Specifically, the minimum offering price has been adjusted from 12,130 VND per share to a precise 33,900 VND per share for the upcoming IPO of 375 million shares.

With this specified offering price, VPBankS is projected to raise over 12.7 trillion VND.

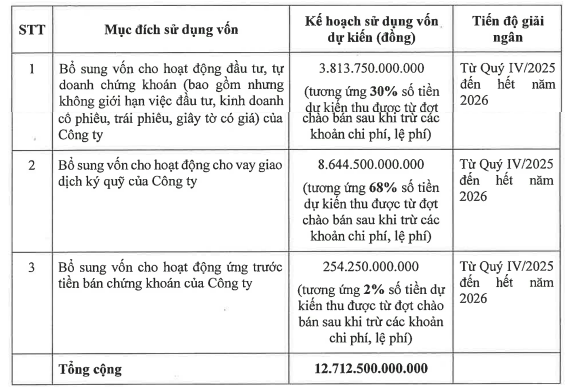

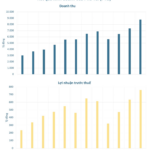

Additionally, the capital allocation plan has been revised. Instead of allocating 70% (approximately 3.2 trillion VND) for margin lending activities and 30% (around 1.4 trillion VND) for securities investment and proprietary trading, the new plan will distribute 68% (over 8.6 trillion VND) for margin lending, 30% (more than 3.8 trillion VND) for securities investment and proprietary trading, and 2% (over 254 billion VND) for advance payment on securities sales.

Regarding the disbursement timeline, VPBankS maintains the original schedule, set for Q4/2025 – 2026.

|

New Capital Allocation Plan of VPBankS

Source: VPBankS

|

Another notable change is in the list of distribution agents. While the original plan included only Vietcap Securities, the new plan introduces two additional partners: SSI Securities and Saigon-Hanoi Securities (SHS). Furthermore, adjustments have been made to the handling procedure for unsold shares.

On the same day, September 25th, the Board of Directors of VPBankS approved the IPO registration dossier.

This IPO, planned by VPBankS, has garnered significant market attention. If successful, the company’s outstanding shares will increase from 1.5 billion to 1.875 billion, raising its charter capital from 15 trillion VND to 18.75 trillion VND.

The offering is scheduled for Q3/2025 – Q2/2026. In fact, VPBankS’ online trading platform has already promoted the event, indicating that subscriptions are expected to open in October 2025.

Announcement on VPBankS’ Online Trading Platform

|

At the announced offering price of 33,900 VND per share, VPBankS is valued at nearly 63.6 trillion VND, equivalent to approximately 2.4 billion USD (based on current exchange rates).

Shortly before VPBankS, Technocom Securities (TCBS) finalized its IPO price at 46,800 VND per share, valuing the company at around 4.1 billion USD. The offering was oversubscribed by 2.5 times, creating a market frenzy.

Both VPBankS and TCBS IPOs are expected to ignite the stock market, marking the end of a prolonged IPO drought. The period from 2025 to 2027 is forecasted to witness numerous IPOs and listings, with an estimated total value of 47.5 billion USD (excluding state-owned enterprises).

– 18:33 26/09/2025

Nam Long Plans Capital Increase for Subsidiary Companies

Nam Long has revised its detailed plan for utilizing the VND 2.5 trillion raised from the issuance of over 100 million shares. The company intends to allocate these funds primarily for investment and capital contributions to its subsidiaries.

HDBank Shares Plummet Unexpectedly as Billionaire Nguyen Thi Phuong Thao Rings the Bell at NYSE

HDB’s stock price, after a period of sideways movement in the morning session, surged dramatically in the afternoon, reaching a peak increase of over 6% at one point.