I. VIETNAM STOCK MARKET REVIEW FOR THE WEEK OF SEPTEMBER 22-26, 2025

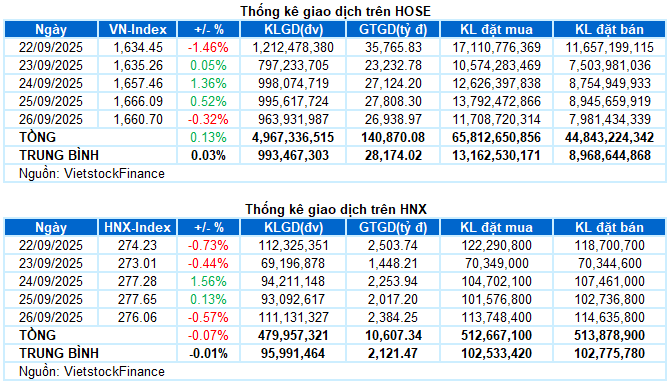

Trading Activity: Major indices retraced during the September 26th session. The VN-Index closed the week at 1,660.7 points, down 0.32% from the previous session; the HNX-Index also declined by 0.57%, settling at 276.06 points. For the full week, the VN-Index edged up by 2.08 points (+0.13%), while the HNX-Index remained nearly flat with a marginal loss of 0.18 points (-0.07%).

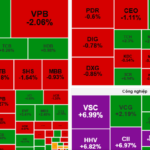

Vietnam’s stock market continued to experience a week of sideways trading. Following the prolonged correction from the previous week, the VN-Index found solid support around the 1,615-point level and staged three consecutive recovery sessions. However, buying momentum proved insufficient to sustain the rally, leading the index to reverse course in the final session. Amid pronounced market divergence, the rotational support from blue-chip stocks played a pivotal role in maintaining market stability. The VN-Index ended the week at 1,660.7 points, inching up by just over 2 points compared to the prior week.

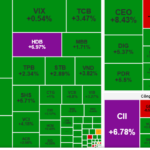

In terms of impact, VPB, HDB, and BID were the most significant drags in the final session, collectively erasing over 2 points from the VN-Index. Conversely, VIC emerged as a rare bright spot, contributing 5.6 points to the upside, though it wasn’t enough to lift the broader index.

Red dominated most sectors during the final session. The energy sector lagged, declining 1.2%, as leading stocks faced selling pressure: BSR (-1.61%), PLX (-0.71%), PVS (-1.45%), PVD (-1.52%), PVT (-3.65%), and PVB (-2.34%).

Given their substantial market capitalization, financial stocks also weighed heavily on the market, with widespread declines. Multiple banking and securities stocks corrected over 1%, including VPB, SSI, VIX, SHS, VND, HDB, MBB, VCI, TPB, EIB, HCM, and MBS.

Conversely, the real estate sector gained 1.31%, primarily driven by VIC (+3.8%), KDH (+2.37%), KBC (+1.9%), KSF (+1.54%), and SNZ (+1.68%). However, sector performance remained mixed, with notable declines in stocks like VHM (-0.5%), NVL (-2.5%), DXG (-1.94%), SJS (-2.2%), PDR (-1.01%), SCR (-2.06%), and IDC (-1.22%).

Additionally, mining stocks within the materials sector stood out, with several hitting their upper limits: KSV, BMC, BKC, KCB, LCM, along with MSR (+9.5%), ATG (+1.19%), and HGM (+3.16%).

