VSDC has certified the registration of 2,311,308,021 shares for TCBS, equivalent to a charter capital of VND 23,113 billion. As of September 26th, all TCX shares have been registered with VSDC as required.

Previously, the State Securities Commission confirmed that TCBS meets the criteria to become a public company under the Securities Law. They also approved a maximum foreign ownership ratio of 100%. This means TCX shares are not subject to foreign ownership limits, facilitating international investment funds’ participation and enhancing liquidity.

TCBS’s IPO success is evident in its strong demand, with total subscriptions exceeding 575.16 million shares, 2.5 times the offered amount, equivalent to over VND 27,000 billion (more than $1 billion). This oversubscription indicates investors’ eagerness to acquire more shares upon TCBS’s listing. Several financial institutions have expressed interest in partnering for negotiated trades once TCBS begins trading on HOSE.

The IPO attracted over 26,000 investors, including 78 prestigious international financial institutions and investment funds, subscribing to nearly $500 million, or 48% of the total. Individual investors also participated actively, with over 34,000 applications, 90% of which were submitted online via TCInvest’s IPO feature. These impressive figures highlight TCBS’s technological prowess and its leadership in digitizing the capital market, offering investors a modern, swift, and unique experience.

With a total offering value of over VND 10,800 billion, this IPO sets a record in Vietnam’s securities industry, surpassing previous deals like DSE (VND 900 billion) and VCI, MBS (approximately VND 1,000 billion). It underscores TCBS’s stock appeal and the effectiveness of its WealthTech self-serve model.

A key question for investors is whether TCBS shares can soon join the VN30 index, comprising the market’s leading stocks in terms of capitalization, liquidity, and reputation. In terms of capitalization, TCBS’s issuance scale and enterprise value place it among the securities industry leaders, qualifying it for the top tier on HOSE. Its shareholder structure, with 28,000 shareholders at listing, sets a new record, far exceeding previous IPOs, ensuring robust liquidity. For context, PV Power’s 2018 IPO attracted nearly 2,000 investors, while SSI, a top securities firm, has around 80,000 shareholders after nearly 20 years of listing (as of 2024). Thus, TCBS starts with an impressive shareholder base.

The fact that 48% of subscriptions came from international financial institutions, including funds managing hundreds of billions, even trillions of USD, reflects their confidence in TCBS’s financial capabilities, leadership, operational model, and long-term strategy. The balanced mix of individual and institutional, domestic and international investors, is crucial for the stock’s sustainability and liquidity upon listing.

Given its large capitalization, balanced shareholder structure, and positive liquidity outlook, analysts believe TCBS has a high chance of joining the VN30 index in upcoming reviews. Prerequisites such as listed company status, free-float ratio, and adjusted capitalization are met. While liquidity criteria will be assessed over the first six post-listing months, the 2.5 times oversubscription and large initial shareholder base strongly suggest TCBS shares will feature among Vietnam’s top blue chips.

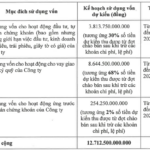

Capital strength is another key advantage for TCBS. As of June 30, 2025, the company’s charter capital was VND 20,802 billion, with owner’s equity at VND 30,063 billion, the highest in the securities industry. Post-IPO, with 231.15 million new shares, charter capital rose to over VND 23,113 billion, and owner’s equity to nearly VND 41,000 billion. This expanded the margin lending limit to approximately VND 82,000 billion, with TCBS currently utilizing about half. This substantial capacity demonstrates both solid capital strength and superior liquidity support, further positioning TCBS as a strong VN30 candidate.

