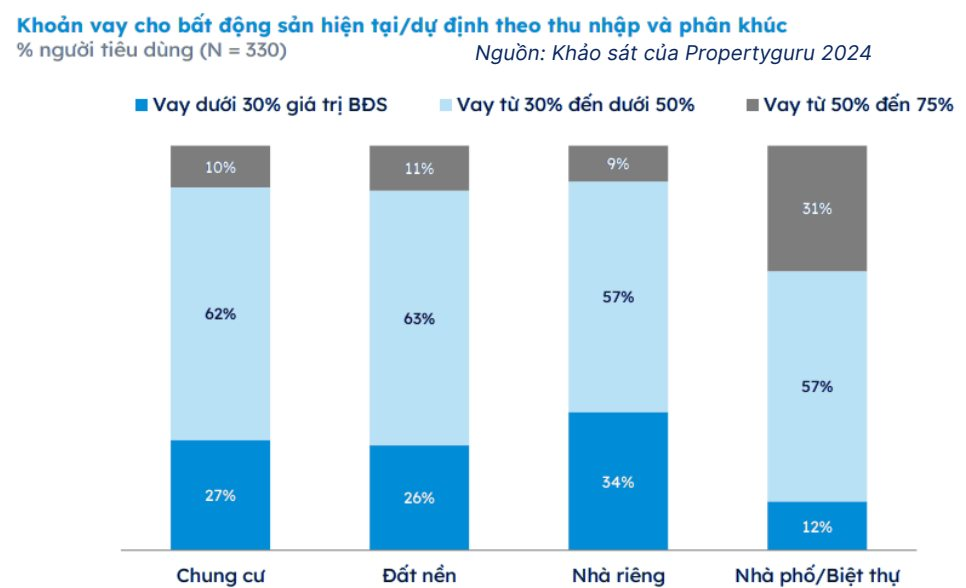

Looking at credit allocation from 2021 to the present, two points stand out. First, real estate is a major “capital absorber”: since the beginning of the year, for every 100 additional credit units, approximately 35 units are allocated to real estate. If extended from late 2022, on average, nearly 30 units out of 100 go into this sector (about 20 units for project developers and 10 units for homebuyers).

This reflects both supply and demand: the supply side has been “strengthened” through restructuring and debt resolution, while housing demand has not recovered evenly, making it easy to create a situation of “price anchoring and thin liquidity” without additional income pull.

Second, securities credit appears to be growing strongly (57.26% CAGR), but this “share” is inherently very small, so its overall impact is not significant.

Other groups such as industry-construction, exports, and small and medium-sized enterprises are also growing but not overwhelmingly.

In summary, the current picture shows that credit is still tilted towards real estate (18.05% CAGR); to spread capital into production and services, additional policies are needed to stimulate real demand (jobs, income, social housing linked to infrastructure) rather than just “supply and restructuring” on the supply side.

West Lake West Real Estate Booms Thanks to Rare Feng Shui Location

Nestled along the auspicious axis of Ba Vì – West Lake, Jade Square embodies the pinnacle of luxury living in Hanoi’s elite circles. Its prime location, steeped in feng shui principles, harnesses the prosperous energy of this golden coordinate, elevating it to a symbol of sophistication and prestige in the West Lake area.

70 Years in Review: Which Products Have Proven to Hold Their Value in Hai Phong?

The real estate market in Hai Phong, shaped by 70 years of development alongside the city, has established a clear principle: enduring value belongs to projects that combine strategic locations, cohesive planning, and elite communities. From bustling historic streets to modern urban developments, this formula consistently proves true.

Post-Merger with Ho Chi Minh City: The Surge in Binh Duong (Former) Apartment Prices Fueled by Satellite City Population Relocation Strategy

Following the merger, the newly expanded Ho Chi Minh City has unlocked vast development potential, emerging as a cutting-edge megacity and a powerhouse for finance, manufacturing, logistics, and innovation. This transformation maximizes the natural, geographic, and infrastructural advantages of all three localities.