On the afternoon of September 25, 2025, SSI Securities Corporation (HOSE: SSI) held its Extraordinary General Meeting of Shareholders for 2025, approving the issuance of additional shares to existing shareholders through a rights offering and other matters within its jurisdiction.

During the meeting, SSI Securities Corporation proposed the issuance of 415.6 million shares to existing shareholders at a ratio of 5:1 (for every 5 shares held, shareholders receive 1 purchase right). The expected offering price is VND 15,000 per share, with the issuance scheduled for 2025–2026 or as decided by the Board of Directors upon approval from the State Securities Commission.

Upon successful issuance, the proceeds are estimated at VND 6,234 billion, increasing SSI’s chartered capital to VND 24,963.5 billion and reclaiming its position as the industry leader in chartered capital. This would make SSI the securities company with the largest chartered capital in the market, surpassing even commercial banks like NamABank, ABBank, and Kien Long Bank.

The funds raised will be allocated to supplement capital for margin lending and investments in bonds, deposit certificates, and other securities as determined by the Board of Directors.

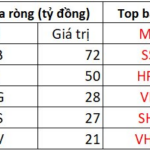

Previously, SSI Securities Corporation also issued 104,042,344 shares privately to professional investors, representing 5.28% of the company’s total outstanding shares. At an offering price of VND 31,300 per share, SSI raised over VND 3,256.5 billion, increasing its chartered capital from VND 19,739 billion to VND 20,779 billion (as of August 30, 2025). SSI plans to allocate 50% of the proceeds to supplement capital for investments in deposit certificates and the remaining 50% for margin lending activities.

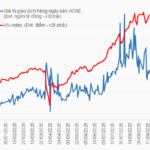

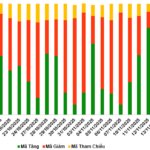

In its report to the meeting, SSI Securities Corporation noted that the Vietnamese stock market experienced significant volatility in the first eight months of 2025, particularly influenced by tariff-related news. Despite a negative start to Q2 2025 following the U.S. announcement of retaliatory tariffs on Vietnam, the market rebounded strongly after both parties reached a trade agreement. By the end of August 2025, the VN-Index closed at 1,682 points, surpassing its 2022 historical peak and growing by 32.8% since the beginning of 2025.

Amid these conditions, SSI’s leadership demonstrated flexibility and achieved effective business results. In the first six months, SSI’s consolidated pre-tax profit reached VND 2.3 trillion (up 12.1% year-on-year), fulfilling 54% of the business plan presented at the April shareholder meeting. Q2 pre-tax profit increased by 13.1% compared to Q1, with positive performance across all segments (investment, brokerage, margin lending, and investment banking). SSI’s brokerage market share grew on all three exchanges, with the highest growth of 9 quarters on HOSE, reaching 10.85%. Margin lending in Q2 2025 hit a record VND 33.1 trillion (up 22.0% quarter-on-quarter and 62.5% year-on-year), driving robust growth in margin lending revenue for the first six months of 2025 (VND 1.5 trillion). SSI closed the September 11 session at a peak of VND 42,450 per share, marking a nearly 63% increase since the beginning of the year. Market capitalization also set a record of over VND 88,100 billion, solidifying SSI’s position as the market leader in capitalization among listed securities companies.

As of June 30, 2025, SSI’s total assets reached approximately VND 91,000 billion. The company’s business performance growth highlights its capital strength, reputable brand value, and service quality. With continuous capital expansion, SSI is expected to pursue innovative strategies and capitalize on the market’s impressive development.

SSI Launches Share Offering to Raise Capital to Nearly VND 25,000 Billion, Margin Demand Surges 30-40% Yet Remains Manageable

On the afternoon of September 25th, SSI Securities Corporation (HOSE: SSI) held an extraordinary shareholders’ meeting in 2025, approving a plan to issue additional shares to existing shareholders. The proceeds from this offering will be allocated to enhance margin lending capital and invest in bonds, deposit certificates, and other securities as determined by the Board of Directors.

Where is the Major Stock Market Correction?

Meet Mr. Market, the enigmatic personification of the stock market, known for his wildly unpredictable moods. When euphoric, he prices assets sky-high, and when despondent, he dumps them at rock-bottom values. Many believe they can outsmart Mr. Market and profit from his whims, but the truth is, few ever succeed.

Massive $450 Million Dividend Windfall for Vingroup

In July 2025, VEFAC successfully completed dividend payments at a remarkable total rate of 435%. The company is now actively seeking shareholder input regarding the second interim dividend advance, proposed at a rate of 330%.