Vietnam Report Announces Top 10 Reputable Retail Companies in 2025

On September 26, 2025, Vietnam Report (Vietnam Report Joint Stock Company) officially unveiled the Top 10 Reputable Retail Companies in Vietnam for 2025.

Companies were evaluated and ranked based on three key criteria: Financial Capacity as reflected in the latest financial reports; Media Reputation assessed through Media Coding—encoding articles about the company across influential media channels; and Surveys of research subjects and stakeholders conducted in August-September 2025.

Top 10 Reputable Retail Companies in 2025 – Hypermarket Group

The 2025 Top 10 Reputable Retail Companies in the Hypermarket Group saw minimal changes, with Central Retail, Saigon Co.op, and Wincommerce retaining their leading positions. Compared to last year’s rankings, Mega Market slipped from 4th to 6th place, falling behind Aeon and Lotte Mart.

Top 10 Reputable Retail Companies in 2025 – Electronics & Digital Devices Group

In the Electronics & Digital Devices Group, The Gioi Di Dong, FPT Retail, and Viettel Store continue to lead. Digiworld, which ranked 4th last year, and Pico, which ranked 10th in 2024, have both dropped out of the top 10. New entrants to this year’s rankings include Cellphone S (6th place) and Di Dong Viet (10th place).

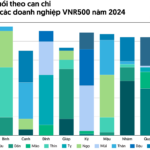

According to the report, reflecting the economic growth momentum, Vietnam’s retail sector witnessed a steady recovery in the first half of 2025, following a promising 2024, despite ongoing segmentation across business segments.

Data from the General Statistics Office shows that final consumption in the first half of 2025 increased by 7.95% year-on-year (compared to 5.78% in the first half of 2024), contributing 84.2% to GDP growth. This underscores the leading role of domestic consumption amid pressures from tariffs and trade tensions affecting exports and investment.

In the first eight months of 2025, retail sales of goods reached an estimated VND 3,495.8 trillion, up 8.1% year-on-year. Vietnam Report’s survey also noted that nearly two-thirds of businesses reported improved performance. Many industry leaders recorded impressive profits by accurately meeting market demands and proactively reshaping the competitive landscape.

Retail Sector Outlook for 2025

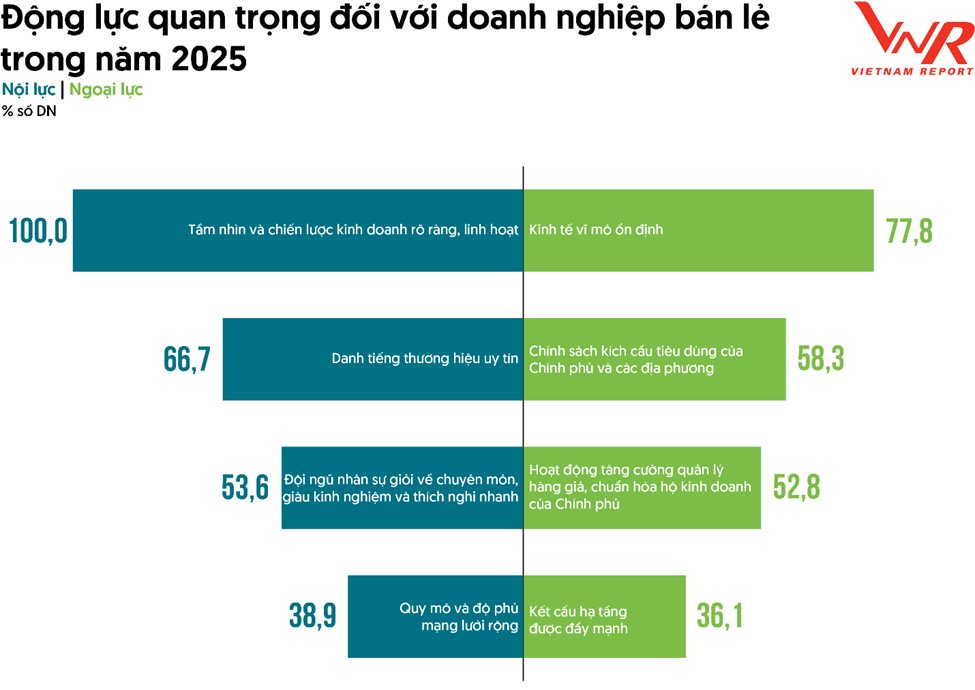

From the perspective of retail businesses, despite lingering uncertainties, recovery remains the dominant trend in 2025. Growth is driven by two factors: internal strategic restructuring efforts and supportive macroeconomic policies.

However, the recovery is uneven, with clear segmentation between retail segments and business groups, depending on product portfolios, management capabilities, and adaptability to change.

Alongside positive developments, Vietnam Report’s survey highlights several challenges for retail businesses in 2025, notably (1) tariff fluctuations and international trade flows, (2) exchange rate volatility, and (3) rising operational costs. These interconnected factors create a multi-dimensional impact on business operations.

Amid rising protectionism and trade barriers, import costs for raw materials and finished goods, especially for durable and high-end products reliant on foreign supplies, are also at risk of fluctuation. Additionally, retailers face high operational costs, including rent, logistics, staffing, and marketing expenses.

Notably, online sales channels—now pivotal in modern retail strategies—have become new cost drivers as e-commerce platforms increase transaction fees, commissions, and advertising costs. This necessitates optimized sales channels and supply chains for businesses.

Overall, Vietnam’s retail market is increasingly dynamic, with businesses accelerating strategies to capture market share in a domestic market valued at hundreds of billions of USD.

“GELEX Ranks Among the Top 50 Most Reputable and Efficient Public Companies”

Celebrating a decade of being a publicly-listed company, GELEX’s anniversary marks a significant milestone of remarkable and sustainable growth.

OPES Ranks Among Vietnam’s Top 10 Most Reputable Non-Life Insurance Companies in 2025

On August 1st, OPES Joint Stock Insurance Company was honored at the awards ceremony for the “Top 10 Reputable Non-life Insurance Companies” organized by Vietnam Report in collaboration with VietnamNet newspaper. This recognition marks a significant milestone in the company’s journey towards becoming a trusted and leading insurance provider in the market.

The Pen is Mightier: Unveiling the Zodiac Signs of Vietnam’s Top CEOs.

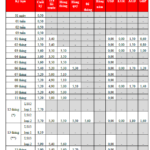

A closer look at the zodiac signs of CEOs leading some of Vietnam’s largest empires reveals an intriguing pattern. With a focus on the Vietnamese lunar calendar and its zodiac animals, we find that CEOs born in the Year of the Horse, Tiger, Rat, and Dog are the most prevalent. Meanwhile, the CEOs of THACO and Traphaco, both born in the Year of the Wooden Snake (Ất Tỵ), navigate through their ‘age’ year.

Considering the Chinese zodiac, the number of CEOs born in the year of the Water Rat (1972) is the highest. Following closely behind are those born in the year of the Wood Tiger (1974), Fire Snake (1977), and Earth Dragon (1976).