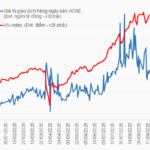

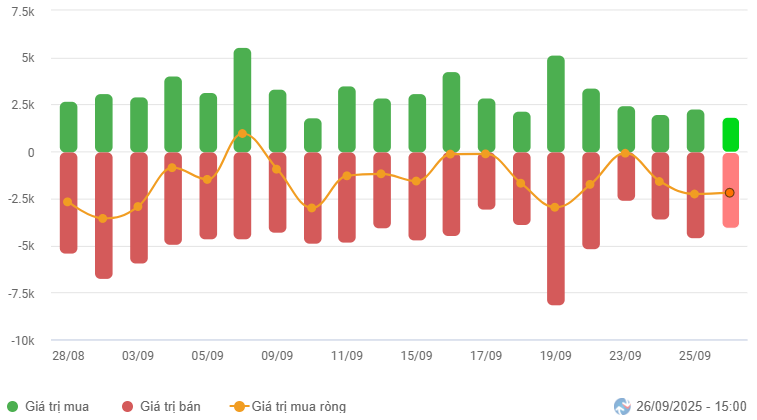

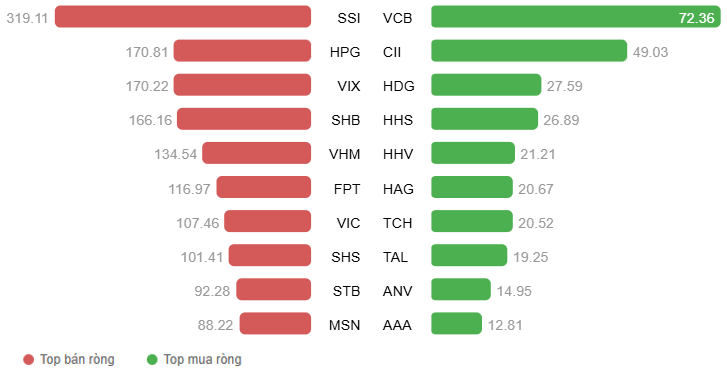

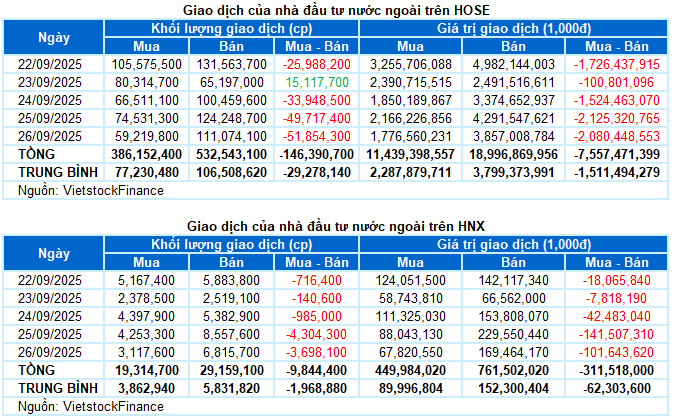

Foreign investors continued net selling, totaling nearly VND 7.9 trillion across both main exchanges last week. Specifically, they net sold over VND 7.5 trillion on the HOSE and more than VND 311 billion on the HNX.

Weekly Foreign Trading Value on HOSE, HNX, and UPCOM. Unit: Billion VND

Net Foreign Trading by Stock. Unit: Billion VND

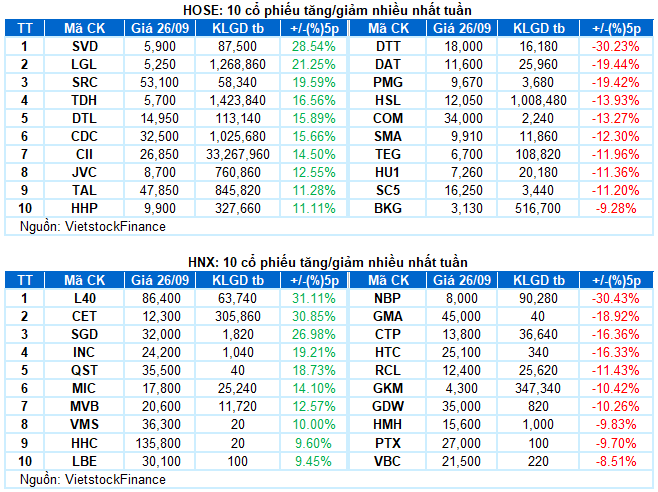

Top Gainer of the Week: CII

CII +14.5%: CII surged in three consecutive sessions after successfully testing the Bollinger Bands’ Middle line. The stock price broke above its August 2025 high, accompanied by trading volume exceeding the 20-day average, reflecting investor optimism.

Furthermore, the MACD indicator signaled a buy as it crossed above the Signal line, reinforcing the stock’s near-term positive outlook.

Top Loser of the Week: HSL

HSL -13.93%: HSL faced intense selling pressure after falling below the Bollinger Bands’ Middle line. However, the stock staged an impressive rebound in the final session, ending a six-day losing streak.

Currently, the Stochastic Oscillator has entered oversold territory. Should buy signals re-emerge in upcoming sessions, short-term risks would likely diminish.

II. WEEKLY MARKET STATISTICS

Economic Analysis & Market Strategy Division, Vietstock Advisory Department

– 17:32 26/09/2025

SSI Launches Share Offering to Raise Capital to Nearly VND 25,000 Billion, Margin Demand Surges 30-40% Yet Remains Manageable

On the afternoon of September 25th, SSI Securities Corporation (HOSE: SSI) held an extraordinary shareholders’ meeting in 2025, approving a plan to issue additional shares to existing shareholders. The proceeds from this offering will be allocated to enhance margin lending capital and invest in bonds, deposit certificates, and other securities as determined by the Board of Directors.

Technical Analysis for the Afternoon Session of September 26: Tug-of-War Around the Bollinger Bands’ Middle Line

The VN-Index persists in its tug-of-war, retesting the Middle line of the Bollinger Bands. The August 2025 low (equivalent to the 1,600-1,630 point range) held firm during the recent correction, underscoring the resilience of this critical support level. Meanwhile, the HNX-Index continues to oscillate sideways within a Triangle pattern, signaling ongoing consolidation.

Where is the Major Stock Market Correction?

Meet Mr. Market, the enigmatic personification of the stock market, known for his wildly unpredictable moods. When euphoric, he prices assets sky-high, and when despondent, he dumps them at rock-bottom values. Many believe they can outsmart Mr. Market and profit from his whims, but the truth is, few ever succeed.