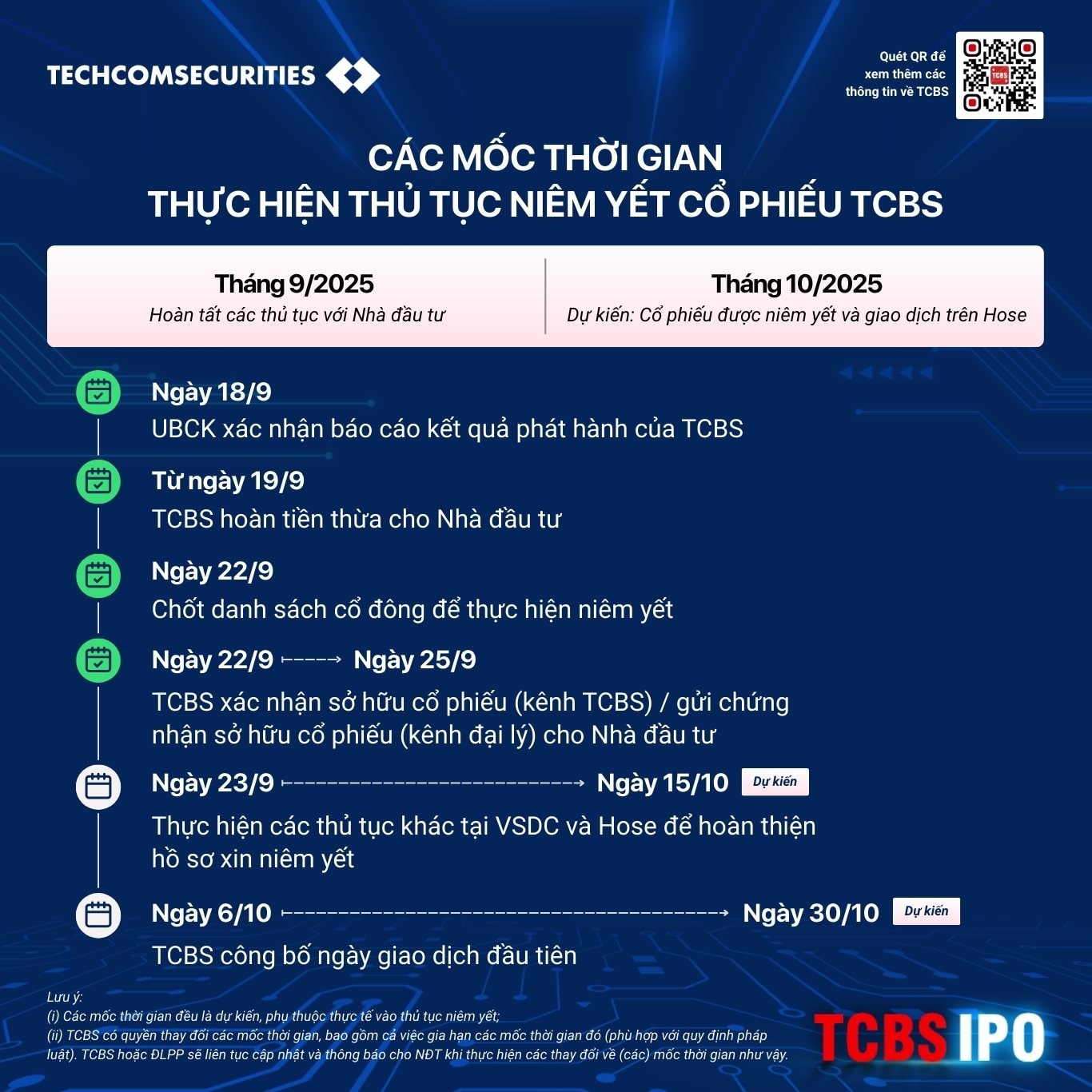

Beyond internal factors, TCBS’s listing is supported by Government Decree 245/2025, which reduces the time to list shares to 30 days post-compliance and removes barriers for foreign investors. This significantly boosts foreign capital inflows, making TCBS shares a focal point for both domestic and international investors. TCBS is expected to list and trade on HOSE in October.

Deconstructing TCBS’s IPO reveals it as a milestone not only for the company but also for Vietnam’s stock market amid its upgrade preparations. With a record issuance scale, strong investor interest, and VN30 prospects, TCBS shares are poised to become a market highlight upon listing.

Revised Building Law Draft: Eliminating Red Tape, Empowering Local Authorities

The proposed Construction Law draft, submitted by the Ministry of Construction, eliminates 3 out of 8 procedural groups compared to the current Construction Law. These include: the appraisal of construction design implementation following basic design; the issuance of construction operation capability certificates for organizations; and the recognition of socio-professional organizations qualified to grant construction operation capability certificates. Additionally, it abolishes all investment and business conditions for 10 conditional business sectors within the construction field, as outlined in the Investment Law.

Xiaomi Delivers on Promise: Mijia Refrigerators, Washing Machines, and Air Conditioners Officially Launched in Vietnam

Xiaomi has officially launched its Mijia smart home appliance line in Vietnam, featuring air conditioners, refrigerators, washer-dryers, and air purifiers. This move addresses the growing consumer demand for diverse smart home solutions and strengthens Xiaomi’s ecosystem of intelligent household products.

VPBankS Sets IPO Price at VND 33,900 per Share, Valuing Company at $2.4 Billion

On September 25th, the Board of Directors of VPBank Securities JSC (VPBankS) passed a resolution approving significant changes to their previously announced initial public offering (IPO) plan. The most notable revision is the official offering price set at VND 33,900 per share, valuing the company at approximately USD 2.4 billion.

Vietnam’s Fruit and Vegetable Exports Reach Unprecedented High

In September, Vietnam’s fruit and vegetable industry achieved a historic milestone, with export turnover reaching nearly $1.3 billion—the highest level ever recorded. Durian exports, the king of fruits, are leading the charge, propelling the sector toward a new record and paving the way to potentially hit the $8 billion mark this year.