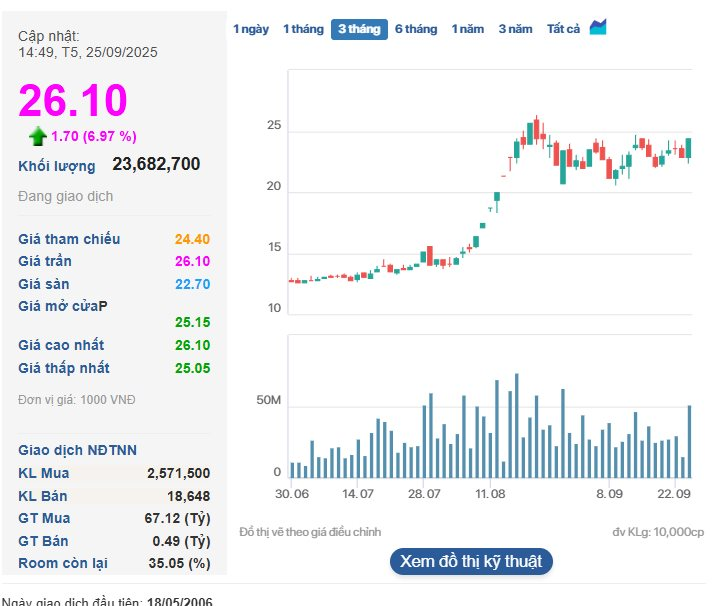

In recent trading sessions, CII shares have been in the spotlight, hitting the upper limit on September 25th, reaching VND 26,100 per share. This surge was accompanied by a significant trading volume and a net foreign buy of over VND 67 billion.

This breakout occurred as the market reacted to news that Ho Chi Minh City plans to auction land plots in Thu Thiem, raising expectations about the value of CII’s land holdings in the area.

The rally seems to be further fueled by effective debt restructuring. Recently, CII announced the exercise of rights for the CII42013 bond issue, allowing bondholders to convert to shares at VND 10,000 per share, significantly below the market price. This move converts debt into equity, reducing financial pressure.

Additionally, the Board of Directors has approved a plan to issue VND 2,500 billion in new convertible bonds to raise capital for long-term projects.

In the long term, CII’s appeal remains centered around its two core business segments: BOT transportation infrastructure and real estate.

Ho Chi Minh City – Trung Luong Expressway – Photo: AN LONG, HCMC Press Center

The BOT segment continues to be a stable cash flow generator, with key projects like the Trung Luong – My Thuan Expressway and Hanoi Highway contributing approximately 70% of toll revenue. CII’s position in the Southern infrastructure sector is strengthening, as the company’s consortium has been proposed as the investor for the expansion of the Ho Chi Minh City – Trung Luong – My Thuan Expressway (total investment over VND 41,000 billion).

Most recently, the consortium led by CII has been approved by the Dong Nai Provincial People’s Committee as the investor to propose the elevated road project along National Highway 51. This project is expected to alleviate congestion on the critical route connecting Ho Chi Minh City and Vung Tau, especially with the upcoming operation of Long Thanh Airport and the continuous expansion of industrial zones.

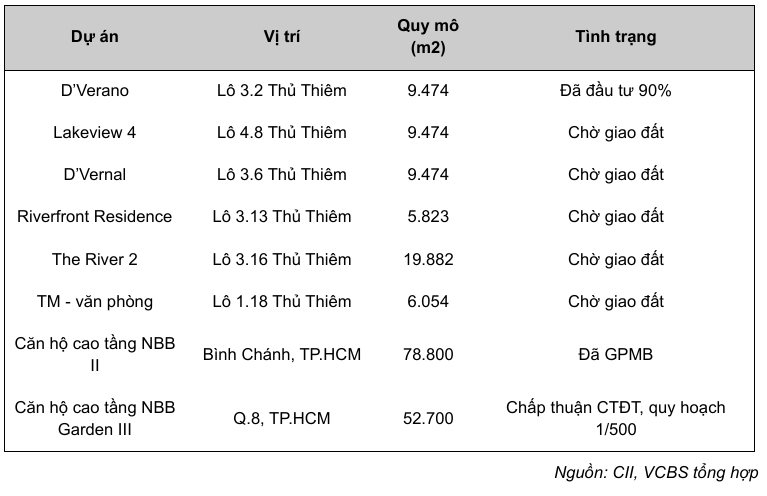

The real estate segment, CII’s “reserve,” is now in the spotlight. Although CII does not own the land plots to be auctioned, it is expected to benefit significantly from the new price levels. The company still holds over 5 hectares of land in Thu Thiem. The key point is that the cost of these land plots was established about 10 years ago under BT contracts.

The first half of 2025 saw a post-tax profit of VND 185.1 billion, a decline compared to the same period last year. The main reason was the absence of the one-time financial gain from the consolidation of subsidiary NBB in 2024.

However, CII’s core business operations remain stable, with net revenue reaching VND 1,427 billion, of which toll fees contributed VND 1,308 billion (nearly 89%).

“A Sharp Downturn: Duc Long Gia Lai’s Profits Plummet by 39% Post-Review”

The recently published audited consolidated financial statements for the first half of 2025 revealed a significant discrepancy in the profit figures for CTCP Duc Long Gia Lai Group (HOSE: DLG). The audited report showed a net profit of over VND 45 billion, a decline of nearly VND 29 billion, or 39%, compared to the self-prepared financial statements.

The ‘Master’ of Thu Thiem Land Stocks: Soaring 34% in Just Two Weeks, What’s the Secret Behind This Surge?

As of early August, CII’s stock has soared by nearly 34%. The company’s market capitalization now stands at an impressive 13.7 trillion dong.