Thailand’s Electric Vehicle (EV) Market Surges in August 2025

According to Autolifethailand, Thailand recorded 9,825 pure electric vehicle (BEV) registrations in August 2025, a 54.4% year-over-year increase but a 3.6% dip from July. BEVs accounted for 25% of the 39,325 new car registrations in Thailand during the month.

This brings the cumulative BEV registrations for the year to 77,082 units. Notably, the MG4 Electric claimed the top spot in BEV sales for the first time, surpassing major players like BYD Dolphin, Atto3, GAC Aion UT, and ChangAn Lumin.

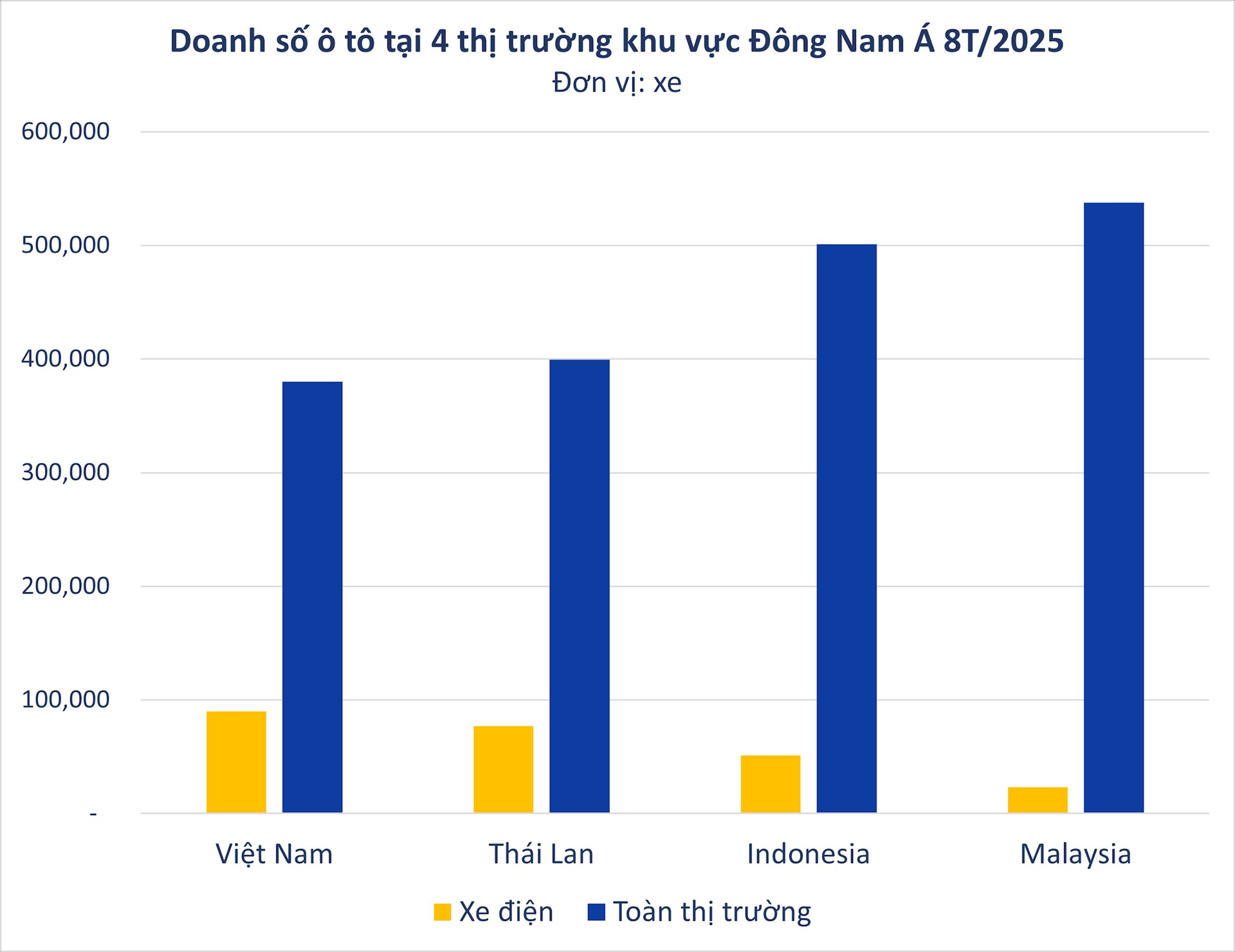

In Vietnam, domestic EV manufacturer VinFast delivered 10,922 electric vehicles in August 2025, despite the traditionally slower Ghost Month, bringing the year-to-date total to 89,970 units. This solidifies VinFast’s leading position in the Vietnamese market.

Interestingly, Thailand’s entire BEV market sales in August were outpaced by VinFast’s single-company performance in Vietnam, highlighting the contrasting growth rates, market strategies, and policy support for EVs between the two countries.

Concerns Over Looming EV Price Wars in Thailand

Wisut Hemphanphairoj, Chairman of the Thai Used Car Dealers Association, has warned of an impending EV price war in Thailand following the expiration of the government’s EV 3.0 subsidy program in December 2025.

“Once the EV 3.0 program ends, a full-scale price war will erupt in the domestic market,” Wisut cautioned. “Its impact will extend beyond new cars to the used car market as well.”

Similarly, China’s EV market is grappling with complex pricing battles. Economic uncertainties have led to oversupply, triggering uncontrolled price cuts and zero-kilometer used car sales. Trade barriers and tariffs in Europe and the U.S. further compound challenges for Chinese brands seeking global expansion.

Chinese EV Dominance in Thailand’s Market

Chinese EV brands currently dominate Thailand’s market, capturing over 70% of sales. The number of Chinese brands has doubled in just one year to 18, intensifying pressure on smaller competitors.

This dominance is fueled by Thailand’s aggressive EV incentives, which have attracted over $4 billion in investments from giants like BYD and Great Wall Motors. However, these incentives come with stringent conditions: brands must produce domestically an equivalent number of vehicles to their 2024 imports to qualify for import tax exemptions.

Brands like Neta, one of the first Chinese entrants in 2022, have struggled to meet these requirements due to sluggish sales and tight credit conditions. In response, Thailand’s Board of Investment (BoI) extended production deadlines in late 2024 to prevent oversupply and escalating price wars.

Under the revised rules, unmet 2024 production targets can be carried over to 2025, but with stricter conditions: brands must produce 1.5 times their imported volumes. The BoI aims to boost Thailand’s EV exports to 12,500 units in 2025 and 52,000 by 2026.

Thailand, historically a Southeast Asian automotive hub dominated by Japanese brands like Toyota and Honda, set an ambitious goal in 2022: 30% of its vehicle production to be electric by 2030. However, excess capacity and fierce Chinese competition have made this target increasingly challenging.