VinaCapital Fund Management Joint Stock Company has recently announced a transaction involving KDH shares of Khang Dien House Trading and Investment Joint Stock Company.

Specifically, Vietnam Investment Limited, a fund under VinaCapital, has registered to sell nearly 9.3 million KDH shares to restructure its investment portfolio.

The transaction is expected to take place via agreement and/or order matching methods between September 30, 2025, and October 29, 2025.

If successful, Vietnam Investment Limited’s KDH share ownership will decrease from over 13.3 million shares to more than 4 million shares, reducing its stake in Khang Dien House from 1.189% to 0.361%.

Illustrative image

Based on the KDH share price of VND 33,700 at the market close on September 25, 2025, VinaCapital’s fund is estimated to generate over VND 313.2 billion if the sale is completed.

Previously, during the trading period from August 12, 2025, to September 10, 2025, Hung Thinh VinaCapital Equity Investment Fund failed to purchase 850,000 registered shares due to unfavorable market conditions.

Post-transaction, the fund retains its 0.0549% stake in Khang Dien House, equivalent to 616,410 KDH shares.

Regarding business performance, Khang Dien House’s audited consolidated financial report for the first half of 2025 shows a net revenue of over VND 1,759.2 billion, a 79.8% increase compared to the same period in 2024.

However, after deducting taxes and fees, the company reported a net profit of over VND 314.9 billion, an 8.5% decrease.

For 2025, Khang Dien House aims to achieve a post-tax profit of VND 1,000 billion. As of the first two quarters, the company has completed 31.5% of its profit target.

As of June 30, 2025, Khang Dien House’s total assets increased by VND 496.8 billion from the beginning of the year to over VND 31,254.5 billion. Inventory accounts for VND 23,007.4 billion, or 73.6% of total assets.

On the liabilities side, total payables stand at nearly VND 11,546.2 billion, up by nearly VND 242 billion since the start of the year. Short-term and long-term loans total VND 9,142.4 billion, representing 79.2% of total liabilities.

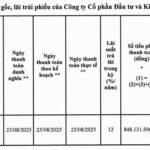

The Khang Điền House Liquidates Over 848 Billion VND in Principal and Interest on Bonds

With a strong track record of financial prudence, Nha Khang Dien has once again demonstrated its commitment to meeting its financial obligations. The company recently made a substantial payment of over VND 848 billion, covering both principal and interest on its bond series KDHH2225001. This timely full repayment underscores the company’s dedication to maintaining a solid financial standing and bodes well for its future endeavors.

“VinaCapital-VESAF Fund Targets Mid-Small Cap Equities”

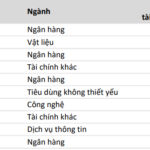

In the latest update report by VinaCapital-VESAF, the fund revealed that the VN-Index witnessed an impressive 18.6% growth in the first seven months of 2025. However, approximately 60% of this growth is attributed to stock groups associated with the Vingroup conglomerate and GELEX. These two stock groups have never been among the fund’s large investment portfolios.

The VinaCapital Member Fund Seeks to Accumulate 850,000 Khang Dien House Shares

The VinaCapital Hung Thinh Stock Investment Fund has registered to purchase 850,000 KDH shares of Khang Dien House, with the aim of restructuring its investment portfolio.