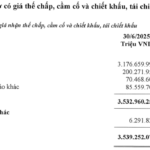

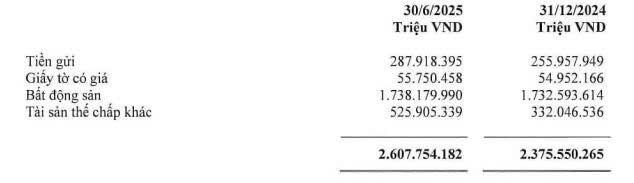

The audited mid-year consolidated financial report of Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank) reveals that the bank’s collateralized assets surpassed VND 2,600 trillion as of June 30, 2025. Compared to the end of 2024, collateralized assets at Vietcombank increased by over VND 232 trillion, equivalent to nearly 10%.

Among the collateralized assets at Vietcombank, real estate holds the largest share, totaling more than VND 1,738 trillion, or 66.7% of total secured assets. Deposits pledged as collateral amount to nearly VND 288 trillion, securities reach over VND 55.75 trillion, and other secured assets stand at approximately VND 526 trillion.

Source: Vietcombank’s 2025 Audited Semi-Annual Financial Report

In terms of business performance, Vietcombank’s consolidated pre-tax profit for the first six months reached nearly VND 21,894 billion, a 5% increase compared to the same period last year, driven by a nearly 50% reduction in credit risk provisioning expenses.

As of the end of Q2/2025, Vietcombank’s total assets exceeded VND 2,200 trillion, up 6% from the beginning of the year. Customer loans and deposits reached nearly VND 1,560 trillion and VND 1,590 trillion, respectively, increasing by 7% and 8% since the start of the year.

With this scale, Vietcombank maintains its leading position in the banking system in terms of profitability and ranks fourth in asset size, outstanding loans, and customer deposits (following BIDV, VietinBank, and Agribank).

As of June 30, 2025, Vietcombank’s total non-performing loans (NPLs) stood at VND 15,576 billion, a 12% increase from the beginning of the year. The NPL ratio slightly rose from 0.96% at the start of the year to 1%.

Concerns Rise Over Abuse of ‘Sole Residence’ Loophole to Evade Bad Debt Asset Seizure

The Supreme People’s Procuracy has raised concerns regarding the draft regulations on the conditions for seizing collateral assets of non-performing loans. Specifically, they caution that classifying “sole housing” as a protected asset may be exploited, potentially becoming a loophole to evade the seizure of bad debt-related properties.

Bank’s Mortgage Real Estate Holdings Surpass $130 Billion, Accounting for 90% of Total Collateral Assets

As of Q2 2025, the bank’s mortgage real estate portfolio reached nearly 3.2 quadrillion VND, accounting for 90% of its total secured assets.

Before the Massive Capital Increase: How Did Saigon Marina IFC’s Developer Perform?

Ahead of its massive capital increase in August 2025, Capitaland Tower—the developer behind Saigon Marina IFC, a leading financial hub—reported significant losses for the first half of this year.