Mr. Pham Anh Tuan – Director of the Payment Department, State Bank of Vietnam

According to Mr. Tuan, following the government’s directive to promote bilateral payments between Vietnam and other countries in the region, the State Bank of Vietnam has collaborated closely with leading Vietnamese banks and the National Payment Corporation of Vietnam (Napas) to implement these services.

Currently, Vietnam has successfully launched bilateral payment systems with three countries: Laos, Cambodia, and Thailand. While the transaction volume remains modest, Vietnamese tourists visiting Thailand can now use their banking apps for payments.

“This is incredibly convenient. Vietnamese travelers no longer need to exchange currency in the destination country; they can simply use their banking apps and accounts as they would in Vietnam,” emphasized the Director of the Payment Department.

Mr. Tuan also noted that the banks selected by the State Bank of Vietnam as settlement banks are highly reputable and experienced in international payments, ensuring favorable exchange rates.

Additionally, the Director of the Payment Department announced that Vietnam is working on bilateral payment projects with China and South Korea. By October, Chinese tourists are expected to be able to make QR code payments in Vietnam, with a similar system planned for South Korea.

“For the China project, Vietcombank will serve as the settlement bank, while BIDV will handle the South Korea project. Our goal is to enable Vietnamese travelers to use these payment systems in these countries by early 2016, similar to the system in Thailand,” Mr. Tuan explained.

“This September, we will officially announce the bank participating in the settlement project with India. We also anticipate a decision soon regarding the bilateral payment project with Taiwan. The State Bank of Vietnam is also working on a payment project with Singapore, with VietinBank as the settlement bank,” the Director added.

Mr. Tuan predicts that 2026 will be a breakthrough year for bilateral payments between Vietnam and multiple countries, significantly benefiting Vietnamese travelers. “We will no longer need to worry about exchanging currency into Renminbi, Won, Baht, or other currencies. Instead, we can confidently use our Vietnamese bank accounts for payments abroad,” he concluded.

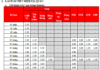

“28 Banks and 4 Payment Intermediaries Linked with VNeID for Social Security Payments”

As of August 15, 2025, the banking sector had successfully acquired and cross-referenced over 123.9 million individual customer records with biometric data. An impressive 32 units have linked up with VNeID to facilitate social security payments, a testament to the industry’s commitment to efficient and secure transactions.

The State Bank of Vietnam Reports: 38 Million Authenticated Biometric Accounts, Fraud and Scam Cases Down by 50%, Scam Accounts Down by 72%

The user experience remains largely unaffected by the implementation of Decision 2345 by the State Bank of Vietnam.