TAL Successfully Raises VND 1.5 Trillion in Capital

Recently, all 15 investors participating in Taseco Land’s private placement have fulfilled their payment obligations, bringing the company nearly VND 1.5 trillion. This includes a capital surplus of over VND 1 trillion from the issuance of 48.15 million shares at VND 31,000 per share. TAL plans to use these funds to restructure debt, reduce financial costs, and strengthen equity—a prerequisite for bidding on new projects under current regulations.

Notably, the transaction attracted significant interest from institutional investors, particularly foreign investors. Prominent among them were funds from the Dragon Capital ecosystem. Collectively, Dragon Capital’s funds invested VND 620 billion to acquire 20 million TAL shares (42% of the issuance), securing a 5.56% stake in the company.

TAL’s shares also garnered attention from major domestic institutional investors. During the offering, Saigon-Hanoi Securities JSC (HNX: SHS) invested VND 248 billion to purchase 8 million TAL shares, equivalent to a 2.22% ownership stake. Meanwhile, VietinBank Securities JSC (HoSE: CTS) invested VND 62 billion in 2 million shares, holding a 0.56% stake.

With nearly 70% of the issued shares purchased by institutional investors seeking long-term investments, TAL’s robust foundation and sustainable growth potential are evident. Their willingness to invest at one of the highest price points in recent private placements within the real estate sector, coupled with a one-year lock-up period, underscores the allure of TAL’s shares.

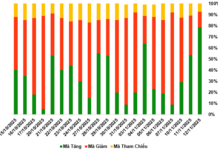

This development occurs amid a broader trend of net outflows by foreign investors, who have recently turned net buyers, reflecting their optimism about TAL’s growth prospects. In recent trading sessions, over 60% of TAL’s trading volume has come from foreign investors. Since its HOSE listing on August 1, foreign investors have net purchased 3.9 million TAL shares.

What Makes TAL So Attractive?

Backed by the robust ecosystem and transparent, efficient management approach of Taseco Group, TAL is recognized by analysts as a well-structured real estate developer with a clean land bank and focused growth strategy. Unlike the industry’s expansionist trend, TAL pursues selective development, concentrating on high-potential urban and regional areas such as Hanoi, Bac Ninh, Thai Nguyen, Ninh Binh, and others. Additionally, TAL is actively expanding partnerships with professional real estate investors from Singapore, Japan, South Korea, and beyond to develop promising projects.

As of Q2 2025, TAL’s land bank totals nearly 1,000 hectares, evenly distributed across three core segments: residential, hospitality, and industrial real estate.

Dong Van 3 Industrial Park Project

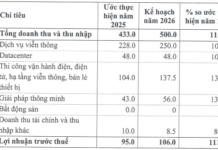

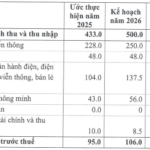

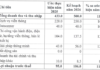

With a high-quality asset portfolio and clear legal status, TAL has achieved impressive growth over the past three years. In the first half of 2025, net revenue reached approximately VND 933 billion, while net profit surged to VND 60 billion, 3.5 times higher than the same period in 2024.

Notably, TAL’s net profit margin on revenue and equity is significantly higher than peers with similar capital and market capitalization. ROA improved from 5.10% to 6.85%, and ROE rose from 13.55% to 18.35%.

TAL plans to increase capital in a controlled manner, selectively expanding its land bank with a target of 3,000 hectares by 2030. The private placement to professional investors, rather than a public offering, not only facilitates rapid capital raising and strengthens equity for new bidding opportunities but also enhances transparency, financial standards, and risk management. This lays the groundwork for TAL’s “thick equity, thin debt” strategy moving forward.

Dragon Capital, SHS, VietinbankSC, and Others Inject Nearly VND 1.5 Trillion into Taseco Land, Instantly Yielding Over 50% “Paper Profit”

Taseco Land has successfully concluded its private placement round, raising a total of VND 1.492 trillion. Notably, the offering attracted significant interest from prominent market players. Among them, the fund group managed by Dragon Capital stood out, investing approximately VND 620 billion to acquire a 5.55% stake, thereby becoming a major shareholder in this real estate enterprise.

Unlock Triple the Value: Why Buyers Are Choosing 3 Tecco Elite City Units Over 1 Hanoi Apartment

On September 21, 2025, Tecco Elite City’s grand opening and customer appreciation event in Thai Nguyen captivated hundreds of attendees. Remarkably, numerous transactions were finalized on-site, underscoring the project’s unparalleled appeal and exceptional advantages.

Palm Manor Emerges as a Real Estate Magnet Following Legal Transparency Breakthrough

Palm Manor has emerged as a focal point with its accelerated progress in Phase 1, gearing up for the valuation of Segment 3 land plots. Since April 6, 2024, the project has witnessed a remarkable price surge of 30–70%. Even after the distribution of land titles, Palm Manor continues to captivate interest, particularly during the seventh lunar month, offering both a prime residential opportunity and immediate value appreciation upon investment.