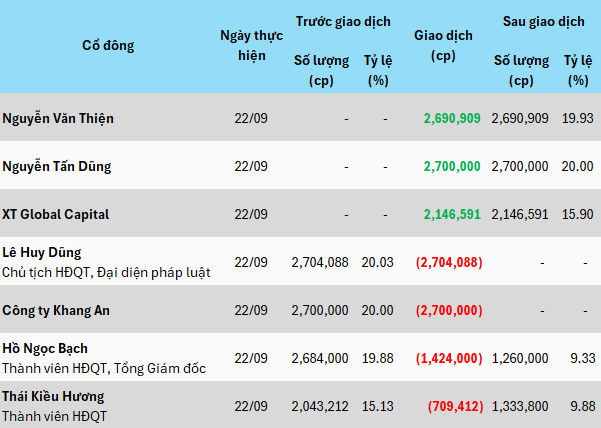

According to transaction reports, three investors participated in the purchase: Mr. Nguyễn Văn Thiện (nearly 2.7 million shares), Mr. Nguyễn Tấn Dũng (2.7 million shares), and XT Global Capital (over 2.1 million shares). As a result, these three shareholders, who previously owned no shares, have now become major shareholders of XTSC, with ownership rates of 19.93%, 20%, and 15.9%, respectively.

Previously, on September 17th, XTSC announced a list of four major shareholders intending to transfer the aforementioned shares. These included Mr. Lê Huy Dũng, Chairman of the Board (over 2.7 million shares), Khang An Agriculture Trading Company (2.7 million shares), Mr. Hồ Ngọc Bạch, Board Member and CEO (over 1.4 million shares), and Ms. Thái Kiều Hương, Board Member (over 709 thousand shares). The total number of shares transferred matches the amount purchased by the three new shareholders.

The sales transactions were executed through transfer agreements, suggesting a series of share transfers at XTSC, totaling over 7.5 million shares (55.83%).

|

Over 7.5 million XTSC shares (55.83%) have changed hands

Source: XTSC, Author’s compilation

|

Among the new shareholders, Mr. Nguyễn Văn Thiện is the Chairman of Xuân Thiện, a diversified conglomerate operating in energy, materials, and agriculture. The group was established in 2000 as Xuân Thiện Ninh Bình LLC and restructured into a corporation in January 2022.

Mr. Nguyễn Văn Thiện is also known as the son of Mr. Nguyễn Xuân Thành, founder of Xuân Thành Group (Ninh Bình), and the brother of Mr. Nguyễn Đức Thụy, Chairman of LPBank.

Mr. Nguyễn Văn Thiện becomes a major shareholder of Xuân Thiện Securities

|

The close relationship among the new shareholders and XTSC’s canceled private placement

Notably, in the transaction reports, aside from direct share ownership, each shareholder’s related parties hold shares equal to the combined total of the other two shareholders.

This is evident in XT Global Capital’s ownership structure. Specifically, within its VND 8,000 billion charter capital, Mr. Nguyễn Văn Thiện and Mr. Nguyễn Tấn Dũng hold 70% and 15%, respectively, with the remainder owned by Ms. Nguyễn Thị Hồng Nhung.

XT Global Capital, established on June 26, 2025, is headquartered in Ninh Bình and primarily engages in other monetary intermediation activities. Mr. Phạm Vũ Tùng serves as both CEO and legal representative.

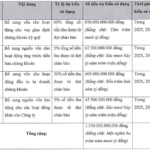

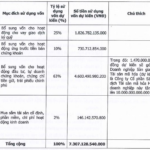

The transfer of a significant number of shares at XTSC occurred just before the September 26th shareholder record date for a rights issue. This offering involves 135 million shares (1:10 ratio) for existing shareholders. The transfer of subscription rights will take place from September 27th to October 8th, with subscription and payment from September 27th to October 15th.

Priced at VND 10,000 per share, XTSC is expected to raise VND 1,350 billion, allocated as follows: 60% for margin lending (VND 810 billion), 5% for advance payment (VND 67.5 billion), 30% for proprietary trading (VND 405 billion), and 5% for working capital (VND 67.5 billion). The funds are planned for use in 2025 and 2026.

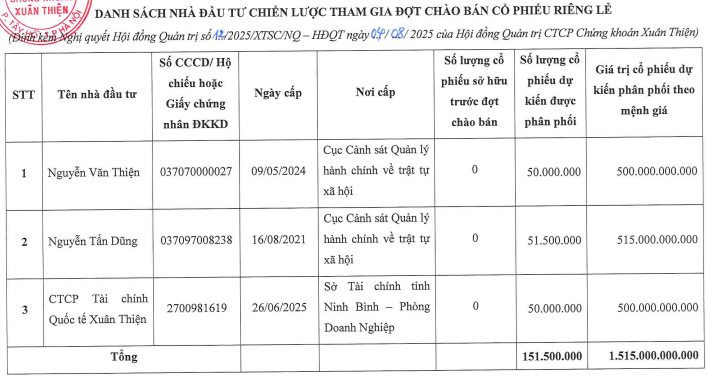

In addition to the rights issue, XTSC previously approved a private placement of 151.5 million shares to raise VND 1,515 billion. However, according to a September 11th notice from the State Securities Commission, the review of the offering file has been halted as XTSC’s Board decided to suspend the plan.

Interestingly, the list of strategic investors for the private placement included Mr. Nguyễn Văn Thiện (50 million shares), Mr. Nguyễn Tấn Dũng (51.5 million shares), and XT Global Capital (50 million shares). This has led to speculation that the investors’ purchase of a substantial number of XTSC shares might be an alternative to the canceled private placement.

Source: XTSC

|

– 3:00 PM, September 27, 2025

Leading Securities Firm to Invest Nearly $60 Million in Establishing a Crypto Asset Trading Platform

This leading securities firm is set to offer 365 million shares at an initial price of VND 20,000 per share, significantly boosting its chartered capital from VND 1,460 billion to over VND 5,100 billion. A key allocation of the raised capital will be directed toward establishing a cryptocurrency asset trading platform.

ABBank Plans to Boost Chartered Capital to Nearly VND 14 Trillion

On September 16th, An Binh Commercial Joint Stock Bank (ABBank, UPCoM: ABB) announced a resolution passed by its Annual General Meeting of Shareholders to increase its chartered capital from VND 10,350 billion to nearly VND 13,973 billion, representing a 35% increase.