Soaring Land Prices Drive Up Project Input Costs

Recently, property prices have surged, far exceeding the affordability of the general population. Experts analyze that one of the primary factors fueling this escalation is the significant increase in land price tables by some localities, aligning with the provisions of the 2024 Land Law to better reflect market conditions.

This has resulted in severe consequences, such as a sharp rise in financial obligations (land use fees, compensation costs for site clearance) for businesses, thereby inflating project input costs.

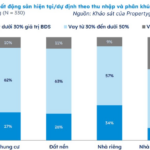

Dr. Trần Xuân Lượng, Deputy Director of the Vietnam Real Estate Market Research and Evaluation Institute, explains that housing prices are influenced by multiple factors, including project input costs. Notably, land use fees, compensation costs, and site clearance expenses account for 30–40% of total project development costs.

The sharp rise in land price tables has become the most significant bottleneck, driving up input costs for real estate projects.

“As land prices soar, input costs surge, significantly increasing total investment levels. In major urban projects, land costs represent an even higher proportion, putting pressure on final selling prices and pushing housing prices upward,” said Dr. Trần Xuân Lượng.

Dr. Trần Xuân Lượng further notes that higher land prices force real estate developers to invest more capital in acquiring land, leading to increased financial pressure (borrowing costs, opportunity costs).

Additionally, elevated land prices make it challenging for developers to introduce products to the market at reasonable prices. In the commercial housing segment, selling prices are often pushed higher, making it difficult for genuine buyers to afford.

Moreover, high land prices distort housing product development strategies, with many companies focusing on high-end or luxury segments to offset the high land costs, rather than catering to the affordable housing market. This results in an imbalance between supply and demand, with a shortage of low-cost housing and an oversupply of luxury properties.

Government to Take Control of Land Price Tables

Regarding land prices, at a recent seminar, Mr. Nguyễn Quốc Hiệp, Chairman of the Vietnam Construction Contractors Association, stated that one of the most critical bottlenecks in the current Land Law is the land valuation method.

Under the 2024 Land Law, land prices are determined by market mechanisms. However, the current unchecked rise in land prices has led to a situation where “land prices chase housing prices,” with no end in sight. Therefore, the government must retain control and regulate the market.

The amended Land Law aims to empower the government to proactively determine land price tables.

Mr. Hiệp emphasizes that land is a critical input for many businesses. When land prices rise excessively, numerous companies are forced to scale down operations or even shut down, leading to localized economic downturns.

According to Mr. Hiệp, revisiting the land valuation method is essential to balance budget revenues, stabilize the real estate market, and foster economic development.

A representative from the Ministry of Agriculture and Environment stated that the current amendment to the Land Law aims to restore the government’s decisive role in determining land price tables and related financial obligations for different land types, representing the collective ownership of the people.

Land price tables will be developed using multiple valuation methods to closely align with market prices, while considering socio-economic conditions and state management requirements in each locality. This approach allows for flexible adjustments to suit specific areas, avoiding a one-size-fits-all approach.

“The 2024 Land Law amendment seeks to restore the government’s decision-making role, combining market principles with state management to prevent the secondary market from dictating primary land prices,” the Ministry representative emphasized.

Soaring Land Prices Fuel Persistent Highs in Housing Costs

According to experts, the sharp rise in land prices over recent times has become the most significant bottleneck, driving up input costs for real estate projects—a key factor behind the persistent surge in housing prices.

SHS: With a Debt of $130 Billion, Is Real Estate “Hijacking” Credit Flows Meant for Manufacturing Businesses?

SHS emphasizes that it’s not real estate “stealing” the share of production, but rather the production sector itself hasn’t fully utilized the available credit. Banks are flush with capital, even in surplus, yet businesses remain hesitant to borrow.